Policy Matters: China’s 20th party congress

27-10-2022

Policy Matters: 20th party congress reaffirms development and its focus on technology innovation

The 20th party congress of the Communist Party of China (the party congress) was held in the week of 16 October 2022. With widespread news coverage already made about the meetings – and with a particular focus on President Xi’s work report and the new formation of the Politburo Standing Committee – now is probably the time to look at their investment implications.

But, first things first, what is the party congress, and why does it matter?

The party congress is a political gathering of senior representatives from the Communist Party of China (CPC), which was founded in July 1921 and is now more than 100 years old.

As the country’s ruling party, the CPC had over 96 million members at the end of 2021, which is more than the combined population of Canada and Spain.

The party congress, held once every five years, attracts most people’s attention, as it usually sets the path of development for the party leaders and the country.

One of the most important events to watch this time was the election of the Politburo Standing Committee (PSC), which is the party’s most senior body. This was first unveiled after the conclusion of the party congress (and in the first plenum).

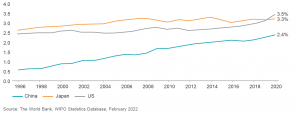

The chart below shows a snapshot of CPC’s core power structure:

The new leaders

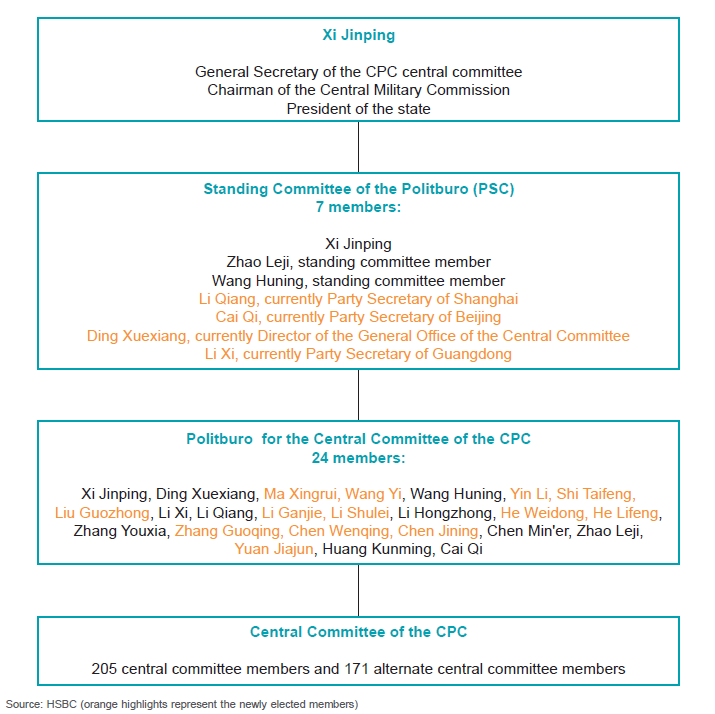

In a widely expected move, President Xi was re-elected to the PSC as the General Secretary, representing his third consecutive term and indicating a strong sign of policy continuity.

Meanwhile, it is also noteworthy that:

1. The total number of PSC members remains unchanged at seven members.

2. Other than President Xi, only two other members of the PSC were re-elected. In other words, more than half of the new leadership committee are “new faces”.

PSC members with a summary of their backgrounds:

What are the key messages from the party congress?

President Xi’s opening speech and work report have largely summarized the achievements in the past years and outlined some key objectives for the future. These objectives include prioritizing the development of education and self-sufficiency and strengthening technology, among others.

However, the work report focused on structural and schematic issues. Hence, anyone attempting to search for the direction of the country’s anti-Covid policies and their economic implications (or any specific details) may find that quite stretched. As one sell-side analyst has written, the “analysis of the wording [of Xi’s report] is like reading tea leaves”.

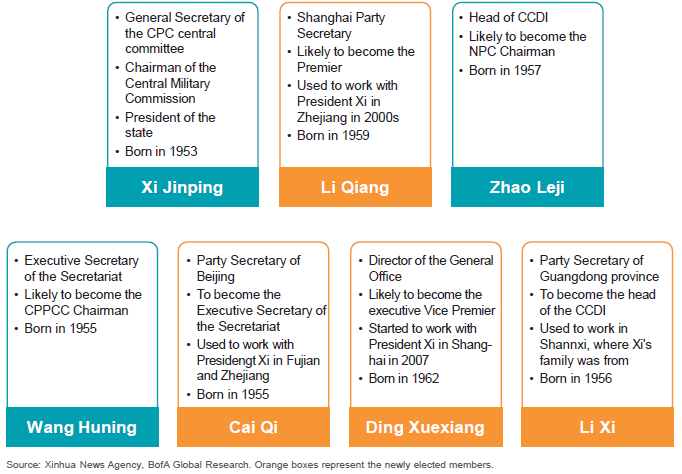

That said, one way to analyze the party congress is to count the number of word mentions (Figure 1). This year, it doesn’t come as a surprise that the most mentioned word is “development”, which also appeared frequently in the work report. While we expect “development” to remain China’s top priority, policy direction could also focus more on “technology”, which has seen a tremendous pickup in terms of mentions.

Figure 1: Key words/mentions in the 20th party congress

We believe the party congress reinforces the stability of leading powers and policy continuity in China. These are considered vital to counter the significantly changing external environment and ensure the country remains on track to achieve long-term quality growth.

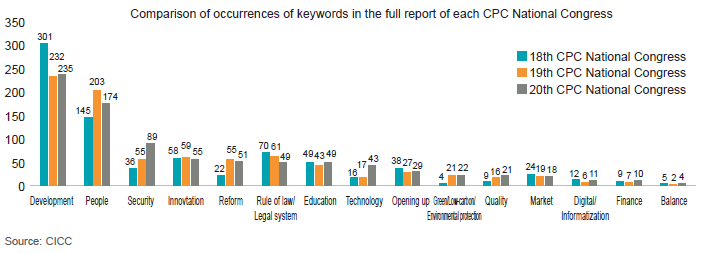

That said, technology in China will remain under the spotlight as a key pillar of China’s economic modernization. Statements made during the party congress suggest this, such as “technology is the first productivity and innovation is the first power”, and “accelerate the implementation of innovation-driven development strategy”. This indicates that technological innovation in China, as represented by the increased R&D spending, will remain a focus of the ruling party. According to World Bank data, China’s R&D spending as a percentage of GDP has continued to rise through the last two decades, although it is still behind other developed countries(Figure 2). This trend is likely to continue and, coupled with China’s growing economic scale, could support the country’s transformation towards an innovation-driven and modernized economy.

Figure 2: R&D expenditure as % of GDP

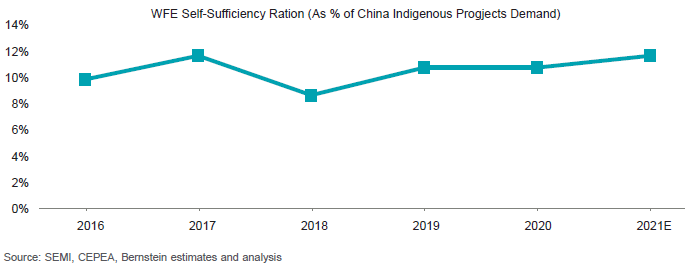

The agenda would also support the need for increasing R&D expenditure to achieve self-sufficiency in wafer fab equipment (WFE), which hasn’t seen much progress in the past few years (figure 3).

Figure 3: China WFE Self-Sufficiency Ratio

Investment implications

Given that Chinese policymakers will likely continue their existing policy agenda, and with an even greater focus on technology advancement, balanced development, and green transition, we view that the following sectors may sustain strong growth and are worth paying attention to:

• Information technology industry, including internet-of-things (IoT), communication equipment, industrial software, and operating systems

• Advanced manufacturing, including industrial automation as well as high-end manufacturing equipment for both civil and smart manufacturing

• Digital creation industry, such as the AR/VR, digital content production, digital culture, creative designs for manufacturing and service industries

• New energy, including the supply chains across wind, solar and hydro powers, as well as the key suppliers in the electric vehicles (EV) industry

• Well-being industry, especially with a focus on the prevention of diseases, early-stage diagnosis, wellness and recovery, modernization of traditional Chinese medicines, and biotech

• Meanwhile, selected players in the semiconductor industry and seed industry may also be bolstered by China’s enhanced focus on the self-sufficiency of electronics and agricultural supply chains.

• Last but not least, we maintain the view that the drive to increase household income and the emphasis on common prosperity will improve wealth distribution, support a broader consumption recovery, and provide a long-term driver to high-quality consumption companies.

It is also important to highlight that, while these industries are supported by policy, we view that continuous and close monitoring of different companies is still required, given there may be considerable differences in how each company benefits from tailwinds. In fact, given the unprecedented market volatility and heightened geopolitical tensions in the near term, we believe that strong stock-picking capabilities are necessary to cherry-pick the players that can ride through the storms and thrive in the long term.

What’s next to watch?

It is worth reiterating that the party congress was not aimed to lay out concrete economic-related action plans and timelines – including the much-awaited changes to the anti-Covid policies (if any).

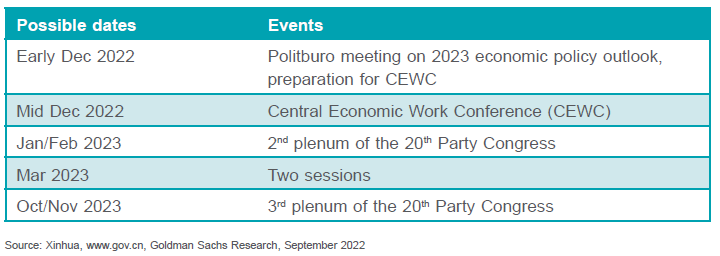

That said, many detailed policies could be unveiled in the following conferences and meetings in the next few months. Amongst them, one particular key to watch is the “two sessions” to be held next March, when the government and provincial leadership changes are likely to be concluded. It is also worth keeping an eye on if a new GDP target will be announced at that time.

Timetable of upcoming events:

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

This commentary has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.