Co-Chairman Mr. Cheah: Attack & Defend against the COVID-19 impacts

30-04-2020

Amid the setback brought by COVID19, the world is experiencing a harrowing rise in unemployment and a total shock from demand and supply. Dato’ Seri Cheah Cheng Hye, our Co-Chairman and Co-Chief Investment Officer, shares his guidebook to the uncertain world, at a live-streaming lecture given to the Belt and Road Initiative EMBA program of Tsinghua University, attended by over 350 participants.

V-shape recovery unlikely

V-shape recovery is highly unlikely. Judging by the current outlook, we believe the recovery will come with a shape of U or W, meaning that we may hover at the bottom for some time and then recover. Moreover, we cannot rule out the possibility for markets like the U.S., which may suffer in an L-letter like trajectory or a long-lasting recession.

Mr. Cheah said: “Within the system, we have seen a combination of multiple shocks – on demand, supply, and financial market and increasingly, on the political front.

“This crisis is much worse than the one we experienced called the Global Financial Crisis in 2008, and it has severely hurt this year’s growth outlook.” Based on the International Monetary Fund’s projection, the U.S. GDP is estimated to decline by 5.9% in 2020. In 2009, the year with the most significant impact of the global crisis, the U.S. fell 2.5% in comparison. For China, the GDP is projected to grow 1.2% in 2020, versus a 9.4% growth after the colossal stimulus introduced by authorities.

He added: “The health crisis has hit the headlines as a once in a century event. Some governments have openly said that the humanity is at war. The crisis can turn into one of the worst economic crises like the Great Depression dated back in the 1930s.”

Cheah’s recommended investment strategy

Mr. Cheah shares his allocation strategy and defines how he “Attacks” and “Defends” at the same time.

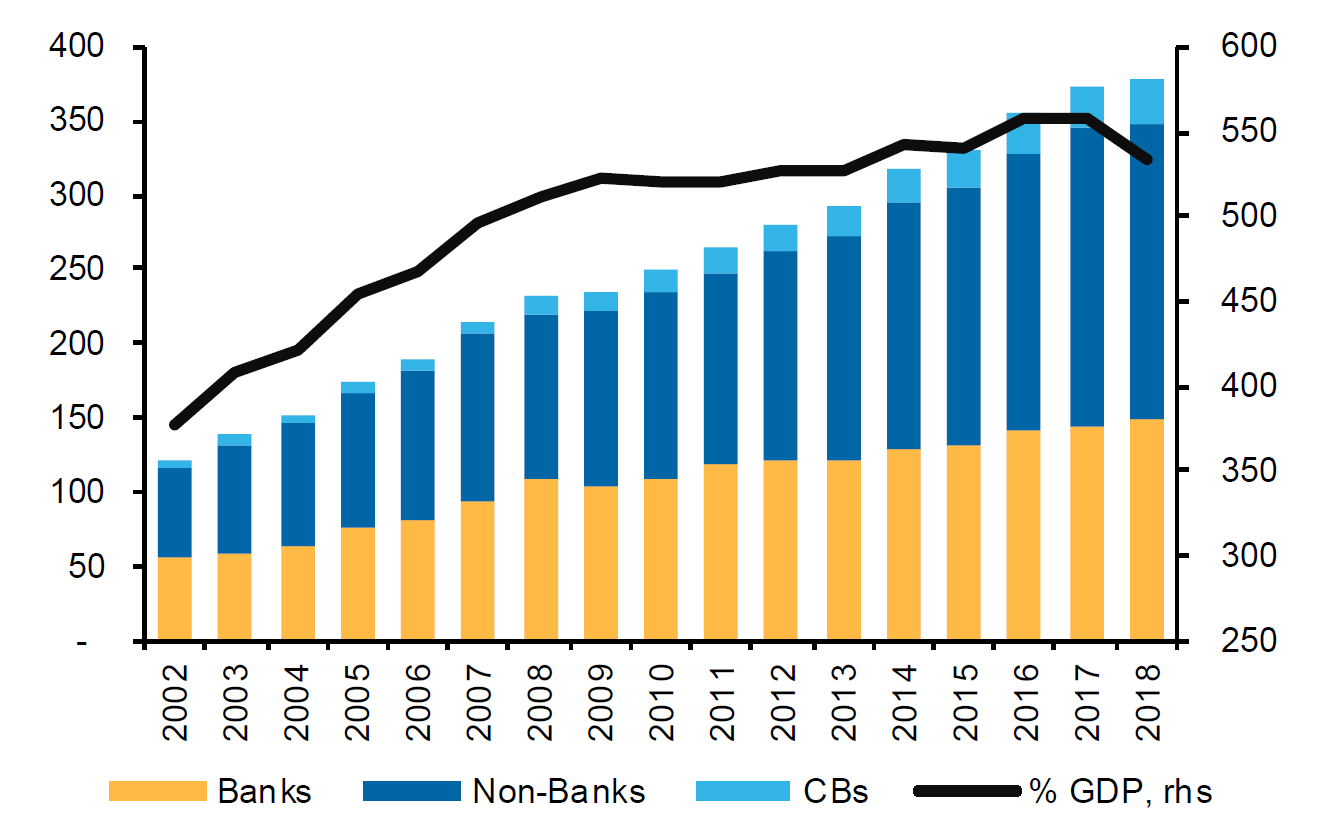

“In today’s world, the financial assets, including loans, bonds, and other financial securities, now account for 5.4 times of global GDP. Paper assets, such as securities, are now many times in excess of the value of the real assets and the real economy. This is pretty dangerous.

“In my view, ‘Attack’ could be buying China-related stocks and bonds. ‘Defend’ could include purchasing gold, which I like, and I think gold still has some great potential in front of it, and holding cash.”

Figure 1: Global Financial Assets

Source: The Financial Stability Board, Macquarie Research, April 2020

Mr. Cheah continued: “If you don’t attack and if you don’t take part in this party, you are always in fear of missing out. To the extent possible, central banks around the world, which includes China, are still willing to use their balance sheets to support asset prices and employment.”

In fact, two countries in the world, the United States and Australia, their central banks have openly said they would do unlimited quantitative easing. The U.S. balance sheet is infinite because the world is hooked on the greenback. As long as they own a money printing machine, they can print any amount of U.S. dollars they want to buy anyone who wants to sell assets. This is the reality of unlimited QE and is scary.

“So you have to put part of your portfolio on the attack to take part in this. We don’t know when it might be. But at the same time, you don’t know when the bubble way of managing the world will end. Something terrible may happen besides COVID-19 – Nobody can be sure.

“For that, you need to have some sort of buffer or defense when the system does collapse. At the moment, there are some defensive methods. One of them is holding gold – physical gold, not paper gold. Another is holding cash, even though the interest rates are meagre,” Mr. Cheah said.

Attack with China – Active fund thrives

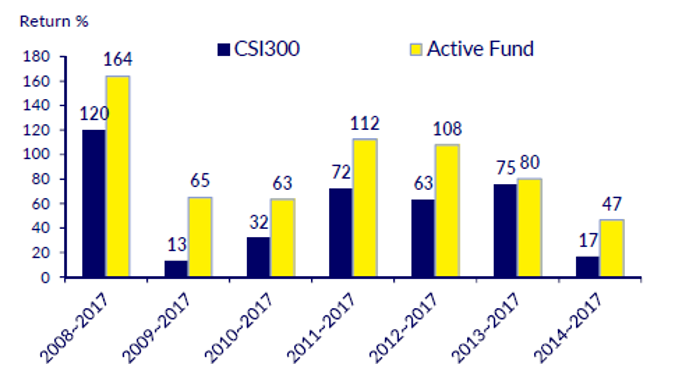

Cheah’s attack strategy, China presents active opportunities. As a value investor, we see the phenomenon that it is not so easy for active investors to leverage in-depth research and to visit companies with a vast analyst team to outperform the broad efficient market. In China, however, active funds can still outperform.

“If you are a professional who works hard and does research, you can still do quite well in obtaining alpha,” said Mr. Cheah.

Figure 2: Active funds outperform due to market inefficiencies

Source: CLSA, Wind

“More, if you invest in a contrarian style, you can also outperform. Professional investors do not dominate China’s market, with 80% of the investors in China are retail.

“Through your professional investor research, you can make money because professional investors who understand valuation will buy when the market is low and sell when the market is high. China is potentially a fascinating place for professional investors.”

Amid the crisis, China showcases its strength in domestic power and idiosyncrasy in the market structure. The country enjoys a vast local market. Also, the partial restriction in capital flow adds a buffer and enables the country to rely on its resources to recover.

“The Chinese system and culture of state capitalism and strong government has proved to be effective. On top of that, China still has significant room for reforms and economic stimulus,” said Mr. Cheah, referring to a broader policy ammunition of China than, for example, of the U.S. He believes China’s story is intact.

He continued: “The country remains on track to becoming the world’s biggest economy by roughly 2030. The room available for Beijing is not just interest rates cut or tax reduction. There is a potential for real critical structural reforms, including the development of the city cluster like Greater Bay Area, and for example, the Internet of Things (IoT) and market-opening reforms, all of which will make the country even more competitive.”

The currency of the last resort – Gold as a defense strategy

A level of defense is much required when the system does collapse. Holding physical gold and cash is the way to lay a suitable buffer, despite the interest rates being meagre. Cheah listed several reasons to be bullish on gold.

- Worrying virus spread has propelled global central banks to trim rates and even to purchase assets in an unprecedented unlimited amount. Gold stands out with its ability to preserve value.

- While the major central banks, led by the Fed, rely on their printing machine to replenish money supply, gold carries precious scarcity. Unlike banknotes, gold cannot be printed endlessly. Moreover, it is believed that most of the gold on earth is mined out so it is unlikely to see new gold supply in large scale.

- Other than Japanese yen and U.S. debt, gold serves as a preferred hedging tool, lifting demand for gold-related investment instruments amid challenging times.

- Gold typically has an inverse relationship to the greenback. Softened U.S. dollar favorably supports bullion prices.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable as of the date of presentation, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

This commentary has not been reviewed by the Securities and Futures Commission of Hong Kong.

Issuer: Value Partners Hong Kong Limited