Thought Piece: Has value come back in the fixed income markets?

01-11-2022

On 12 September 2019, The Economist published an article titled “Austria’s 100-year bond has delivered stunning returns”, with the subtitle reading “its price will crash if interest rates rise. But most buyers won’t live long enough to regret it.” There was truth in the statement at the time of the publication: Since the bond’s issuance in October 2017, the bond returned 170% in euro terms.

However, on the same day this year, three years after the article was published, the three-year return of this 100-year bond was -86%. I believe most of the buyers in 2023 probably are still alive and likely have regretted the decision of still holding it, perhaps apart from those liability-driven investors who are less concerned about mark-to-market losses.

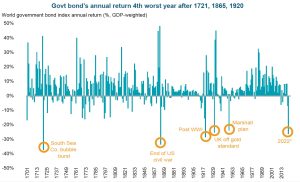

While one might think that a 100-year bond may be extreme, it was, in fact, not, as the return of the government bonds year-to-date has been the worst in a hundred years, as shown in the chart below. The FTSE World Government Bond Index has lost -21% in USD terms on an unhedged basis.

Govt bonds ann. 4th worst year after 1721, 1865, 1920

Source: BofA Global Investment Strategy, GFD Finaeon. 2022 annualized as of end of September

The above illustrates the speed and magnitude of the regime change we have experienced over the last 12 months, mostly driven by inflationary pressures. As mentioned previously in our article <<When Powell turns to Volcker, you should turn to Value>>, we believe that recent changes in the investing environment are just the beginning of a paradigm shift away from the last 15 years, given the large shift in the global geopolitical landscape. We also explained that this might mean a comeback of value investing in equities. In fact, this paradigm change also means that value has finally started to return for bond investors.

A painful adjustment, but pricing differentiation is back

When interest rates broke the zero lower bound by the European Central Bank (“ECB”) in 2014 to handle the European debt crisis, value vanished for fixed income, as negative yielding bonds ballooned to US$18 trillion and peaked in December 2020. Negative interest rates and yields – where you need to pay to lend money to others – do not make economic sense. Moreover, they have resulted in an arguably dysfunctional credit market, as there is no pricing differentiation for good or bad corporates, and ample liquidity has kept afloat even for the worst-run companies in the world.

Now, inflation and hawkish central banks have lifted yields everywhere, with the amount of negative-yielding bonds falling back to US$1.8 trillion, contracting 90% from its peak. We have started to see the markets moving back to the old days, where there was pricing differentiation among companies with good and bad credit profiles. This adjustment will be painful, and it is going to take some time.

After all, this is the only time we have seen some meaningful change in investors’ expectations and the macroeconomic fundamentals for over a decade. At this period, it is essential for fixed income investors to pay extra attention to the quality of issuers and risk management – be it currency, duration, or sector risk. Building enough “margin (i.e., spreads in the case of fixed income) of safety”, which is a concept that is core to value investing, is also going to be more critical, given lower cash flows and earnings visibility and heightened macroeconomic uncertainty.

Source: Bloomberg, Value Partners, as of 20 October 2022.

Now is the time to rebuild fixed income positions

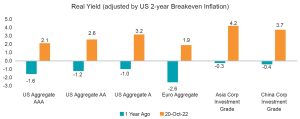

While the adjustment is ongoing and may last for a while, we also believe it is about time for investors to start rebuilding positions in credit and even sovereigns. Given central banks’ aggressive rate hike agenda, inflation may not likely stay at the current elevated level over the mid to long term. The chart below shows how much real yields have changed over the last 12 months for the different fixed income assets, with all increasing from negative to reasonably positive real yields. This highlights how much value has gone back into these assets.

Source: Bloomberg, Value Partners, as of 20 October 2022.

For the more technical readers, as evidenced in Ilmanen (2011) – Expected Returns: An Investor’s Guide to Harvesting Market Rewards, using data from 1962 to 2010, history suggests that high current inflation and yield levels are associated with falling rate expectations and elevated bond risk premiums, as well as realized bond returns in subsequent periods. The situation now exactly fits into such descriptions of high bond risk premiums, and hence it is also reasonable, if history holds, to expect higher returns from both sovereign and corporate bonds in the ensuing periods.

Source: Figure 9.3 from Expected Returns: An Investor’s Guide to Harvesting Market Rewards, Ilmanen 2011. Bloomberg, Federal Reserve Board, Federal Reserve Bank of Philadelphia, Blue Chip Economic Indicators, Consensus Economics, Sharon Kozicki, own calculations. BRP stands for Bond Risk Premium.

While we would not dare to make the same comment as The Economist did for investors buying into Austria’s 100-year bond now, we certainly believe buyers are less likely to regretit three years from now than three years ago.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

This commentary has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.