Navigating through uncertainty in the midst of normalization

13-08-2021

Preface: The year of normalization

Some semblance of normalcy returned during the first half this year, as the global vaccine rollout has led some economies to gradually recover. While remaining cautiously optimistic, we continue to monitor developments of the recovery, as new risks and a changing economic environment could affect investors’ appetite for the rest of the year.

A broader recovery during the first half

The global stage was set to restart in 2021.In December, we said that the eventual vaccine rollout should unlock a gradual recovery process this year. Indeed, we have seen improvements in the economy during the first half.

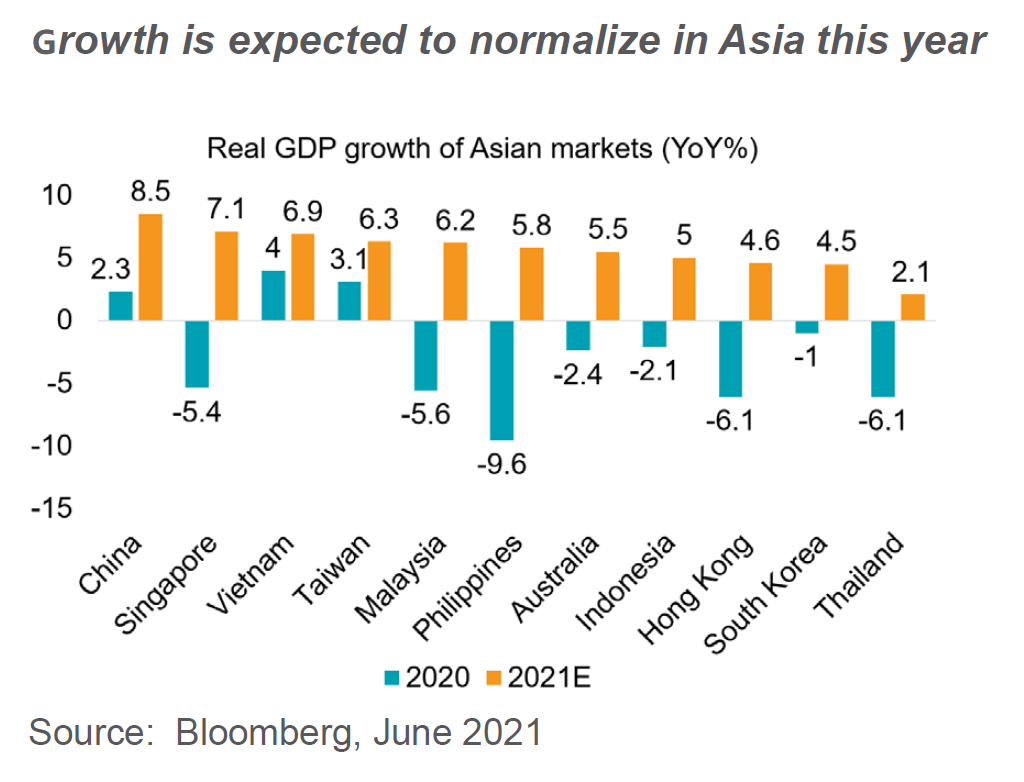

The macroeconomic outlook in Asia has become encouraging, with economic growth expected to be more broad-based across all markets throughout the rest of the year.

During the first quarter, North Asia led the economic recovery in the region, as they were more successful in containing the pandemic relative to their Asia counterparts.

In addition, earnings per share growth in Asia also saw a broad-based and more balanced recovery across all markets this year from last year, indicating that earnings normalization is also on track.

Pandemic risks continue to loom

COVID-19 remains a risk in the financial markets. We continue to monitor developments of the pandemic, especially since new variants of the virus, particularly the highly contagious Delta variant, are putting a halt in recovery in several parts of the world.

In Asia, several markets saw the resurgence of the pandemic, such as in Taiwan in May, which caused its financial market to be volatile. During that month, the MSCI Taiwan Index first dipped 11.5% in the middle of May, and then recovered to close at only 1.2% lower at the end of the month1, despite the market’s overall fundamentals being solid.

Pandemic risks also continue to loom in Southeast Asia, with some markets recording an increasing number of infections during the first half.

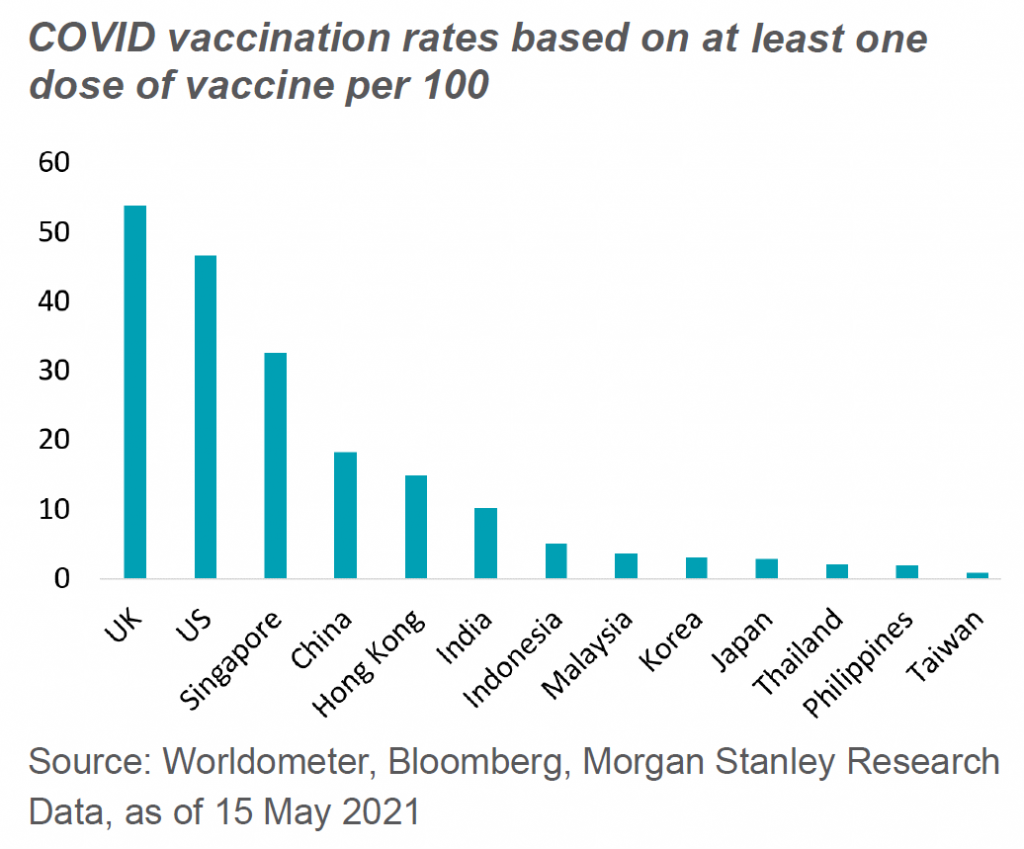

Vaccination rates also remain low in Asia relative to the UK and the US, making the region vulnerable to new infections.

We view that the willingness to get vaccinated, the supply and availability of vaccines and their effectiveness to the new variants all contribute to the recovery. Stamping out the epidemic still requires precautionary measures, border controls and active testing.

China: Moderating growth and regulatory direction take the center stage

While recovery was robust in China postpandemic, we expect that economic growth in the country will continue but moderate in the second half of the year.

Several indicators have pointed to this normalization. China’s GDP, for example, has started to slow down during the second quarter.

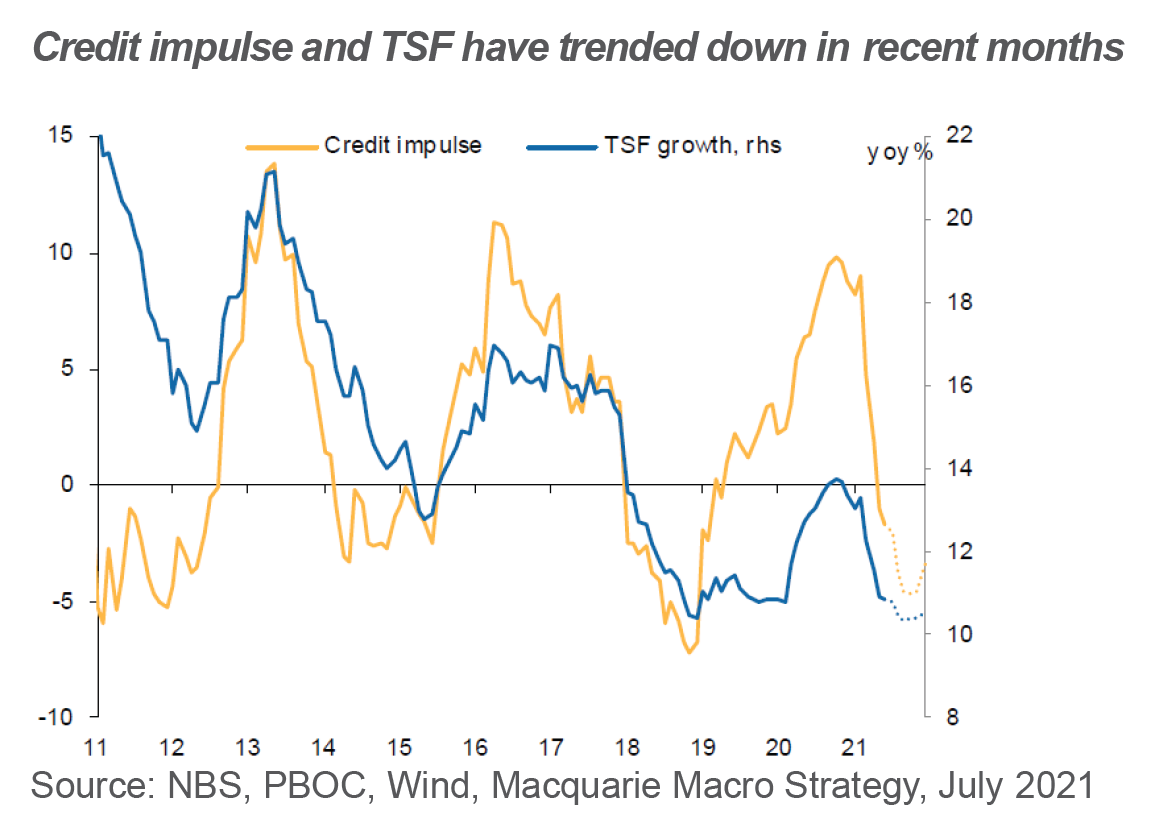

We are also seeing normalization in other growth indicators. Purchasing Managers’ Index (“PMI”), exports and investments, for example, have trended down. On the credit growth side, indicators have also pointed towards moderating growth. China’s credit impulse has peaked in 2020 and has started to slow down in recent months. We are also seeing a similar trend in the country’s Total Social Financing (“TSF”) growth, which is an indicator of the country’s liquidity levels.

This downtrend is not surprising, as the government has already mentioned that it will be limiting credit growth this year to prevent the economy from overheating. We expect that both credit impulse and TSF growth to slow down during the second half.

Adding to moderating growth concerns is the pick-up of inflation that has led to fears about earlier-than-expected tightening, which may hinder growth.

Asia credits: weathering the policy tightening cycle

The vaccination rollout and easing of mobility restrictions should reset global growth higher. However, the growth pace in the near term could be derailed by the Delta variant and fading low base effect, but we view that the uptrend in growth should be maintained. With global credit spreads being priced for growth recovery and benign default rates, in the coming quarters, we are cautious about any shift in the Fed’s tone on policy normalization in the US and taper timetable and any change in China’s onshore financing environment that has been kept in a tightening mode for most of this year as growth slowly dissipates.

>> Download the full report

Featured fund:

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.