Asian credits: Hunting for value in a fragile world

10-07-2020

Nowadays, policy easing is a universal way to land the global economy. Yet, with a varying level of liquidity among countries, traditional sources of safety and income are outshined by the risk-reward profile of Asian credits.

A risk rally or a risky rally?

Following the surprise from the oil price slump, the U.S. Federal Reserve decided to take the interest rates to its record low ahead of its regular meeting schedule, twice. The Fed’s promise also expanded to a new money-market support facility of an unlimited amount to prop up the market. The unprecedented move of buying non-investment grade corporate bonds and the historic scale of the rescue package have altogether flooded the market with massive liquidity.

The easing extent of this kind has artificially suppressed the interest rates and taken important market information out from the proper pricing of risk assets. Their prices no longer reflect the risk-reward considerations, but principally the Fed’s actions.

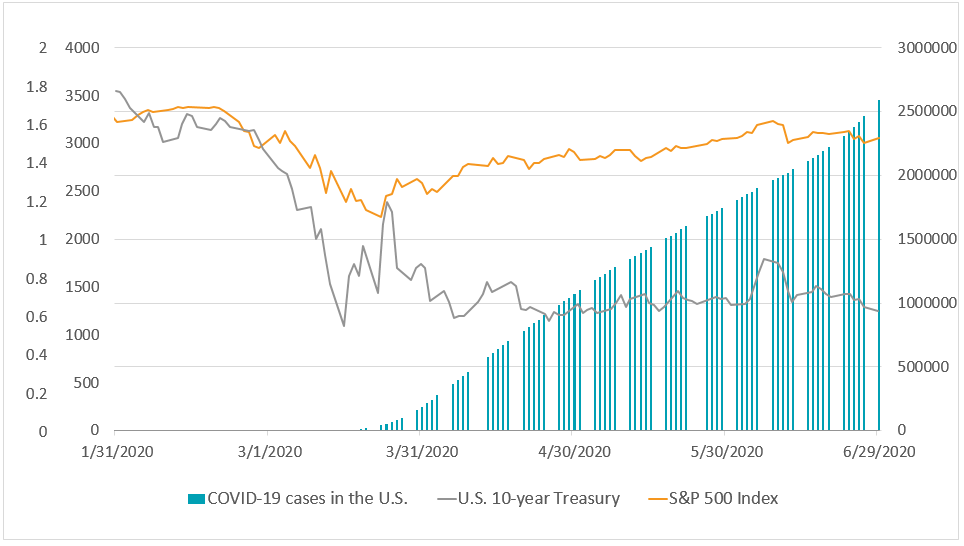

The case is strong when we compare the rising trend of new COVID-19 infected cases in the U.S. and the rallying S&P 500 Index and bond market. This reflects fundamentals detached from reality. Thus, the risk-reward in the U.S. market is not entirely attractive.

Figure 1: COVID-19 cases versus performances of the U.S. equity and bond markets

Source: Bloomberg, 30 June 2020

Investors may question: Would the Fed and the expected V-shaped recovery in the U.S. economy disappoint the market? How long will this risk rally endure? More importantly, when will be the so-called Day of Reckoning? We are not entirely sure.

Yet, one should recall what happened after the Fed decided to reduce its scale of bond-buying program in 2013 (“Taper Tantrum”) and triggered a sharp spike in Treasury yields and massive selloff of risk assets. Since the 2008 Global Financial Crisis, the market has become extremely used to central banks’ rescue whenever there is a massive market rout. Global central banks are now on the hook to such market expectation, which has burnt deep into investors’ minds. Central banks have to keep doing more and more to satisfy an ever-demanding market. Any rhetoric and intention to do less would have an undesirable effect on the market.

Today, the room for central banks to maneuver around crises is narrow. The ultra-low rate policies have distorted what an economic cycle would typically look like and traditionally how the central banks follow the flow and adjust the rates when needed.

Under such a fragile backdrop, where do investors still find value in the case of bond investing?

Hunting for China value

Mounting risks and minimizing policy room in the U.S. put forward a theory of sticking to where we find relative value.

Compared to the U.S. and other developed markets, China, the second-largest economy in the world, has been rather conservative in its monetary stance, even in the face of the trade war and COVID-19. China’s 10-year treasury still offers an attractive yield of between 2.5% and 3.5%2.

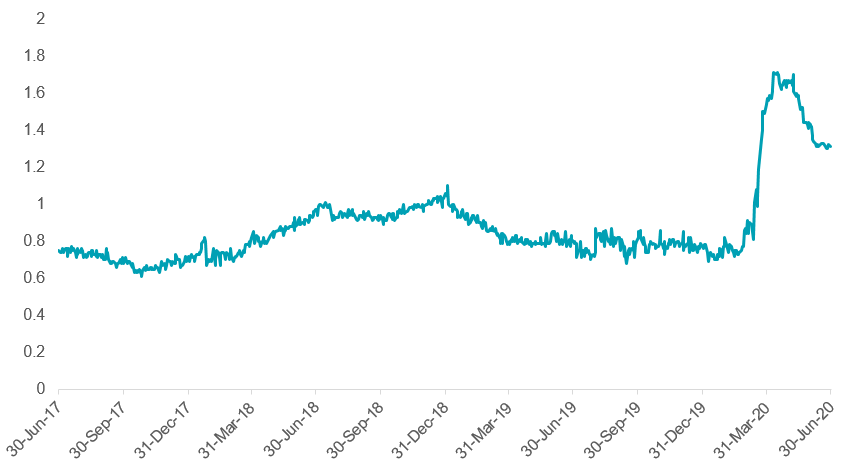

Figure 2: Yield Spread between Asian and U.S. comparable investment grade bonds

Source: Bloomberg, 30 June 2020

Figure 3: Yield Spread between Asian and U.S. comparable high yield bonds

Source: Bloomberg, 30 June 2020

Furthermore, credit issuers in China, and even wider in Asia, continue to provide a decent liquidity and refinancing profile, thanks to the favorable onshore funding and preemptive offshore funding.

China’s annual “Two Sessions” meeting set the tone of ensuring the job market and social stability for the year ahead after the COVID-19 hit. We expect the mainland’s policy directions to remain city- and industry-specific. In addition, as the country exhibits a “first-in, first-out” case, bonds issued by Chinese firms outshine those from the virus-stricken areas.

As the Sino-U.S. relations worsen, oversold Asian and China credits saw a widening spread between the two countries and made valuation more attractive. Taking into account concerns over the trade dispute and geopolitical risks, we are inclined towards an income-based credit strategy. This allows investors to obtain regular coupon income while being diversified.

Given the political uncertainties, Chinese-issued U.S. dollar bonds turned soft, providing us with a valuable entry opportunity. We can purchase safer assets at a relatively low price. We choose the performing Chinese corporates, which are mostly domestic-facing and less impacted by swinging market sentiments, in order to obtain a stable stream of income.

- Source: Bloomberg, 30 June, 2020

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable as of the date of presentation, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

For Singapore investors: This commentary has not been reviewed by Monetary Authority of Singapore. Value Partners Asset Management Singapore Pte Ltd, Singapore Company Registration No. 200808225G.

This commentary has not been reviewed by the Securities and Futures Commission in Hong Kong. Issuer: Value Partners Hong Kong Limited.