Move with the times – A dynamic multi-asset strategy

14-04-2021

Dynamic allocation proves to be an approach to flatten your roller coaster ride in the volatile Asian market into a pleasurable Ferris wheel experience.

A Ferris wheel is a metaphorical symbol of stability.

It allows riders to reach highs and lows while being comfortably seated. To us, the idea is likened to a multi-asset allocation that dynamically captures returns under a managed volatility. But how can this thought be applied to investing in Asia through market cycles and events?

Approaches to multi-asset investments are many. Some maintain a constant mix between stock and bond components, some act more defensive or benchmark-hugging, while some even take a single asset class as the leg of the entire portfolio. The approach we trust is, in contrast, considered active and dynamic. Our allocation decisions are not bounded by a pre-set percentage between weights in equity and fixed income. We are thus allowed to adjust and react. We can take into account the changing geopolitics and economic climate.

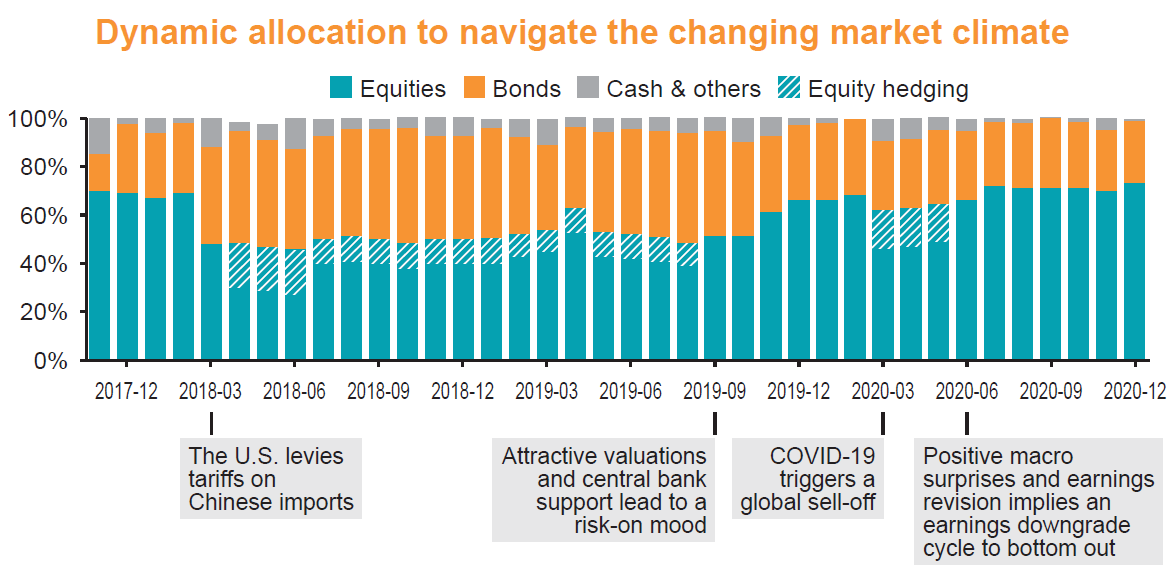

Navigating the changing market climate

In search of an optimal balance of risk and return, our team utilizes a quantitative lens and a qualitative overlay. This data-driven and fundamental-aware method allows us to stay on top of changes in the economic cycles and market climate. Our long- and short-term views are thus formed, and that would determine allocation and risk exposure.

Longer-term views are reflected in the strategic allocation. This core part of the portfolio addresses the economic and market cycles as well as their prolonged implications.

On the contrary, the dynamic allocation expresses short-term views. The portfolio manager constantly adjusts to arrive at the right tactical allocation that accounts for market events that cause unexpected volatility. Though taking a smaller portion than the strategic allocation, the dynamic mechanism has been proved effective against significant and unpredicted changes and the way we navigated through the public health crisis in 2020 was a prime example.

To better manage risks, the portfolio manager also employs hedging strategies. They can be deployed not only to reduce risk but as an alternative to selling down securities directly.

As such, we could achieve a rigorous all-weather model considering economic and fundamental changes while keeping volatility at bay.

Figure 1: Dynamic allocation along market events

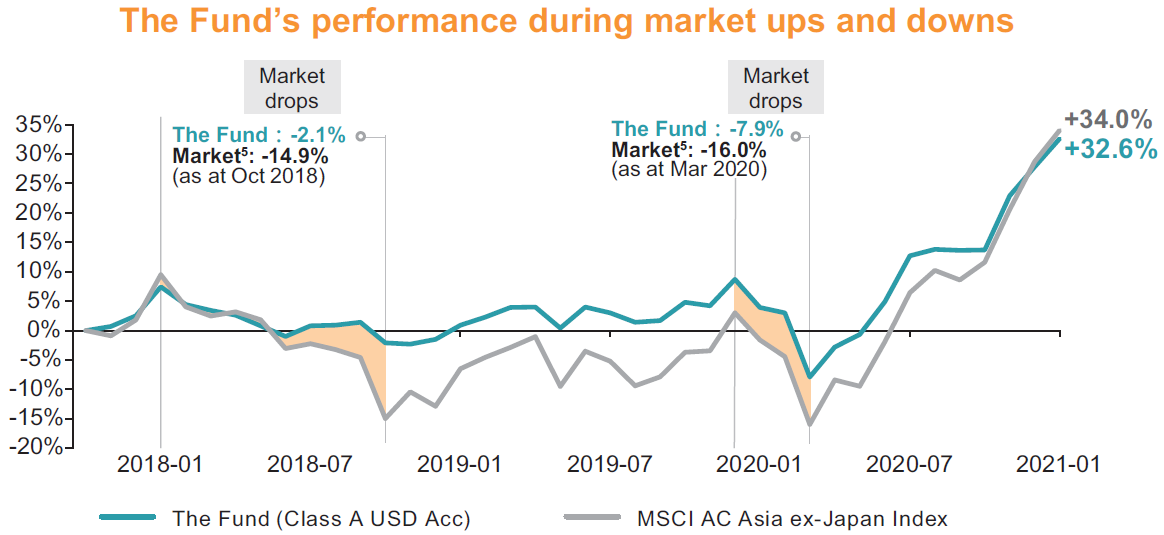

The power of dynamic approach

The three most recent adjustments are detailed as a testimony on how this style introduces investors a steady ride on a Ferris wheel through the unprecedented and most unexpected COVID fears.

Figure 2: Value Partners Asian Income Fund’s performance during market ups and downs

| Time period: March 2020 – June 2020 | Background: Pandemic outbreak, oil slump, confidence crisis As COVID turned into a global contagion, coupled with the spectacular collapse in oil prices triggered massive deleveraging of investors’ positions globally, the market was severely punished. The dual shock dragged all risk assets, exhibiting an almost perfect correlation with each other – a phenomenon not seen since the 2008-09 Global Financial Crisis. Action: Putting an equity hedging overlay that accounted for 15% of the portfolio Performance: The Greater China equity market recorded its deepest drawdown1 in the past five years. Over a span of 11 trading days (5-19 March 2020), the MSCI China Index plunged 18.9%2. Over the same period, the MSCI AC Asia ex Japan Index also posted a 24.1% fall2. Our hedging strategy shielded the allocation from the heaviest exodus in the decade |

| Time period: June 2020 – Vaccine arrival | Background: Macro recovery, vaccine hopes Asia demonstrates a first-out case walking its way out of the pandemic woes. From mid-2020, the region has been printing macroeconomic data that are more benign than feared. Earnings downgrade stabilized and corporates began to provide better guidance for the next quarters. Action: Removal of all equity hedges Performance:In hindsight, the adjustment was timely. The removal of hedges allows a ride through a strong stock rally from June 2020, led by Chinese equities. To put data into perspective, the MSCI AC Asia ex Japan Index and MSCI China Index rose 29.2% and 24.2% in the second half, respectively3. |

| Time period:As of late | Background: Vaccine rollouts induce macro improvement. Changes in macro backdrop The vaccine roll-out looks set to broaden the recovery progress. To reflect the macro shift, we add the unloved value and cyclical stocks, as they would benefit from the economic expansionary cycle and the inflation that may follow. Action: Unchanged preference for equity, allocating to traditional stocks. |

1. Source: Bloomberg, 31 March 2021

2. Source: Bloomberg. Period: 5–19 March 2020

3. Source: Bloomberg. Period: 1 July 2020 – 31 December 2020

Read more:

Source:

- Bloomberg data

- FactSet, Jefferies, December 2020. Excluding Financials.

- FactSet, MSCI, Goldman Sachs Global Investment Research, November 2020

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

This commentary has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.