Fixed Income Q4 Market Outlook

16-10-2020

Asian credit continued its recovery, albeit at a slower pace. In the 3Q20, the asset class returned 2.1%, with the JACI Investment Grade Index and the JACI High Yield Index growing 2% and 2.7%, respectively. The recovery slightly decelerated as the market was perturbed about the system and political risks, including:

- The greenback strength,

- The Fed’s landmark shift in inflation approach,

- A delay in the fiscal stimulus package,

- Volatile oil prices,

- Intensifying Sino-U.S. rivalry, and

- The upcoming election.

EM bond issuance and fund flow

Year to date, the primary market activity of the EM corporate hits record levels ($395 billion), running modestly higher than the same period of 2019 ($386 billion). The run is primarily driven by the investment grade issuance ($273 billion YTD vs $232 billion 2019 YTD), while high yield is lagging at $122 billion YTD (vs $155 billion 2019 YTD). By geography, Asia, LatAm, Middle East & Africa and EM Europe contribute to $261 billion, $66 billion,$39 billion and US$29 billion, respectively. The robust supply trend has also been seen across other credit markets as well, with the EM sovereign ($168 billion YTD) and US HG ($1.4tr) running near all-time highs. Corporate precautionary funding, supportive yields, and central bank purchase programs are the main reasons for such robust gross issuance. But given the upcoming U.S. elections, we expect primary market activity to moderate, which might support current spreads. Year to date, the inflow into emergency market hard currency funds are US$2.2 billion, with 2Q inflows at $10.8 billion. In the current low yield environment, many investors continue to find the EM attractive in the search for yield.

Valuation

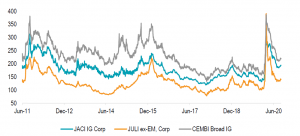

The JACI IG Index is currently trading at a spread of 194bp, 53bp wider versus the U.S. IG corporate (Fig 1). The IG spread is still higher than the 5-year average of 170bp and the 10-year average of 180bp with spread retracement of 60% for 2020. We still see value in Asian IG credits for short- to intermediate- maturity. The U.S. government has established the Primary and Secondary Market Corporate Credit Facilities to support the U.S. IG bond market and potential spillover demand from cross over investors.

Fig 1: JACI IG spread retraced of 60% from the widest while the current spread maintains at 53bp wide versus U.S. IG corporate

Source: JP Morgan

The JACI HY Index is trading at a spread of 744bp, 141bp wider than the U.S. HY credit. The current JACI HY spread is higher than its 5-year average spread of 528bp and 10-year average spread of 576bp. We are cautious about the potential default for the B-rated names as the primary capital markets may not be open for refinancing purposes in the view of their elevated spreads. However, the year-to-date default rates in Asia HY is a manageable level of 3.3%. We expect spreads to compress further for the HY credits with limited liquidity and refinancing over the next year and stick to the quality and liquid benchmarks.

Fig 2: JACI HY spread retraced of 66% from the widest while the current spread is at 141bp wide versus US IG corporate

Source: JP Morgan

Read the full report

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable as of the date of presentation, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

This commentary has not been reviewed by the Securities and Futures Commission in Hong Kong. Issuer: Value Partners Hong Kong Limited.

For Singapore investors: This commentary has not been reviewed by Monetary Authority of Singapore. Value Partners Asset Management Singapore Pte Ltd, Singapore Company Registration No. 200808225G.