Surviving rate hike cycle with multi-asset strategy

22-03-2021

The global economic recovery gains momentum, but investors are now concerned about the challenges that follow.

As the macro outlook turns benign, the market quickly forms expectations on rising inflation. The jump-forward in long-term bond yields was a clear sign of such consensus. These would lead to higher corporate borrowing costs, which ultimately pressure profit outlook.

In light of such changes, volatility is now at the top of investors mind. To gear up for these macro shifts, we believe that diversification across asset classes could generate an exciting risk-reward profile that achieves a balance between income generation and growth potential.

Asia income shines as region leads global recovery

To generate a more compelling income return, investors need to identify economies with strong foundations for recovery and regions that have attractive corporate profit growth potential.

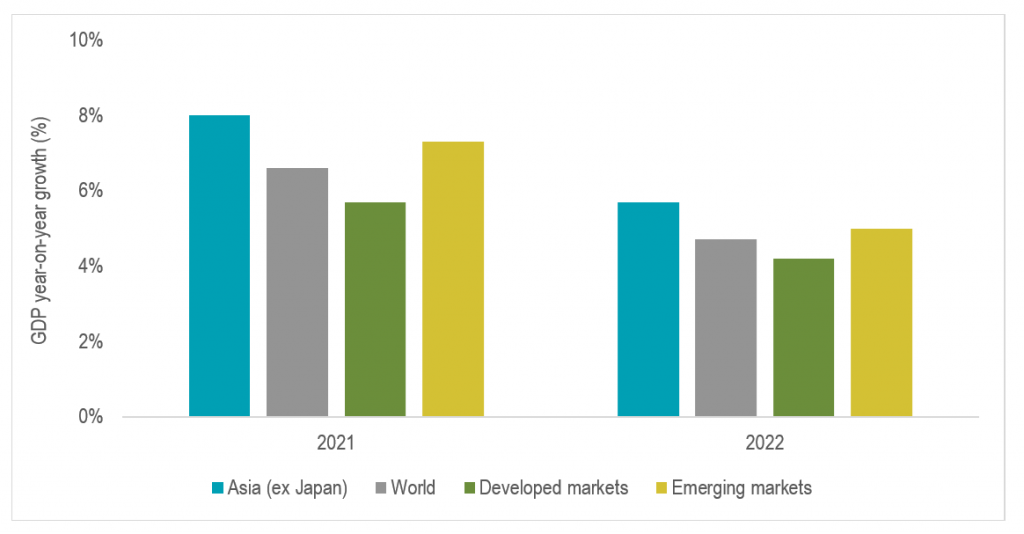

Asia (ex-Japan) is expected to lead global recovery (Chart 1). The market continues to exhibit extreme confidence in the region’s corporate profit outlook, with compound annual growth rates forecast to reach nearly 15% from 2020 to 2022, compared with the 8% global average. Greater China is poised to continue leading the region’s recovery, with multiple macro indices confirming the pace of its bounce back. An example is the latest February consumption data out of mainland China, which shows sales of retail and food services jumped 28.7% year-on-year1. And while the official Purchasing Managers’ Index (PMI) posted a slight drop, overall, it is still in positive growth territory2.

Chart 1: Asia (ex-Japan) is leading a V-shape recovery in the global economy, with growth of 8% and 5.7% projected for this and next year respectively

Source: Goldman Sachs research, as at 9 March 2021

Looking at the data, Asia’s capital inflow has been gradually picking up since the end of last year, with even more impressive gain recorded in the year-to-date. A weakening USD has also been crucial in driving capital into emerging markets, including Asia, providing support for the market.

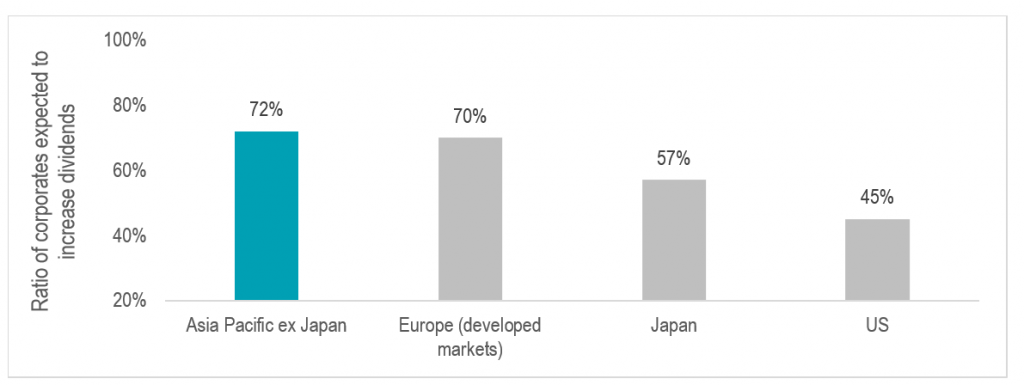

About 72% of corporates in the Asia (ex-Japan) region are expected to consider raising dividends in 2021 (Chart 2). Dividend payout is a primary element when weighting total investment returns in Asia. Over the past 10 years, dividends account for 40%3 of the total return of the MSCI AC Asia (ex-Japan) Index. As such, the decisions to raise dividends will provide major support to the returns for Asia stocks, benefiting in particular high-dividend stocks. On fixed income, as Asian credit issuers tend to have shorter duration, credit spread and premium still remain attractive. We also believe that the gradual normalization of prices and demand for commodities will support bond prices.

Chart 2: Over 70% of Asia (ex-Japan) index component stocks favor dividend increases

Sources: Jefferies, FactSet, December 2020. The above are MSCI Index regional breakdown. Dividend increases exceeding 5%

Change in inflation direction: no need to panic

What makes 2021 different from the past few years is that we are now moving from a near zero-rate environment to a V-shape economic recovery. This has driven up inflation expectations and added to rate hike concerns. In the face of higher volatility and recent market corrections, investors need to stay calm while keeping in mind that overall fundamental factors have not worsened, and that the profit outlook remains positive. Furthermore, the sharp rallies in some sectors over the past 11 months have led to the tightening in equity risk premium, giving the market ample reasons for a short-term correction. It is also worth noting that many of the stocks that fell were among the best performers in 2020, making profit-taking nothing out of the ordinary. Investors may well see these as good buy-and-hold opportunities.

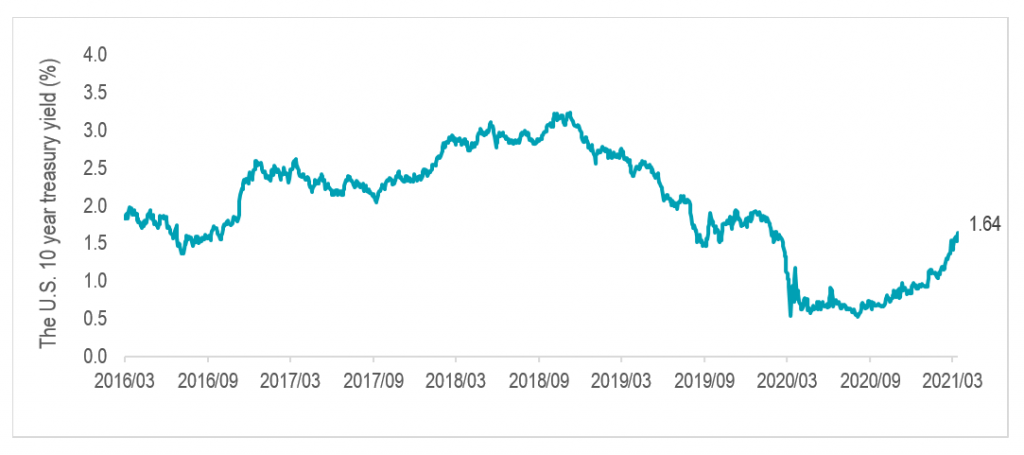

The 10-year US Treasury yield has risen to the current 1.6% from 0.9% at the beginning of the year (Chart 3), reflecting a rise in investors’ inflation expectation. Yet in the long run, inflation doesn’t necessarily increase the risk of investing in stocks. As historical data shows, resistance levels would only form when the 10-year treasury yield rose above 3%. As such, with bond yield currently nearing a 10-year low, it could mean there is still plenty of buffer in the stock market.

Chart 3: The U.S. Treasury yield in February rises to pre-pandemic level of 1.6%

Source: Bloomberg, data as of 12 March 2021

By the same logic, as the increase in treasury yield becomes steeper, it inevitably triggers downward pressure in the global bond markets. But as long as the rise is gradual, bond prices will behave similarly. Moreover, different bonds tend to react differently to changes in interest rates. For example, the shorter duration and wider credit spread of Asian credit should give it plenty of buffer against rise in the U.S. Treasury. Also, the strong rebound in the overall Asian economy continues to support corporate balance sheets while giving room for bond spread to tighten. We believe this will improve the outlook for bonds with shorter duration, which are less sensitive to interest rate movements. Investors should opt for issuers with stable cash flow and sound financial health, especially good quality, high-yield bonds that are less affected by interest rate movement.

Taking charge: navigating volatile markets through proactive management

There’s little doubt that the market will see higher volatility in the future. Yet it doesn’t necessarily mean a lack of investment opportunity. On the contrary, investors should see this as a good time to adopt a dynamic approach to their portfolio and utilize changes in the market to proactively reallocate their assets and optimize income generation opportunities.

We still favor equities. Value stocks and cyclical sectors, which have been neglected over the past year, is now back as one of our primary investment themes. Most of these stocks cover more traditional industries and show a high correlation to the economic cycle.

With the current momentum, the profit outlook for these stocks is expected to improve significantly. Our top picks are energy and industrial stocks. In terms of geographical regions, we forecast North Asia to continue to outperform. The Taiwanese technology and hardware sector in particular has attractive valuation, strong cash flow, making it one of the sectors with the best growth potential.

In conclusion, despite pressure on interest rates to adjust in the medium term and the market’s concern over the return of inflation, central banks worldwide have made it clear that it is now too early to talk about shrinking balance sheets. From an investment perspective, low rates will continue for some time, even though there are divergent expectations in the market which may add to volatility. Investors should adopt approaches that will allow them to reap the benefits of both dividend and growth potential, generating return from multi-sources. This is the only way to avoid getting caught out by cyclical impacts.

Source:

- JP Morgan, 1 March 2021

- National Bureau of Statistics, People’s Republic of China, 28 February 2021

- Bloomberg, 31 December 2020

Read more:

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

This commentary has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.