How to navigate investment risks and opportunities in 2019

15-03-2019

Turbulence amid grey skies. That was the overriding theme in financial markets in the second half of 2018 as a number of surprises rocked already fragile investor sentiment. U.S. president Donald Trump waged war against China in the international trade arena, which further weighed on China’s already cooling economy, while uncertainty surrounding the pace of U.S. interest rates hikes sapped investor appetite for risky assets, especially in emerging markets.

Although sentiment has brightened considerably recently, much of the uncertainty that clouded 2018 is expected to stretch into 2019 as a number of key risk factors continue to linger. Primary among them is the synchronised slowdown in global economic growth. The Purchasing Managers’ Index (PMI) – a closely watched gauge of the health of the manufacturing sector – has been trending downwards over the past year in key economies around the world, including the U.S., the Eurozone, China and Japan.

In particular, China’s PMI slipped below the critical 50 mark to 49.41 in December, marking the first time since 2016 that the sprawling manufacturing sector in the world’s second largest economy has contracted. Beijing has also revised down its GDP growth target and is aiming for GDP growth of between 6% and 6.5%2 in 2019, lower than the 6.5% target set for 2018. Additionally, retail sales has been slowing in China over the past year, while in the U.S., it logged its steepest decline since 2009 in December.

The slowdown in global economic growth inevitably trickles into corporate earnings. Weak earnings sentiment is another risk that investors face in 2019. The current 2018 results season hasn’t gotten off the best of starts, with a number of companies globally having fallen short of earnings expectations and unveiled disappointing guidance. In 2019, we expect further earnings downgrades for all major markets.

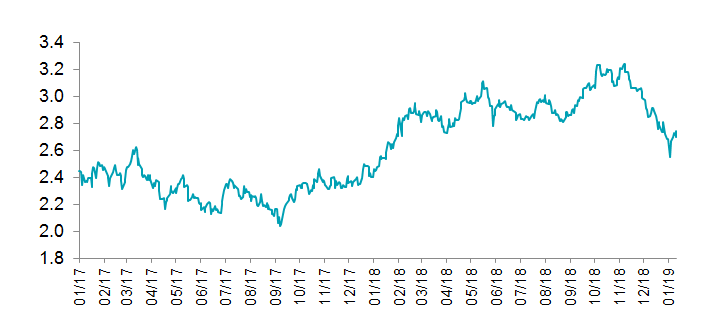

However, there are silver linings. The U.S. Federal Reserve has switched to a more dovish tone at its recent policy meeting in January after having made four 25 basis point rate hikes in 2018. The Fed has put a brake on further rate hikes as it assesses economic conditions following a weakening of leading indicators including business and consumer confidence. The number of rate hikes in the next 12 months, as implied by short-term interest rate futures, has slipped from more than two in mid-2018 to zero at present.

With U.S. monetary policy being a key driver of the value of the U.S. dollar, we subsequently expect a reversal of the greenback rally of 2018 this year. This would be a relief for emerging markets, which have been hit by outflows as the U.S. dollar strengthened.

10-Year US Treasury Yields

Source: Bloomberg, Value Partners

In China, monetary policies have become more accommodative as Beijing looks to cushion economic growth. Key gauges, including consumer spending, manufacturing output and investments have sank to record lows, as the economy grappled with the after effects of the government’s deleveraging efforts and the squeeze of the U.S.-China trade war. Recent measures to support the economy include RRR cuts, tax cuts and the introduction of a new “targeted medium-term lending facility.”

Finally, the U.S.-China trade war is showing signs of easing. The original March 1 trade negotiations deadline has since been extended, which reflects a greater willingness from both sides to reach an agreement as the strains of the trade war take their toll on the U.S. and Chinese economies.

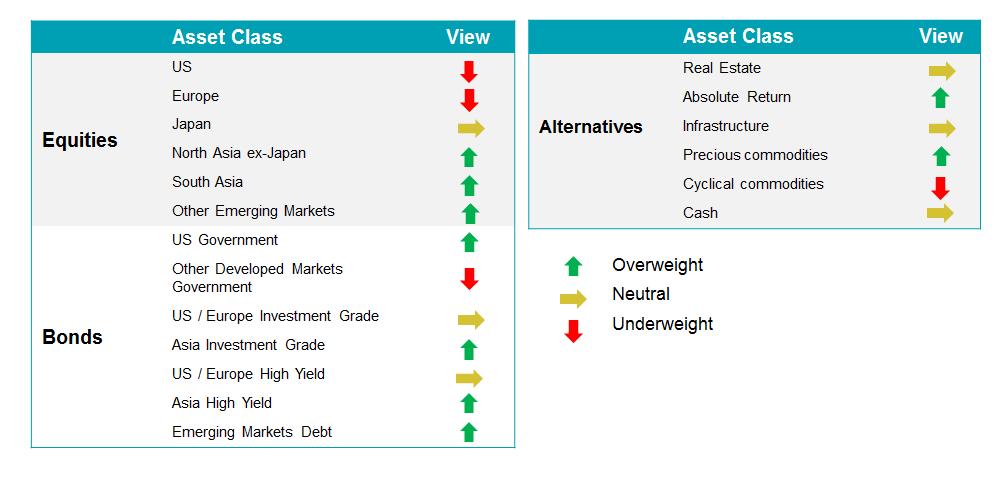

Asset allocation: Overweight North Asia ex-Japan equities, Underweight U.S. equities

So how should investors allocate their assets? Given the set of risk factors and silver linings, we recommend being overweight North Asia ex-Japan equities, South Asia equities, other emerging market equities, U.S. government bonds, Asia investment grade bonds, Asia high yield bonds, emerging market debt, absolute return alternatives and precious commodities. However, we recommend being underweight U.S. equities, European equities, other developed market government bonds and cyclical commodities.

With Central Banks around the world being more dovish and policies easing in China, liquidity has started to return, which has prompted an uptick in fortune for riskier assets and markets. We believe this is positive to risky assets across the entire spectrum, but Asia and emerging market equities have the most upside potential.

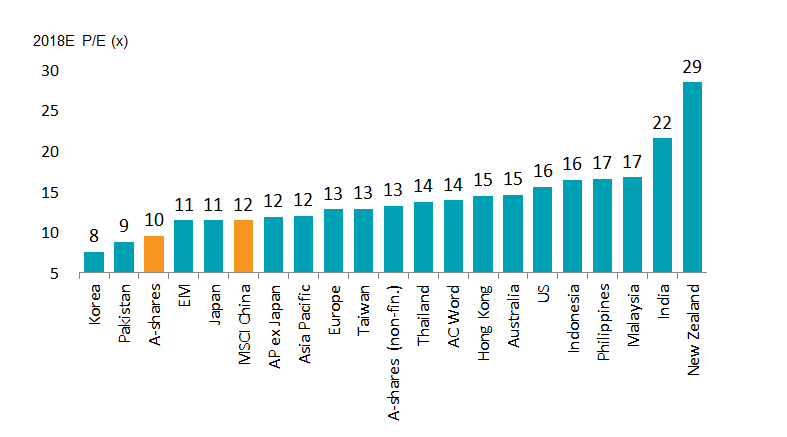

That is because the valuations of Asia and emerging market equities are either trading below or near their 10-year averages. In contrast, U.S. equities are still almost one standard deviation above their mean. Additionally, given that most of the policy stimulus is coming from China so Chinese equities, especially A-shares, will be the major beneficiary following an extremely bearish 2018.

China equities: Opportunities in healthcare, internet and education

Valuations are looking attractive for Chinese equities. Multiples for many sectors of the MSCI China Index are trading at or close to 10-year trough levels on a price-to-earnings basis. The MSCI China Index itself fetches 11.3 times forward earnings, which is well below the 16.5 times at which the MSCI USA Index trades. While earnings visibility and trade talks continue to be uncertainties in the market, a weaker greenback, lower oil prices, and more accommodative monetary and fiscal policies have historically paved the way for positive developments.

Comparing market valuations globally

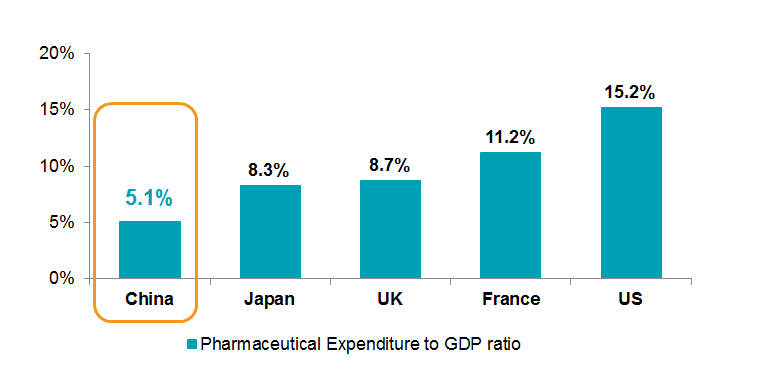

Three sectors that could present attractive investment opportunities in 2019 are: healthcare, internet and education. Defensive healthcare stocks have been persistent outperformers in recent years. However, valuations have fallen to cyclically low levels following a significant derating that was triggered by a vaccine scandal in the second half of 2018. Subsequent drug price cuts by the 4+7 group purchase organisation exerted further downward pressure.

In spite of the recent headwinds, structural demand remains strong as the quality of drugs continue to improve in China. In particular, we favour pharmaceutical companies with strong R&D capabilities and firms that produce supplements as well as healthcare products that are not subject to government reimbursements.

Pharmaceutical expenditure remains relatively low in China (2017 data)

Source: China Healthcare Statistical Book

Valuations for Chinese internet stocks have also become more attractive after the sector’s underperformance last year. However, the shadows for online gaming are starting to lift with the resumption of approvals for new gaming titles in December 2018, while e-commerce continues to enjoy growth drivers stemming from new retail and China’s consumption upgrade.

Policy uncertainties dented the once rosy education sector last August. The announcement of the draft private education implementation regulation last year raised uncertainties and concerns about increasing taxation for for-profit schools. That overhang has since been removed, with areas like Chongqing and Sichuan announcing that the corporate tax for privately-owned universities, for example, to be 15% rather than the normal corporate tax rate of 33%. Moreover, the National Development and Reform Committee has also categorised higher education as one of their “encourage list” for foreign investors, which reinforces the government’s commitment towards the sector.

The A-share market was notorious for being an expensive market just a few years ago. Now, its valuation has become one of the lowest globally at 10 times 2018 earnings. In the A-share market, we like sectors that benefit from countercyclical policies such as railway, defense and construction, and select leading industrial companies that are leaders of niche markets and have strong balance sheets, healthy cash flows and reasonable valuations. We also like stocks with high dividend yields given interest rates are declining in China.

1.Source: National Bureau of Statistics of China, 28 February 2019

2.Source: People’s Bank of China, 5 March 2019

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable as of the date of presentation, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.