China In Focus: The Post-COVID-19 Era

11-08-2020

We broadly categorize the backdrop facing equity investors into four key points that impact the markets during and after the pandemic. China emerges with its “first in, first out” experience, which is to play out in the second half of the year, and stands on its own feet despite geopolitical challenges.

1. What do we expect in the post-pandemic recovery path?

The worst of the pandemic is likely behind us. One of the signposts we are using to track the impacts of the pandemic is high-frequency data from different channels. Data shows that Asia, particularly China, is ahead of the recovery curve, or as we put it, a “first in first out” case. Fig 1 showcases the sequential recovery recorded in various sectors in China.

Fig 1: China highlights – our channel check (YoY growth %)

| Market Leaders | March | April | May | June |

| Hotel Occupancy Rate | 23% | 36% | 44% | 51% |

| A leading hotel chain’s occupancy rate | 46% | 63% | 69% | 69% |

| Sportswear Companies | -34% | -13% | 7% | 4% |

| A domestic leading brand | -30% | -15% | 5% | 0% |

Source: Value Partners

The countries that discovered and recovered from the pandemic early, such as China, Taiwan and Korea, share similar experiences. They tend to i) run an active virus tracking system, ii) adopt a stringent testing approach and iii) conduct regular neighborhood surveillance to stem the infection chain from expanding. Though, we do not feel complacent about the flattened curve and maintain our constant watch over the recovery progress.

2. Policy easing is everywhere – how do we gauge the scale?

Policy easing is prevalent in virtually every country in the world. The U.S. Federal Reserve took the rates to its record low twice in the first half of 2020, ahead of its regular committee meeting. In the middle of the unprecedented lockdown, the Fed also promised an unlimited amount and purchase of recent fallen angels.

Such a scale of rescue package can help anchor the economy and the injection of money to the system also implies an inflation in the capital markets and asset prices. While monetary and fiscal easing policies are all enforced globally, unlike the Western countries, Asia, especially China, did not employ an aggressive asset purchase program during the pandemic. Instead, China focused on loosening credit facilities to assist enterprises in overcoming such a public health crisis. Meanwhile, Asia’s economy also runs a fiscal deficit to GDP that is already close to 10%, nearing Global Financial Crisis levels.

3. Sino-U.S. tensions: Is the duo down a path of decoupling?

One of the major risk factors facing equity investors, especially China-related markets, is the re-escalation of Sino-American tensions. From a practical perspective, we believe that neither China nor the U.S. can afford a long term breakdown in their relationship.

In our view, decoupling China and the U.S. – arguably a pair of complementary powers – would complicate the solutions to the world’s problems. In fact, necessity makes it a logical situation where the U.S. and China will have to become partners. While the headlines are loaded with a rhetoric that the Sino-U.S. relationship falls out, we take a somewhat contrarian view.

Our view is that the future direction of their relationship would move towards cooperation out of sharing necessity. On this basis, we would envision that after the U.S. presidential election in November, the relations would stabilize. Indeed, there is a possibility to realize another side of the story, where China’s tensions with America will remain strained. In that event, China continues to offer vast investment opportunities with its domestic reforms and development.

But, if we are right about refreshed or recovered relations, Chinese equity markets shall enjoy a substantial rerating. The recovery in that relationship expand the room for foreign interests in China by a significant margin.

4. After the momentum rally, where does the valuation stand?

The liquidity in the market seeks to park in good assets. While the earnings outlook for the world equities stagnates in general, this has led to price-to-earnings ratio less indicative. We look into the price-to-book ratio for equity estimates and such valuation is not particularly stretched despite the second quarter’s rally. For reference, the MSCI China Index currently trades slightly above its long-term average. The same trend is observed in the broader MSCI Asia ex-Japan Index.

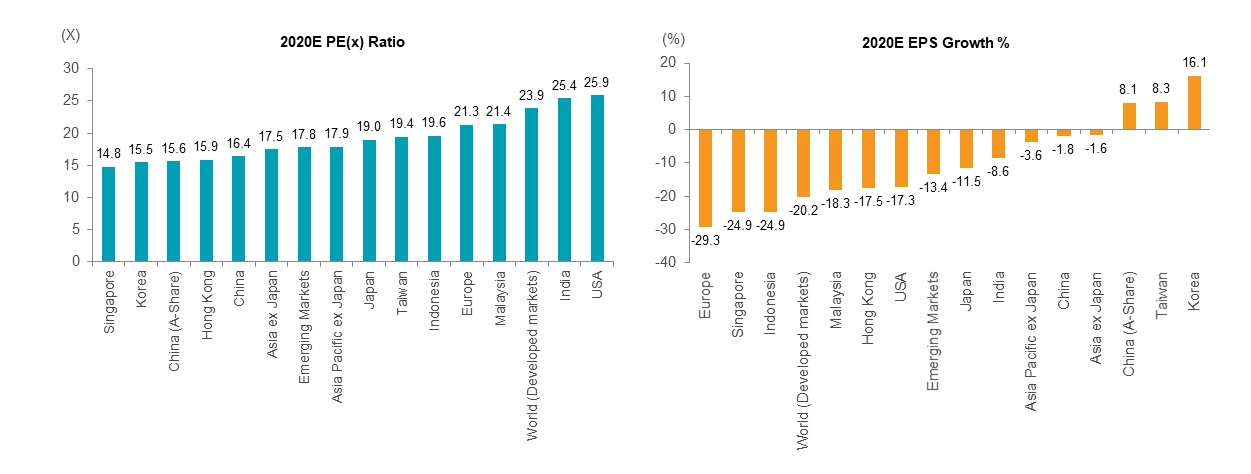

Fig 2: China onshore and offshore equities see an attractive relative valuation in view of its earnings growth

Source: FactSet, I/B/E/S, MSCI, Goldman Sachs Research, 31 July 2020

Read more

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable as of the date of presentation, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

For Singapore investors: This commentary has not been reviewed by Monetary Authority of Singapore. Value Partners Asset Management Singapore Pte Ltd, Singapore Company Registration No. 200808225G.

This article has not been reviewed by the Securities and Futures Commission in Hong Kong. Issuer: Value Partners Hong Kong Limited.