Coronavirus ignited gold ETF inflows

10-06-2020

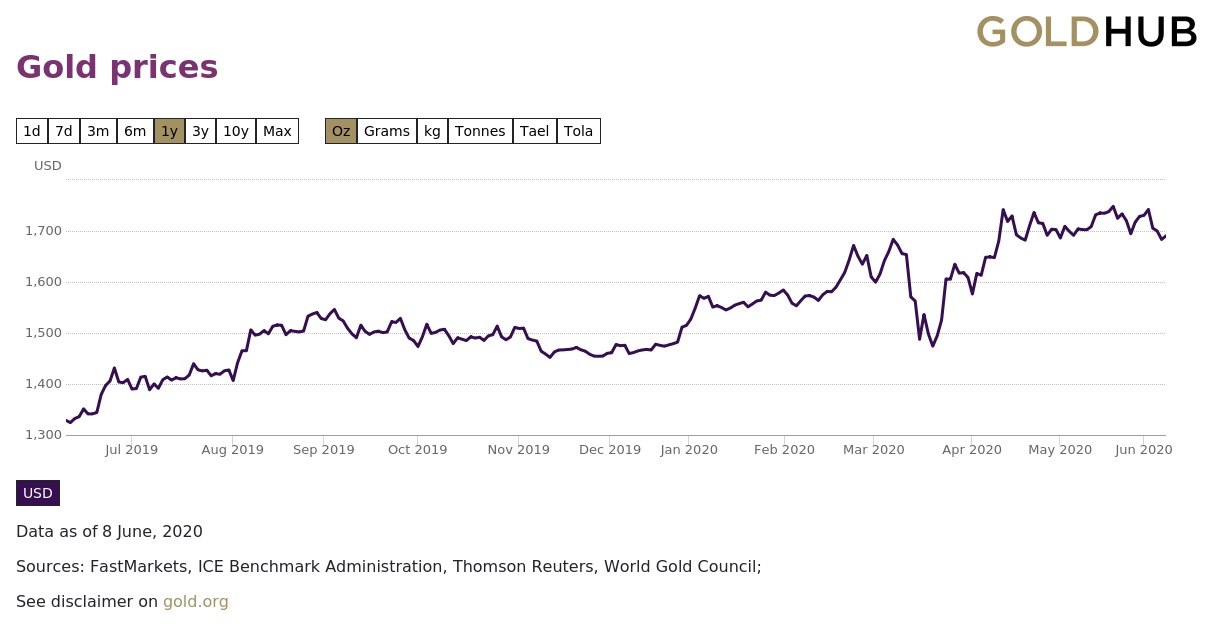

The COVID-19 pandemic has fueled the demand for investing in safe haven assets like gold. Year-to-date, gold assets has outran the major risky assets in performance, with gold Exchange Traded Funds (ETFs) outperforming in particular.

Positive flows combined with a rising gold price

Due to the virus outbreak and weakened consumers’ demand for jewelry, gold prices were volatile for a short period in March due to liquidity squeeze elsewhere. Investors’ appetite for gold investment has since been increasing reflected by the strong ETF inflow and robust central bank demand, given gold’s nature as a risk hedge.

Despite the recent retreat, the medium-term upside of gold is supported by the lingering uncertainties caused by COVID-19, the U.S.-China tensions and social unrest in the U.S. Gold still shines over other assets amid the ultra-low rate.

Global gold-backed ETFs inflows through May outpaced records for any calendar in only five month and the year to May net inflows have already exceeded the highest annual net inflow level recorded in 2009. The global holdings of gold ETF reached a new all-time high of 3,510 tons, with 154 tons added in May1.

The reason for gold-backed ETFs being more attractive can be attributed to their security, transparency and liquidity. They also give investors access to the safety of owning physical gold without the need to arrange storage and insurance.

Other than physical gold, the market offers a wide array of instruments, including paper gold, gold futures and gold miner stocks, gold ETFs and leveraged gold ETFs – all provide a level of gold exposure. Though the barrier to buy physical gold is high and paper gold relies too much on the broker’s reputation and liquidity. In contrast, gold futures and leveraged gold ETFs bear high risk while gold miner stocks, linked to a company’s operation and fundamentals, move beyond the gold trend and are sensitive to the equity market momentum.

Caption: Value Partners’ Co-Chairman and Co-Chief Investment Officer Dato’ Seri Cheah Cheng Hye visits the HKIA Precious Metals Depository

Physically-backed gold ETFs, exchange-traded commodities (ETCs) and similar funds account for nearly one-third of investment gold demand2. As of 5 June 2020, there are approximately 16 gold-backed ETFs across the world, collectively holding 2,685 tons of gold worth approximately 143.7 billion dollars3.

Value Partners’ gold ETF is the world’s first gold ETF with three currency counters and the only ETF backed by physical gold stored in Hong Kong. Recently our management visited the Hong Kong’s very first large-sized precious metals depository4, which helps us to keep gold bars, to learn about how physical gold is stored.

Physical gold storage in Hong Kong

Hong Kong is one of the world’s most time-honored gold trading centers and is an important storage and distribution center for international precious metal banks.

Located at the Hong Kong International Airport, HKIA Precious Metals Depository, the first large-sized precious metals vault is wholly owned by the Airport Authority of Hong Kong.

Established in September 2019, the depository serves as a gold custody and a service provider of secured storage and physical settlement and custodian services of gold bars. The vault is facing the demand of global bullion banks, precious metals refineries, commodity ETF issuers and institutional clients, by taking full advantage of Hong Kong’s strength as a major international financial center and transportation hub in the region.

The depot holds a Type 1 Security License under the Security and Guarding Services Ordinance of Hong Kong and has a robust and integrated security system using the latest technology and physical protective measures. Hong Kong has around 800 security companies holding similar licenses and some of them are for storing gold, according to HKIA.

The vault can store up to 150 tons of gold, with 3 tons of them owned by Value Partners. Costing HK$400,000 each, the gold bars are kept safely in boxes. On the bars, there are engraved markings revealing information including its fineness, purity, weight and manufacturer.

A total of 197,576 tons of gold has been mined globally and the below-ground reserves amount to 54,000 tons. Among the mined gold, official holdings, including by central banks and International Monetary Fund, stand 17.2 percent. 47 percent is jewelry and private investment takes 21.6 percent5.

The world’s largest known depository of monetary gold is the Federal Reserve Bank of New York. As of 2019, the vault housed approximately 497,000 gold bars, with a combined weight of about 6,190 tons6. Other large gold vaults include Bank of England, Bank of France and United Bank of Switzerland.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Sources:

- World Gold Council, Gold ETF inflows through May outpace records for any calendar year in only 5 months

- World Gold Council, Gold-backed ETFs and similar

- Bloomberg

- Hong Kong International Gold Association

- World Gold Council, How much gold has been mined?

- Federal Reserve Bank of New York website, Learn about the Federal Reserve Bank of New York’s gold vault