Markets this week: An octane fuelled mix

13-03-2020

The cocktail of plummeting US Treasury yields and tumbling oil prices have shaken investor confidence. Much of these concerns have also echoed the spread of COVID-19 which has disrupted supply chains and traffic in addition to dampening consumer sentiment.

The market’s reaction may be upset but there is little evidence to suggest that a prolonged and protracted economic recession is imminent. The environment which now faces sluggish growth has now prompted louder calls from policymakers in multiple regions for monetary and fiscal policy incentives to cushion the effects of a slowdown. So while weak data could persist into the second quarter of 2020, a quick recovery is likely and risk appetite will follow as governments ready an arsenal of stimulus packages.

Which brings us to the protagonist of the week – US Treasuries

Much of the recent US Treasury rallies (and slumping yields) were triggered by a search for safe-haven assets, worries that the current global expansion is nearing its end, and aggressive Fed monetary easing. Since recovery (post COVID-19) is on the cards, current US Treasury yields are unlikely to sustain lower for longer and we urge investors NOT to buy US Treasuries, despite being a popular ‘flavour’ this week.

In addition to extending the economic cycle, central bank interest rate cuts such as in the case for the Fed, also led to a rally in equity. If investors bet too hard on a recession in the near term, they can miss out on scenarios similar to 1995 and 1998 where equities rallied after a Fed rate cut.

Now who is the antagonist?

When the powers of OPEC speak, the oil market listens. However both Brent and crude are now down to 1991 levels as a result of an implosion in relations between non-OPEC oil producing Russia and the OPEC cartel. This exacerbated oil prices which had already been weakening as a result of a drop in demand globally.

Hide and seek

For investors seeking shelter from oil prices, pockets do exist away from commodities exposure. India high yield and Indonesia high yield have significant (over 45%) exposure to commodities, which drives our preference towards China high yield over Asia high yield.

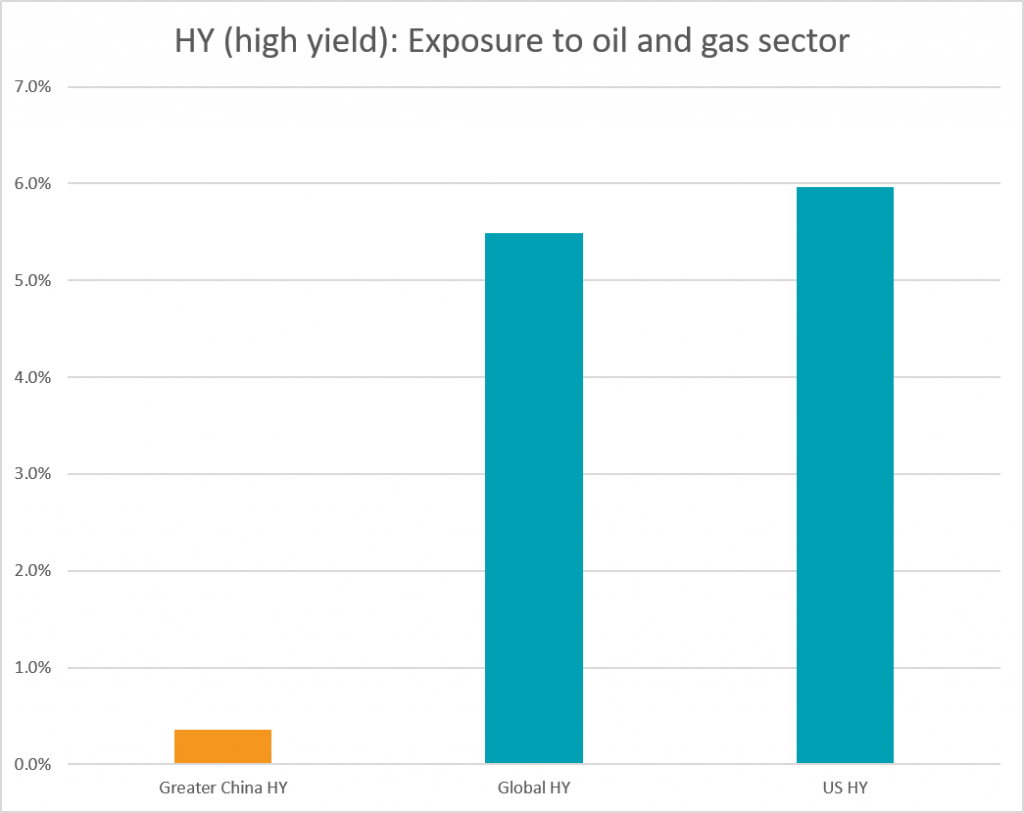

Another reason is the relatively low exposure (0.4%) of Greater China high yield to the oil and gas sector compared to their global (5.5%) and US counterparts (6%). Prior to the sell-off this week, our high yield position had little exposure (less than 2%) to companies which were sensitive to oil.

Source: Bloomberg, JP Morgan

While the effects have reverberated with oil-related names (both stocks and bonds) sliding 5 to 30 percentage points, China property credits were down much less between 1 to 5 percentage points, depending on the rating, duration and spreads.

Policy to the rescue

Let us come back to policymaking. Since the Fed sets the tone for global monetary policy, other central banks are expected to follow suit in term of easing rates. Central banks in Asia hold more ammunition for easing compared to their western counterparts, which should bode well for Asian bonds as investors retain an appetite for yield chasing. Because interest rates in Japan and much of Europe are in negative territory, and the Fed having recently slashed rates, investors will still seek higher yielding opportunities outside of developed markets. With Asia policy rates well above zero, Asia bond markets could benefit.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Issuer: Value Partners Hong Kong Limited