China equities: Domestic consumption at play

15-01-2021

The dual circulation strategy is at the core of China’s economic development for the next five years and onwards. The circulation’s internal loop emphasizes the importance of local demand. Given that the geopolitics may not subside entirely, China taking a domestic-oriented approach as a pillar strategy shall reduce the growth volatility driven by external risks. Our preference for the locally-facing sectors is unchanged. Their visibility in future growth trajectory would prevail in the medium-to-long run. In particular, we illustrate the paradigm of China’s consumers and their spending pattern and the investment implications.

Intact consumption upgrade

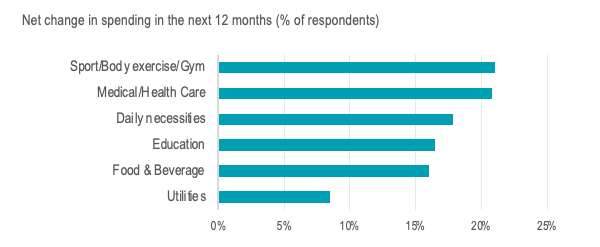

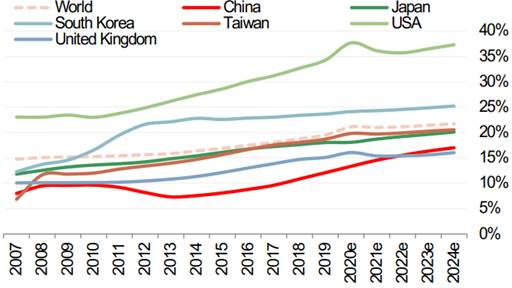

The pandemic impacts did not interrupt the structural trends of consumption upgrade in China (Figure 1) as the willingness to spend more on lifestyle upgrade continues. The drivers of growth – the rise of the middle class, surging household income and urbanization – remain intact and continue to spur on domestic consumption in the future.

While the Chinese individual savings level is among the highest globally, consumption only accounts for a smaller proportion of China’s GDP than that of Japan and the U.S. This situation continues to evolve, however, especially when domestic dependency is a core policy agenda to steer China’s economic development. Such an agenda is well supported by the rising purchasing power of the middle-class income nationals. This cohort accounts for 600 million citizens1 – roughly a double of the U.S. population – and serves as a solid ground to foster the consumption upgrade behavior.

Figure 1: Consumers shift to spending more on consumer items related to personal well-being

Source: UBS, November 2020. Measured as % of people who will spend more minus % of people who will spend less.

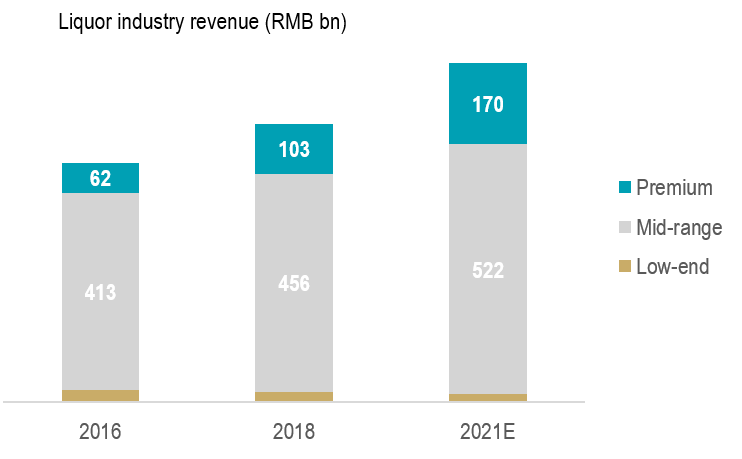

Figure 2: Premium baijiu is expected to see the highest demand growth among liquor products in China (RMB bn)

Source: Euromonitor, company data, Morgan Stanley Research, July 2020.

Within China’s expanding consumer market, our focus has been the leaders with scalable businesses operated under reputable and innovative brands, which best position them to capitalize on the structural trends. Using this logic, we illustrate the power of premiumization on the mainland with Chinese white liquor (baijiu) as an example.

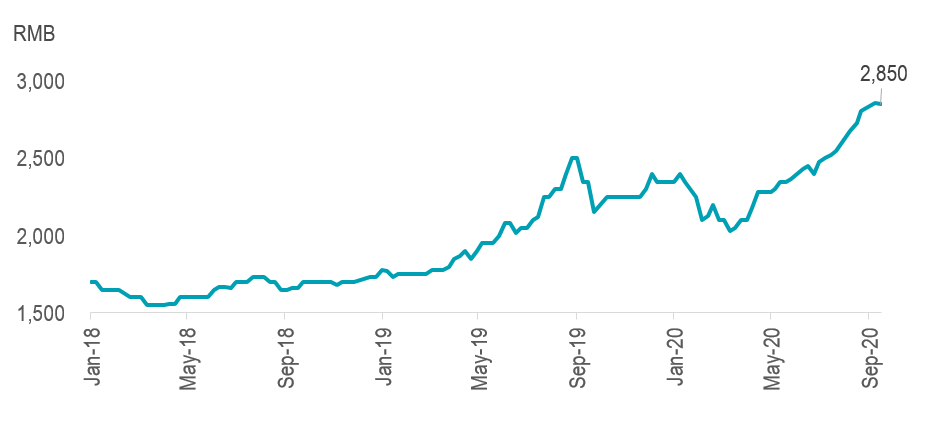

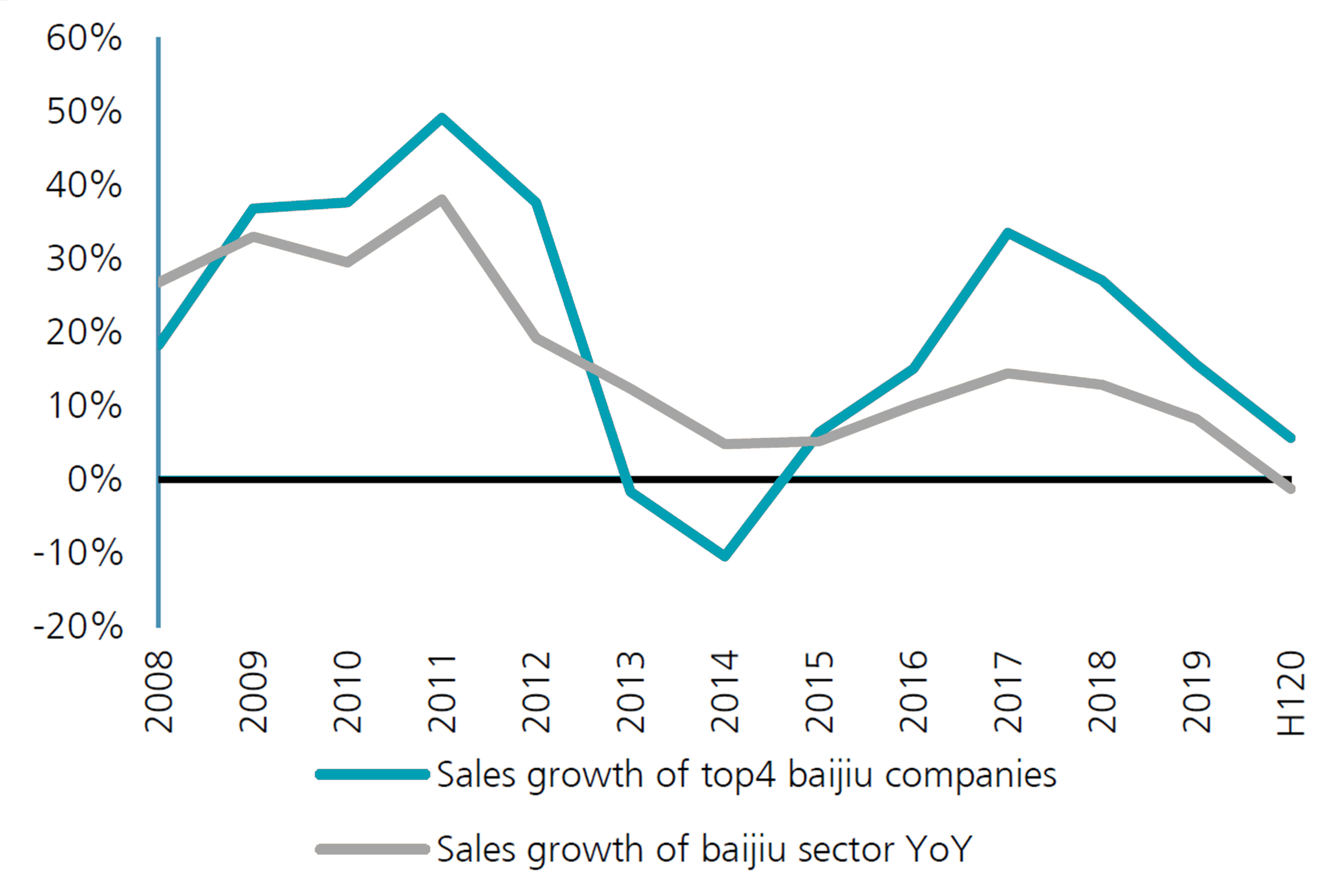

High-end baijiu makers’ value is predicated on the perceived social value and the limited brewing capacity (Figure 2). In the premium liquor industry, new brand entrance is unlikely as it has been highly consolidated and dominated by four known brands. Due to their strong market positioning, sustained demand from affluent consumers and increasingly from the mass market, top-tier baijiu’s pricing power is held sturdy even under the COVID-19 interruptions (Figure 3, 4). This confirms our thesis of sticking with the quality leaders.

Figure 3: The wholesale price of 53% Feitian Moutai (per bottle)

Source: Kweichow Moutai, Value Partners, September 2020

Figure 4: Sales of top four baijiu brands outperformed the broader market despite COVID-19

Source: National Bureau of Statistics, Company data, Wind

Another example is sportswear. The COVID-19 outbreak exposes the critical importance of an individual’s well-being and enhances public health awareness. This brought sports exercise to the forefront and gave a boost to the Chinese sportswear market, providing that sportswear as the category mainland shoppers would spend more in (Figure 1). From top-down, increasing the population who exercises regularly is also on the central government’s agenda as it plans to bring the current 34% actively exercising population to over 40% in 20302. These are beneficial to sportswear makers, which are expected to grow at a compound annual growth rate (CAGR) of 13%3.

Apparel is always associated with sentimentality; sportswear is not an exception. Guochao, which literally means China’s chic, expresses confidence in national identity and appreciation of traditional culture in outfits. Riding on the homegrown fashion wave, the sentimental makeover helps premiumize the brand image of quality domestic sportswear names, which take up popularity among the younger generation in particular. It collides with the trend of athleisure style, which blends active and fashionable wearables.

It would catalyze a convergence of Chinese activewear spending towards its neighboring countries (Figure 5), driving the per-capita expenditure of US$33 closer to the average of US$145 among other Asian countries. Other than sentimentality, another important catalyst to drive sportswear to premiumize is the advancement of materials and functionality, that arouses shoppers to pay a premium for better experience.

Figure 5: Sportswear takes roughly 15% of China’s total apparel market.

Source: Euromonitor, Morgan Stanley Research, November 2020

Untapped services market in focus

E-commerce platforms have been in the spotlight through the pandemic, especially during the citywide lockdowns. We consider the pandemic as one of the major tipping points for e-commerce adoption as the lockdown boosted the usage and first-time user experience when people needed to shift consumption from offline to online. We believe the convenience brought by digitalization is an irreversible trend to drive e-commerce growth structurally.

We consider the pandemic as one of the major tipping points for e-commerce adoption as the lockdown boosted the usage and first-time user experience when people needed to shift consumption to online.

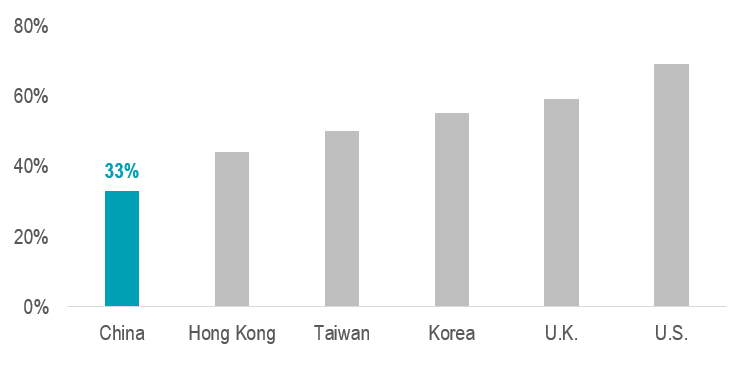

After the year-to-date rally on share prices, our approach to e-commerce has strategized towards more on services- oriented e-commerce platforms. Mainland Chinese shoppers spend rather less on service-related items than the neighboring and advanced economies (Figure 6). Even more, the penetration rate of e-commerce platforms offering services is a mere 10%4, far less than the platforms for merchandized goods that penetrates 30% of the market. The untapped market, expanding online spending habits and gradual upgrade in consumption would altogether uplift these platforms’ user base and eventually their profitability.

Figure 6: Service consumption in China accounts only for 33% consumer spending, lagging far behind advanced economies

Source: WIND, UK Office for National Statistics, Statistics Korea, National Statistics of Taiwan, Census and Statistics of Hong Kong SAR, National Bureau of Statistics of China

Investment case:

We take an online fresh food marketplace as an example. We favor the leader in the field as they innovate and overcome a major logistics difficulty leaping ahead of its peers.

Some e-commerce platforms are impeded by the limited shelf life and the time-constrained delivery of fresh produce across the mainland. The company launches an eco-system that collaborates with widely found mom-and-pop stores for last-mile delivery.

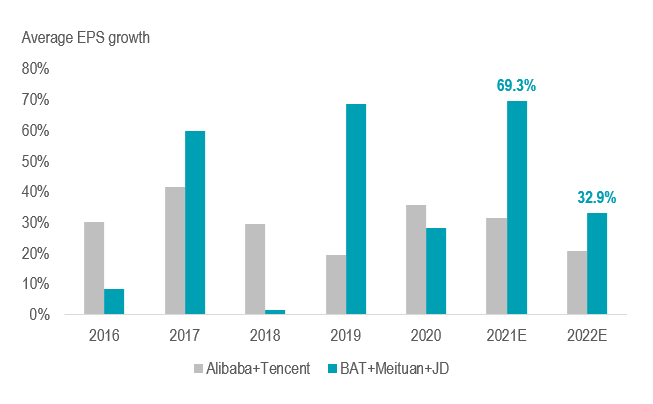

Customers can pick up packages from local shops while the platforms enjoy substantial cost benefits. The centralized stocking and refill also enhance efficiency. This is a breakthrough that enables increasing user base and profitability, thus forming a solid investment case (Figure 7).

Figure 7: Service e-commerce platforms add more fuel to earnings growth among the key tech giants in China

Source: Value Partners forecast, HSBC research

Source:

- Citi estimates

- The State Council of the People’s Republic of China, July 2019

- Euromonitor, Morgan Stanley Research

- Value Partners estimates, November 2020

Learn more: Value Partners Classic Fund

Disclaimer: The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable as of the date of presentation, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. This material has not been reviewed by the Securities and Futures Commission in Hong Kong. Issuer: Value Partners Hong Kong Limited.

For Singapore Investors: This commentary has not been reviewed by the Monetary of Singapore. Value Partners Asset Management Singapore Pte. Ltd., Singapore. Company Registration No. 200808225G