Multi-asset perspective – August 2021

10-08-2021

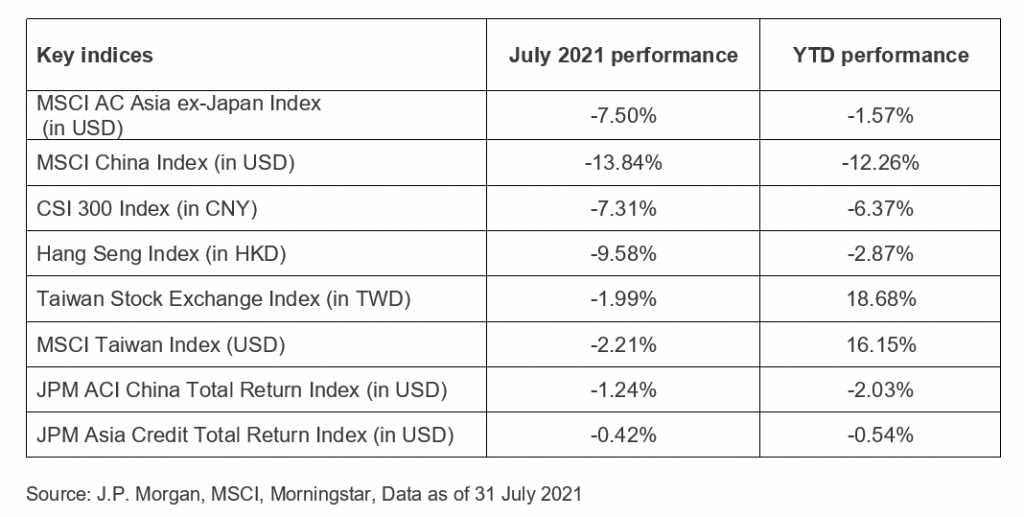

Markets were down in Asia, especially for Greater China markets, as the regulatory crackdown on various sectors in China has dampened investor sentiment. Meanwhile, the pandemic continues to be a key risk in markets, as the spread of the Delta variant may delay economic recovery.

China / Hong Kong equities

Market sentiment has been hampered by the increasing regulatory oversight on various sectors, especially in the internet and education sectors. Although valuations have become appealing after the correction, most investors would rather remain on the sidelines amid the regulatory uncertainty.

Flows have steered towards sectors that are more supported by the government. Given the defensive nature of the investors, defensive sectors such as utilities, telecom and local Hong Kong stocks are expected to continue to outperform.

China A-Shares

Economic growth in China has clearly peaked. With the Delta variant surging among different parts of the country, the market is concerned that a slowdown in China would be more imminent for the rest of the year.

Tourism and consumption would be hurt during the mid-autumn festival and golden week in October. Investors should focus on sectors that would benefit from the potential targeted easing policies that may be announced towards the fourth quarter.

Asia ex-Japan equities

Investors are concerned about the tighter liquidity environment as the Fed starts to consider tapering, especially after a very strong payroll number in July. Inflation expectations have also rebounded as wage growth continued to rise.

The technical strength in the US dollar has also hampered the performance of Asian ex-Japan equities.

Upward earnings revisions have peaked in the region, with the risk of having downgrades later in the year after first half results are reported. Investors will remain to be cautious.

Emerging market ex-Asia equities

With the Delta variant spreading across different countries, concerns over a delayed recovery have hampered the demand outlook on oil. Together with the gradually increasing supply, oil prices have corrected. Although countries such as Brazil and Russia are still expected to enjoy economic recovery for the rest of the year, investors have become more cautious about emerging markets in general.

Japanese equities

Investor sentiment should have bottomed after the conclusion of a successful yet closed Olympics. The economic surprise index has stabilized, indicating that the market has turned more positive on the country’s economic recovery. Economic data has also beaten expectations and foreign net flows have come back to the Japanese equity market.

Asia investment grade bonds

With the strong July payroll number in the US, the recent flattening of the Treasury yield curve will be challenged with the rebound in inflation expectations and increasing tapering concerns. However, with the weakness in the equity market, a strong appetite for Asian investment grade bonds will remain.

Asia high yield bonds

The liquidity concerns on some of China’s property companies have caused the Chinese property high yield bond space to correct further.

With a risk-off sentiment, indicated by investors’ rotation to the defensive areas of the market, Asia ex-Japan high yield credit spreads have widened. We expect that it will take time for sentiment to pick up for spreads to tighten back.

Emerging market debt

The weaker oil and commodity prices will hurt the outlook of emerging market bonds. However, as the demand for yield continues, emerging market bond spreads will remain stable.

Gold

Gold is likely to move sideways as the US dollar has tactically strengthened. However, the valuations of Gold are becoming attractive versus other commodities. Over the long term, Gold remains a good hedge against geopolitical uncertainties and would benefit from easing fiscal policies.

Multi-asset

Multi-asset offers lower volatility compared to traditional single-asset or balanced portfolios. However, the correlation between risk-assets, such as equities, credits, and commodities, has increased dramatically recently. In an uncertain environment with low yields, income becomes an essential source of return for investors.

The author is Kelly Chung, our Senior Fund Manager.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

This commentary has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.