Fixed income outlook – 2Q 2021

21-04-2021

Highlights

We believe there are still scopes for 10-year U.S. Treasury yield to go higher at end-2021, though some consolidation may occur in the meantime on flows repositioning, etc. Disappointing data and vaccine pace in the U.S., or yield curve control, may cap the U.S. rates, none of which, however, seems imminent for now.

Under this backdrop, we stick with our bottom-up approach on bond selection and focus on more liquid bonds in 2Q 2021, as beta remains high under a growth-led tightening regime in China and as we are closer to a taper discussion. We also adopt a strategy to balance China property exposure with non-China and commodity credits.

1Q 21 market review

The volatility in the U.S. rates, buoyed by the USD1.9 trillion fiscal stimulus and inflation fear, had picked up materially in 1Q 2021. The sharp move of 80bps in 10-year U.S. Treasury yield (Figure 1) during this period has caught the market off-guard as it resembled a sell-off in the 2013 taper tantrum. Higher vaccine rates, better Purchasing Managers’ Index (“PMI”) and job data in the U.S. all signal a fast momentum of economic recovery. To further stimulate growth, the U.S. administration has proposed a new fiscal package (infrastructure, health care) to be approved later this year. Given this plan is multi-year, the immediate fiscal impact could be less relative to the extraordinarily large amount in 2020-21.

Figure 1: Rising 10-year U.S. Treasury yield and growth-led credit slowdown in China

Source: Bloomberg. China Credit Impulse and London Metal Exchange Index rebased to 100, as of end March 2021

China’s economic activities rebounded strongly in January – February 2021 from a low base, led by exports, property investment and industrial production. The National People’s Congress set GDP growth target at “above 6%” for 2021, but there is upside bias on this guidance (markets expect c8.5-9%). It emphasized supportive macro policies to the economy and not to turn sharply. The balancing need for growth recovery and risk control should see credit slowdown persisting. This implies tighter liquidity and regulatory measures, e.g. control of shadow credit, more stringent supervision of financial holding companies and Fintech.

Robust demand from China, supply disruptions and “reflation trade” inflows have supported commodity prices in 1Q 2021. Copper and aluminum outperformed while gold lagged. Oil prices also witnessed a strong rebound (+23% year to date) on collaborative Organization of the Petroleum Exporting Countries (“OPEC”) cut and pick-up in demand. A widely expected trend will be sharp accelerations in inflation in the coming months globally and in Asia. With inflation in Asia unlikely to move sharply, central banks’ policies should remain loosened except China.

Asian credit valuations

Despite the strong reflationary backdrop, credit spreads of J.P. Morgan Asia Credit Index Investment Grade (“Asia investment grade index”) and J.P. Morgan Asia Credit Index High yield (“Asia high yield index”) tightened 25bp and 40bps, respectively. Within the Asia high yield index, non-China credits outperformed that of China amidst onshore tightening conditions. A pullback in total return (-1.6% year to date) in the Asia investment grade index was led by the rise in 10-year U.S. Treasury yield and longer duration, while the Asia high yield index fared better at 1% year to date.

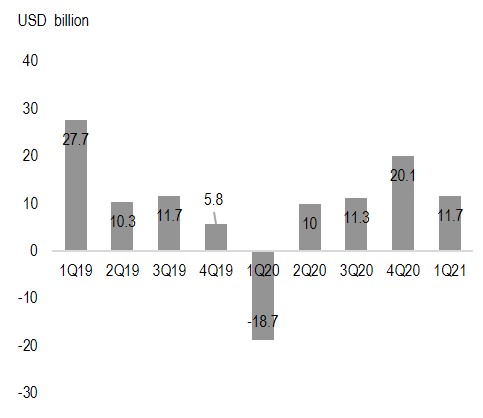

Emerging markets exhibited fund inflows in hard currency bonds year to date (Figure 2) except in early March 2021 with a notable move in 10-year U.S. Treasury yields. Lagging growth in emerging markets ex-China versus developed markets and U.S. rates volatility may risk outflows. Nonetheless, Asia should prove to be resilient than its emerging markets peers and faced less redemption pressure. In developed markets, the U.S. Investment Grade bond inflows slowed from March 2021 (+USD81 billion year to date) and outflows (-USD4 billion year to date) was noted in the U.S. high yield bond.

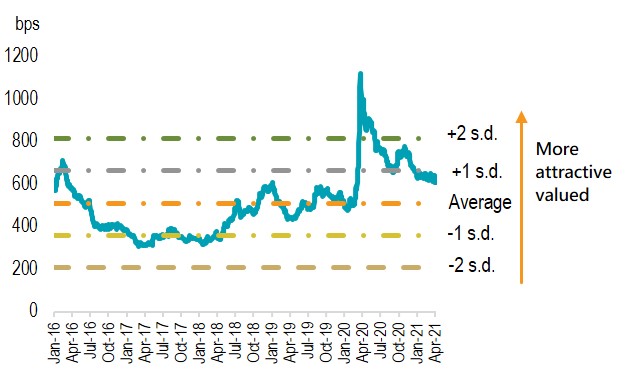

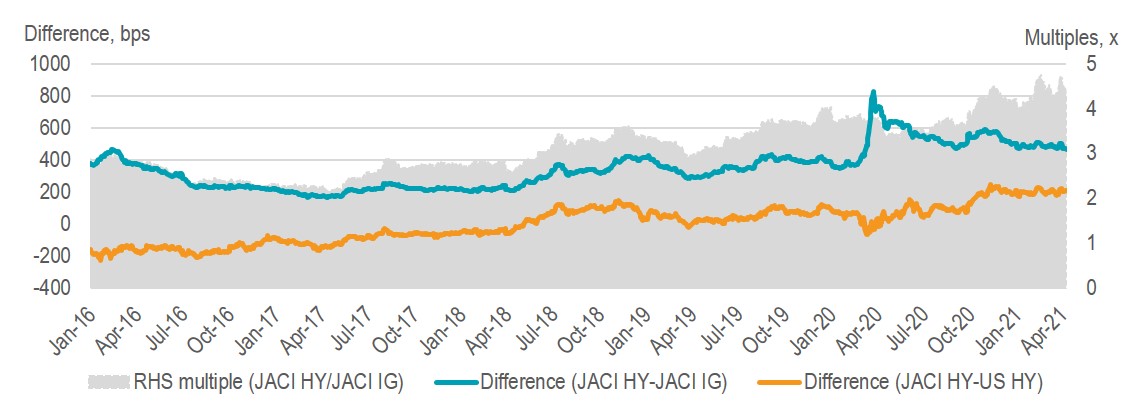

Overall, the prospects for growth recovery in Asia, manageable default rate and the strength in CNY should bode well for the region’s dollar bond market and attract fund flows. Asia high yield bond is preferred over Asia investment grade bond on a shorter duration, and from a total return perspective as credit spreads remain at c1 standard deviation (s.d.) cheap over the last five years, or 4.6x over Asia investment grade bond currently (Figure 3&4).

| Figure 2: Steady emerging markets fund flows | Figure 3: Asia high yield index credit spreads are relatively more attractive |

Figure 4: Asia high yield index offers attractive value over Asia investment grade index and U.S. high yield index

Source: Bloomberg , as of end March 2021

2Q 2021 outlook and strategy

We believe there are still scopes for 10-year U.S. Treasury yield to go higher at end-2021, though some consolidation may occur in the meantime on flows repositioning, etc. Disappointing data and vaccine pace in the U.S., or yield curve control, may cap the U.S. rates, none of which, however, seems imminent for now. The market will stay cautious on a tapering and rate hike timetable and look for a shift in tone at June/September 2021 Federal Open Market Committee (“FOMC”) meeting. Fed will debate around whether inflation trend is transitory or not, and versus average inflation target (“AIT”) of 2%. Near-term U.S. rate hike remains very remote, in our view…

Read the full report

Read more:

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All material has been obtained from sources believed to be reliable as of the date of presentation, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

This commentary has not been reviewed by the Securities and Futures Commission in Hong Kong. Issuer: Value Partners Hong Kong Limited.

For Singapore investors: This commentary has not been reviewed by Monetary Authority of Singapore. Value Partners Asset Management Singapore Pte Ltd, Singapore Company Registration No. 200808225G.