2021: The year of normalization

04-01-2021

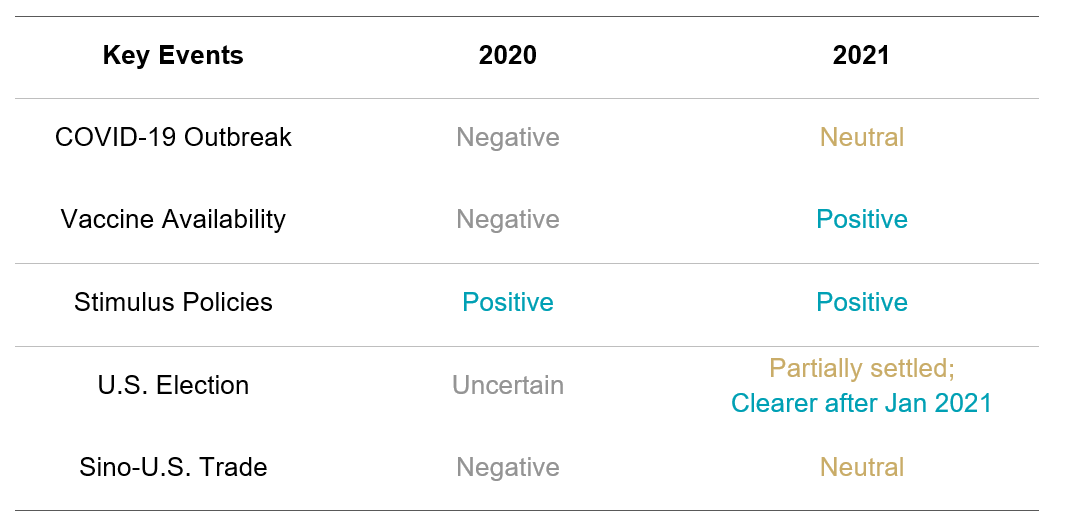

The year 2021 is poised for a restart. Vaccination and other signs of relief permit the world to start envisioning recovery beyond the dreadful COVID strains. A recovering process can take far more steps and we believe the five fundamental events and their developments next year outlined in Figure 1 would extend investors’ risk appetite into 2021.

Figure 1: Key events constitute a more stable outlook in 2021

Source: Value Partners, December 2020

Vaccine: The centerpiece of the recovery

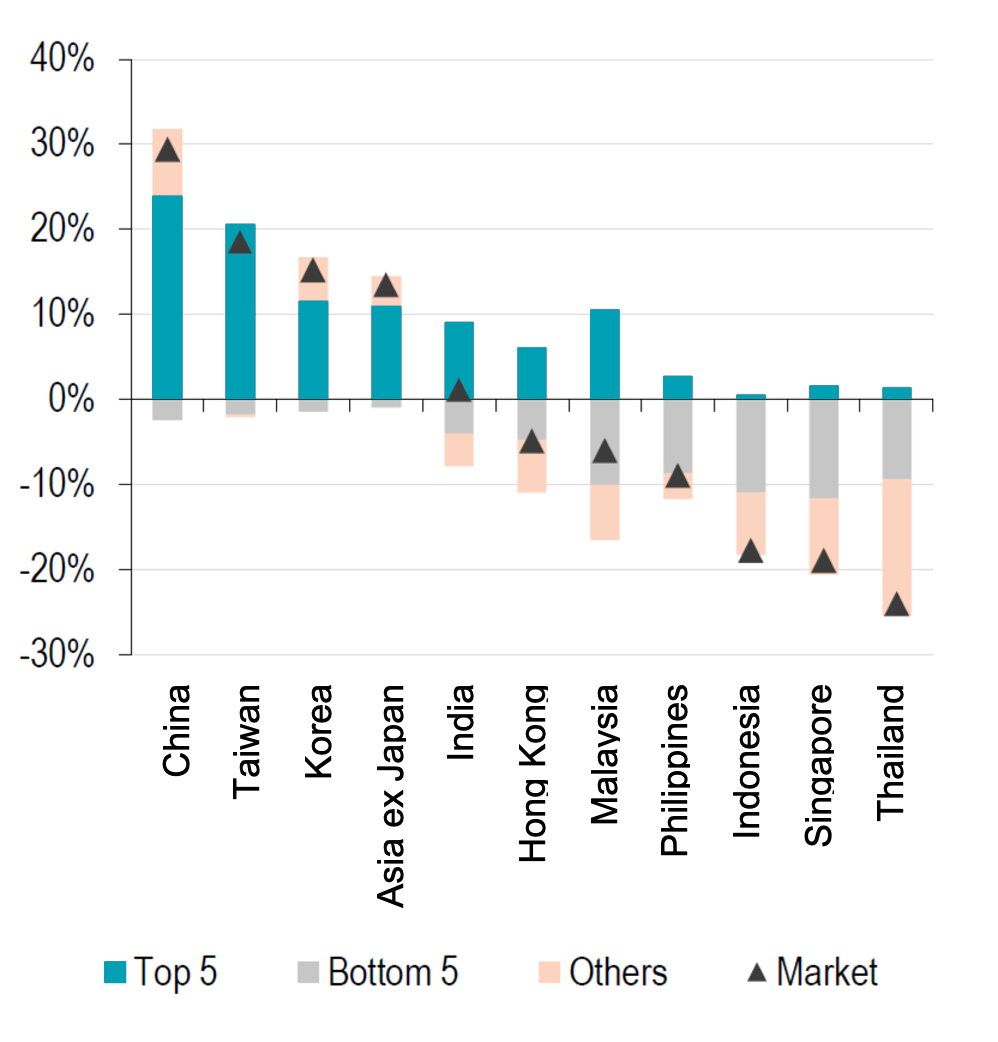

On COVID, we believe the worst is behind us as the key piece of the puzzle to recovery – vaccine development saw positive trials and approvals. The arrival of vaccines shall unlock much of the reopening and recovery process in 2021. Contrary to 2020 that growth scarcity drove skewed sectors strong performance (Figure 2a, 2b), laggards that were heavily battered by the pandemic, such as financials and retailers etc., may enter the recovery phase and bring a broader and balanced recovery in 2021.

Figure 2a: Top performers dominated Asian equity markets performance in 2020

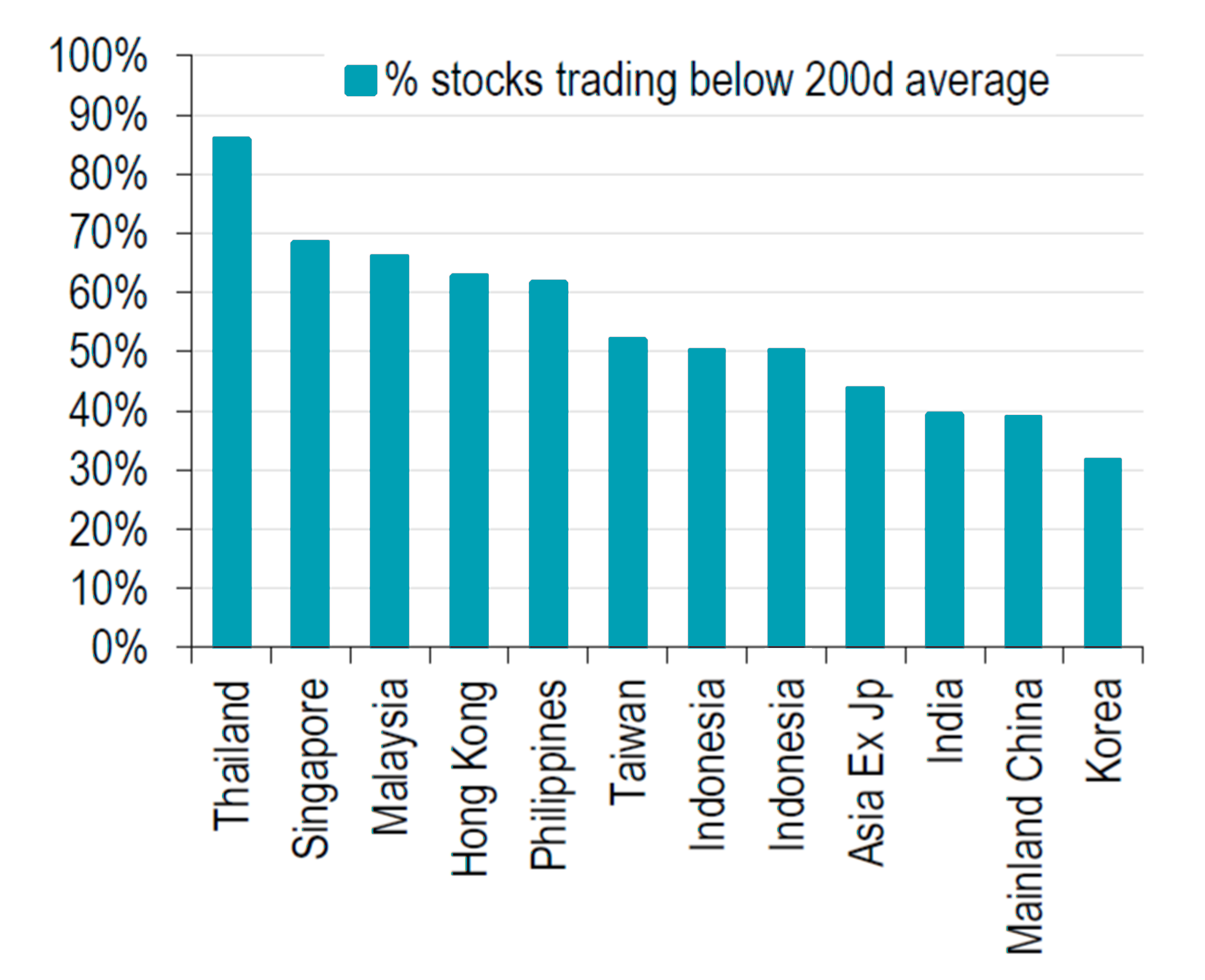

Figure 2b: High percentage of laggards across the region due to the uneven recovery paths among countries and sectors

Source: FTSE Russell, FactSet, HSBC Research, November 2020

While the markets have been responding positively to the vaccine scenario towards the last quarter of 2020, we believe vaccination alone cannot keep the virus at bay. Stamping out the epidemic requires precautionary measures, borders control and active testing. In addition, the willingness to get vaccinated, the vaccine inventory and effectiveness would all contribute to this key piece in the recovery path.

Liquidity sets the agenda

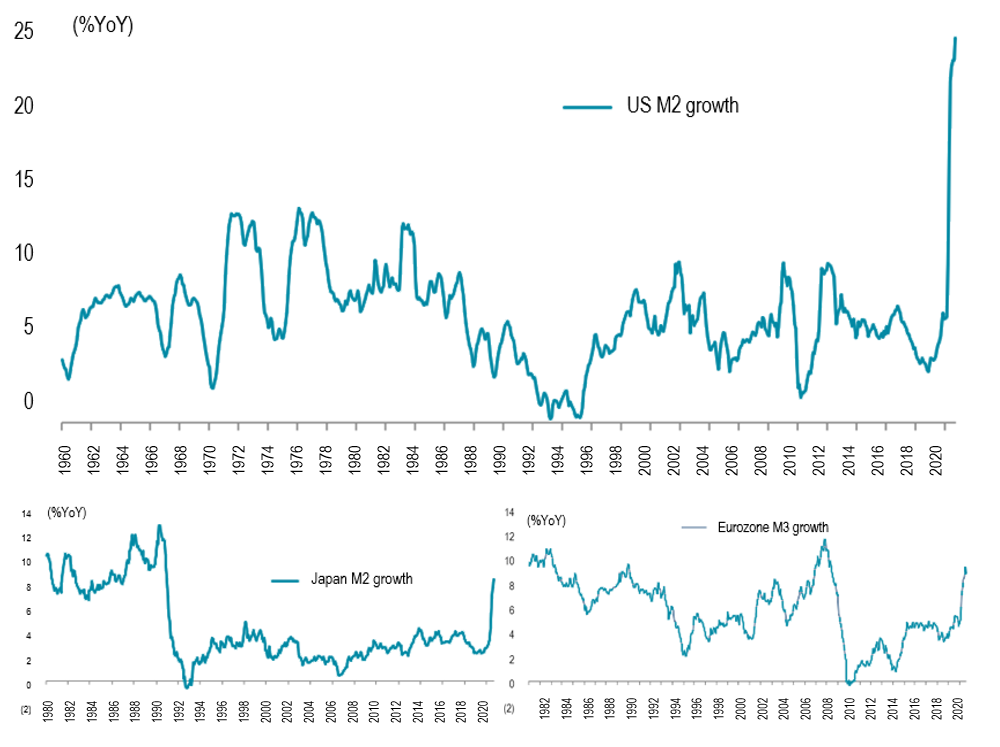

The preemptive and supportive monetary and fiscal policies have been a major tailwind to global equity markets in 2020, and we expect the liquidity-driven environment would not subside in 2021. Firstly, the U.S. Federal Reserve has explicitly expressed its intention to keep borrowing costs low, potentially through 2023.

Former Fed Chair Janet Yellen was picked to take the role of treasury secretary, which gives the market implications that a dovish tone would stay and fiscal spending may enlarge.

Secondly, other advanced economies, such as Japan and Europe, are likely to follow or even ramp up their stimulus measures of other forms to guide their fragile economies away from the recession. The combination of low interest rates and abundant liquidity in the global system shall sustain investors’ risk appetite in 2021, and our overweight position in equities and high-yield bonds reflects this view.

This level of liquidity has a historical track record of leading to a weakening greenback, which is positive for emerging markets equities. With the recovery ahead of the curve, China and selective Asian markets are expected to continue to attract capital inflows under the accommodative policy backdrop around the globe.

Figure 3: Liquidity remains abundant

Source: Federal Reserve; European Central Bank; Bloomberg, Bank of Japan; HM Treasury, Bank of England, Jefferies

A timeout on political tussles?

The U.S. election-related risks were partially erased as Joe Biden becomes the president-elect. The attention has shifted to policy and cabinet candidate selection under a Biden administration and a Congress of a split-party control.

At this point, the Sino-U.S. relationship under the Biden administration remains uncertain, although the market generally expects a more open platform for discussion, unlike the past four years when President Trump was in office.

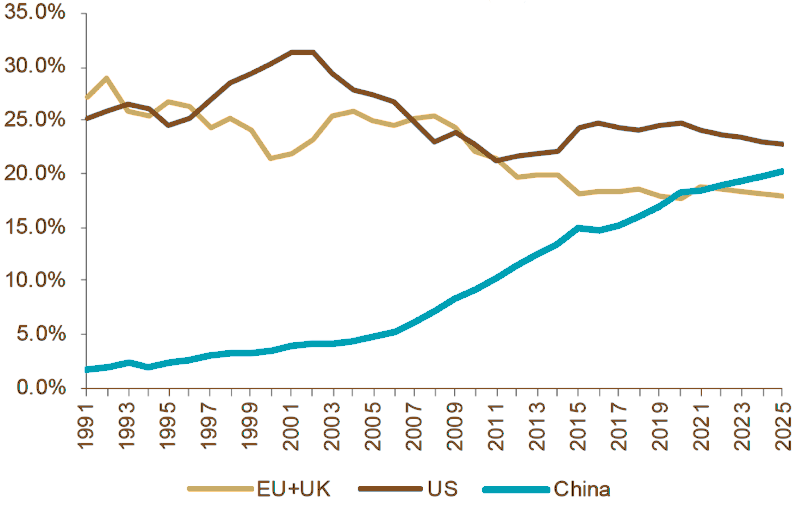

The intensity of tension is not expected to go away entirely and we do not foresee a complete reversal of the policies implemented during Trump’s presidency. Unlike in the past decades, when China was the world factory to supply labor at low costs, the U.S. and its Western allies have repositioned their tactics toward China, to some extent driven by China’s rise and ability to exert greater influence on the global political and economic arena (Figure 4a & 4b) as well as its rapid development in the higher-end value chain categories, such as technology. Several reports released by the U.S. use the rhetoric that take China as a strategic competitor. Thus, sanctions and restrictions could become an ongoing topic, especially if protectionism remains a key policy agenda.

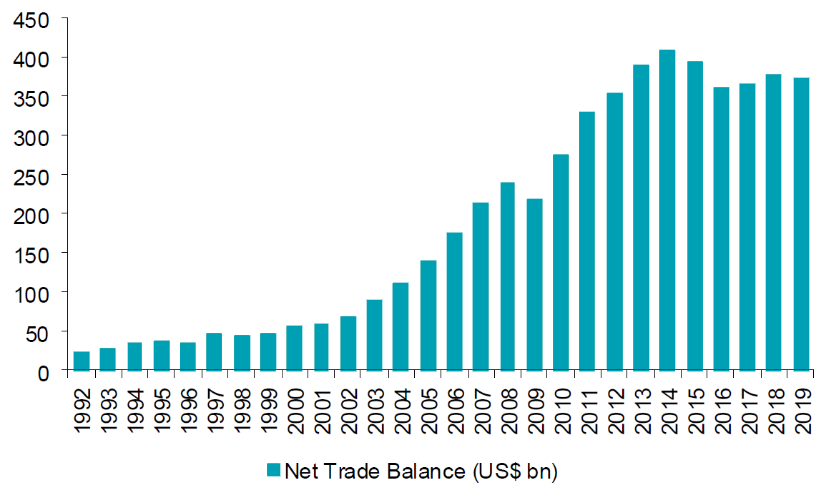

Figure 4a: China’s economic power, in the share of GDP terms, surpassed the European Union and the UK combined, soon becoming at par with the U.S., the largest economy

Figure 4b: China’s consistent surpluses of net trade balance (USD bn)

Source: International Monetary Fund, Comtrade; Macquarie Research, December 2020

China’s Five Year Plan, a blueprint to steer the country’s economic development, announced that the dual circulation strategy is at the core of this plan and a response squarely addressing the changes in geopolitical dynamics. The circulation’s internal loop emphasizes the importance of local demand and moving up the industrial chain to engage in advanced manufacturing. Given that geopolitical risks may be ongoing, China taking a domestic-oriented approach as a pillar strategy shall reduce the growth volatility driven by external risks.

In the next insight article, we will dissect the dynamics of these fundamental events in 2021 and their investment implications on the equity and fixed income market across Asia and Greater China.

Value Partners’ Featured Funds:

Disclaimer: The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable as of the date of presentation, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. This material has not been reviewed by the Securities and Futures Commission in Hong Kong. Issuer: Value Partners Hong Kong Limited.

For Singapore Investors: This commentary has not been reviewed by the Monetary of Singapore. Value Partners Asset Management Singapore Pte. Ltd., Singapore. Company Registration No. 200808225G