Fixed Income Insights: Q4 2019 Market Review

23-01-2020

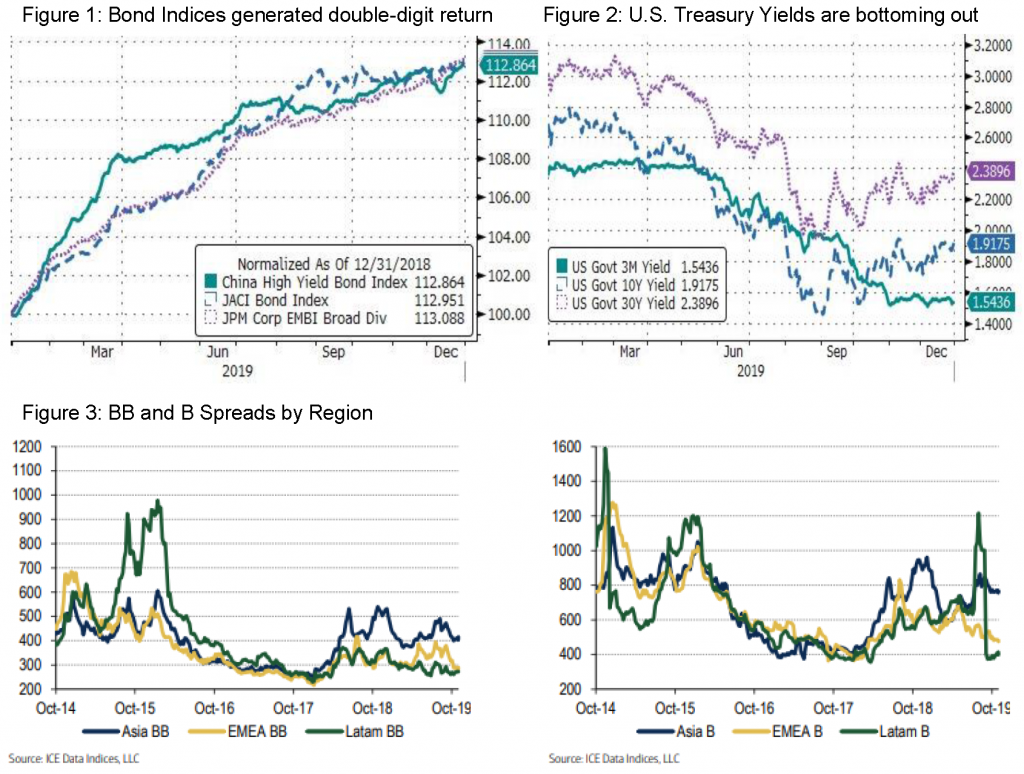

Mixed signals and prolonged discussions of the U.S.-China trade talk continued to take center stage throughout the fourth quarter. As an initial bilateral deal is expected to soon be inked, U.S. equity marked its best yearly return in six years and oil prices staged its strongest rally since 2016. Looking at the tables below, we believe the improving trade situation propelled an increase in treasury yields in the first half of 4Q19, with interest rates being range-bound and moving toward the 2% level subsequent to the announcement of a trade deal. Emerging market corporate and China high yield space, moreover, benefited from a lack of supply and investors’ crave for yield. That said, sporadic credit default events among the non-property names in December had undermined the sentiment. We will continue to closely monitor the onshore space development and potential default cases. Social and financial market reform as well as central bank policies are supportive to China’s bond market. The initiatives by the government include making rates market-driven system, pledge to relax restrictions relating to hukou, or household registration system, as well as central bank’s decision to lower reserve requirement ratio.

Major central banks globally have taken dovish tone in their monetary policies, and even introduced negative interest rate, putting pressure on global high-yield assets. Bonds offering yield over 5% currently accounts for merely 5% of the entire public debt market. Compared to the U.S. and other emerging markets, Asian credit market, especially U.S. dollar-denominated China property bonds, carries scarcity value. It is expected that future capital inflows will continue. While it remains an unknown in what forms the bilateral trade conflicts to evolve, inexpensive valuation of Asian credits, especially China, stands out. We favor a strategy that emphasizes strong income generation amid the battle between the two superpowers, which is highly likely to become a new norm.

Click here to read the full report

* Source of data/charts: ICE/BAML, Bloomberg and Value Partners, 31 December 2019.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable as of the date of presentation, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

This commentary has not been reviewed by the Securities and Futures Commission in Hong Kong. Issuer: Value Partners Hong Kong Limited.

For Singapore investors: This commentary has not been reviewed by Monetary Authority of Singapore. Value Partners Asset Management Singapore Pte Ltd, Singapore Company Registration No. 200808225G.