Why Asian assets remain relevant in the year of restart

08-01-2021

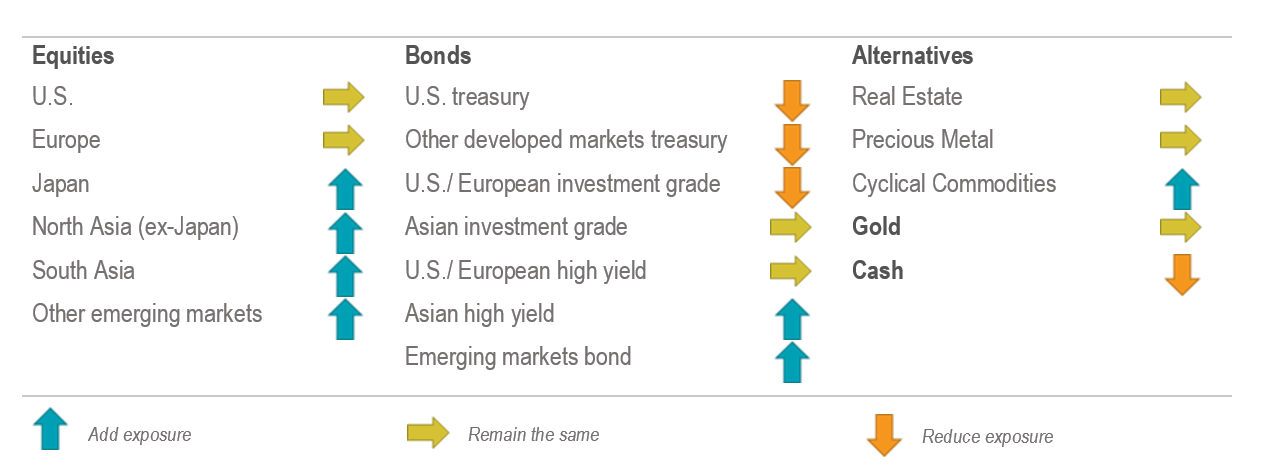

Vaccines, coupled with continuing support from central banks, shall lend support to extend the momentum of investors’ risk appetite in 2021. Our cautiously optimistic views are reflected in the overweight position in equities and high yield bonds (Figure 1). Furthermore, the softening U.S. dollar is anticipated favoring emerging market equities if history is any guide.

Figure 1: Asset Allocation Views for the next 12 months

Source: Value Partners, December 2020

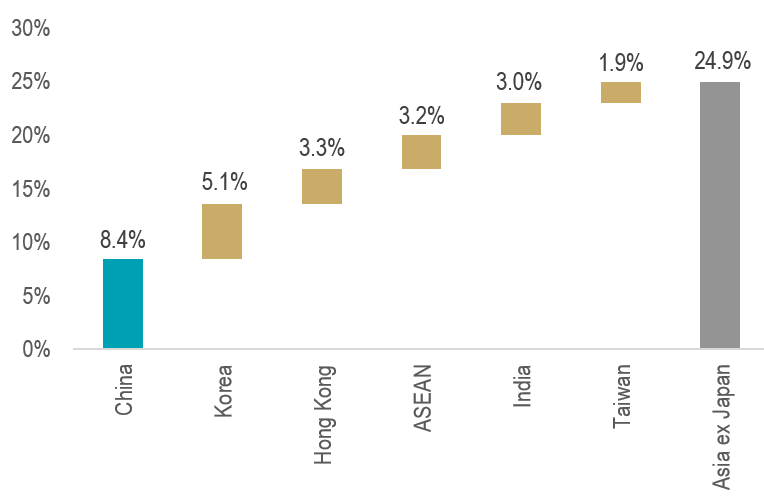

Figure 2a: China remains the engine to drive regional earnings growth, expected to take up roughly one-third of growth contributed to Asia ex-Japan equities in 2021

Source: FactSet, MSCI, Goldman Sachs Global Investment Research, November 2020

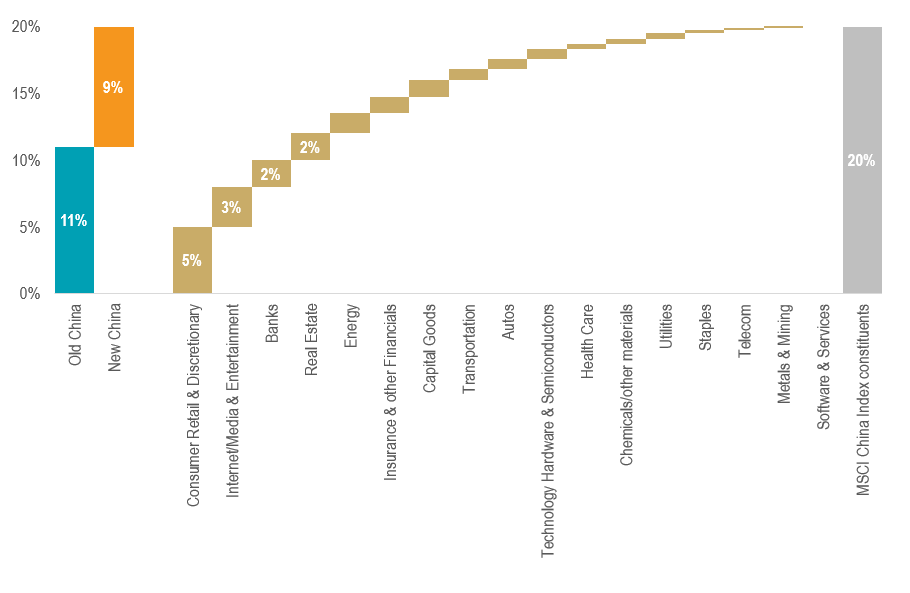

Figure 2b: EPS growth of MSCI China Index constituents would be on an even keel between old and new economies

Source: FTSE Russell, FactSet, HSBC Research, November 2020

Asia ex Japan equities, especially China-related companies, continue to be in focus. As indicated in Figure 2a, the regional earnings-per-share growth is expected to rebound by 25% in 2021, with China contributing one-third of the growth. Unlike the past couple of years, profit growth derived from old and new economy sectors is forecasted to be more balanced (Figure 2b).

Taiwan’s equity market sees strong fundamentals, thanks to its global leadership in advanced tech components for areas such as 5G infrastructure, AI and high-performance computing. The soaring demand for IT hardware postpandemic is intact into 2021. In 2021, it is expected that the worldwide shipment of new-generation smartphones will surge to 470 million units from 260 million units from a year back. As 5G-enabled smartphones and other new tech devices popularize, it will pull a greater demand for critical components such as chips that are widely used in connectivity, processors and integrated circuits.

Similarly in South Korea, the robust external demand under an increasing digitalization trend shall lead the country’s recovery in 2021. We expect manufacturing activities to be the main growth driver as export orders look to recoup most of the losses in 2020 and offset the milder recovery in domestic consumption amid the tighter social distancing measures. The pick-up in external demand also increases the expectation on more investment in the private sector, and such capital expenditure recovery shall support a more sustainable economic growth and thus driving a more stable equity market sentiment in 2021.

After the sluggish performance in 2020, the South Asian equity market emerges as a catch-up potential, seeing a considerable amount of foreign institutional capital inflows towards the end of the year. In addition to fund flows, a weaker U.S. dollar shall be favorable to the emerging markets, including ASEAN. Our positive view is reflected in an overweight rating.

The regional earnings-per-share growth is expected to rebound by 25% in 2021, with China contributing one third of the growth.

On the fixed income side, the rosy earnings estimate and the sentiment towards Asian corporates will continue to lend support to high yield bonds. An eased risk aversion globally, together with a low-rate environment, would benefit the Asian high yield issuers.

Other than the stock and bond rally in 2020, Gold was one of the winning asset classes as bullion reset the historical high of over US$2,000 per ounce. Demand for gold would continue as a portfolio diversifier, although gold prices may be range-bound into 2021 as extreme risk aversion may subside under a broad recovery.

Value Partners’ Featured Funds:

Disclaimer: The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable as of the date of presentation, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. This material has not been reviewed by the Securities and Futures Commission in Hong Kong. Issuer: Value Partners Hong Kong Limited.

For Singapore Investors: This commentary has not been reviewed by the Monetary of Singapore. Value Partners Asset Management Singapore Pte. Ltd., Singapore. Company Registration No. 200808225G