Thought Piece: Market viewpoints and outlook from Value Partners

14-12-2022

Government policy reversed after the 20th National Congress of the CCP

After the 20th National Congress of the CCP, the Chinese government issued a series of policies, including:

- The “three arrows” policy mix for real estate enterprise financing (bank credit, bond issuance, and equity financing).

- The 10 new measures for fine-tuning the country’s anti-Covid policy.

- The crackdown on internet enterprises is also coming to an end, and more emphasis is placed on “promoting the stable and healthy development of the platform economy”, thus reducing investors’ concerns about “common prosperity”.

Hong Kong stocks were among the best performers globally in November, as the government made it clear that economic growth remains its top priority. The Hong Kong market was up 26.6%, representing the territory’s best monthly performance since 1998.

China entering a new cycle next year

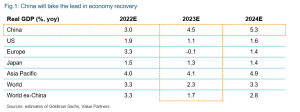

We remain very optimistic about the performance of the Chinese stock market. Developed markets, such as Europe and the US, may enter a recession next year. In contrast, China may return to a high growth cycle from this year’s slow down and take the lead in recovery (See Fig.1: GDP estimates of Goldman Sachs: Apart from Asia Pacific, the growth of other major markets will be lower than that in 2022, while China is expected to record higher growth).

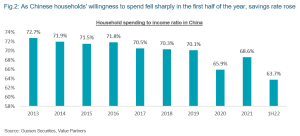

The main reason is that under the uncertainty of China’s zero-Covid policy in 2022, the average proportion of household consumption to income dropped from the average of 70% in previous years to nearly 64% in the first half of this year (see Fig.2), seriously impacting the economy. That said, China still boasts good economic fundamentals:

- China’s household savings ratio is among the highest in the world.

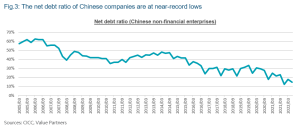

- While many companies have cut back on investment because of the downturn, their cashflows remain strong, improving their net debt ratios (see Fig.3).

We believe that as soon as business and household confidence in the economy recovers, China’s huge savings will eventually flow into consumption and investment. Moreover, China has the lowest inflation rate in the world, giving the government room to cut borrowing rates further. In addition, we believe the market may be underestimating the impact of the fine-tuned pandemic prevention policy on consumption. If the pace of relaxation accelerates next year, real economic growth may beat expectations.

In the short term, the market is expected to rebound sharply and may be subject to correction as the relaxation of anti-Covid measures will not happen overnight. In addition, the number of new cases will likely rise, which may cause relatively large market fluctuations. However, we consider any significant pull-back as a good long-term buying opportunity.

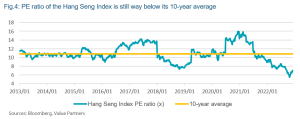

Overall, we believe there is still massive room for potential share price appreciation in Hong Kong stocks. After a sharp rebound in November, the latest P/E ratio is now just 7.2x, still well below its average of around 10.8x over the past decade (see Fig.4). When the economy recovers its growth momentum next year, we expect Hong Kong stocks to return to a PE of around 9x, which is a 20-30% room for increase.

China has promising long-term prospects and is expected to outperform other markets

There are concerns about China’s long-term prospects:

- Whether the common prosperity agenda will lead to a shift in policy away from the pursuit of economic growth

- Whether China can avoid the middle-income trap

- Whether the Sino-US relationship will impact enterprise innovation

- Without the real estate sector as a driving engine, whether China’s economy can still maintain sustained growth

We are still confident about the Chinese market and believe it will outperform major developed countries in the next five to 10 years. The reasons are as follows:

- China boasts a huge deposit base, with household deposits exceeding RMB110 trillion and total deposits exceeding RMB250 trillion, with the latter being more than double its GDP in 2021. In the future, we believe that China will introduce a series of policies, such as increasing social welfare security, to boost more spending.

- China is the world’s second-largest consumer market and has a well-developed infrastructure. Its colossal size creates economies of scale that allow leading domestic players to become the world’s lowest-cost suppliers. For example, Chinese companies have established global competitiveness and are even the world’s lowest-cost producers in various industrial chains, including consumer electronics, photovoltaic energy, and electric vehicles. In the field of electric vehicles, BYD, which makes the vast majority of its sales in the domestic market, is set to overtake Tesla this year as the world’s largest maker of electric vehicles.

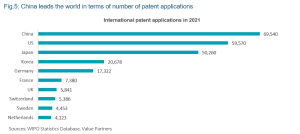

- On the R&D front, our survey shows that many Chinese companies are catching up with the world’s leading enterprises. Last year, China became the world’s top patent filer, with nearly 10,000 applications more than the US (see Fig.5). Driven by national security concerns, the US sanctions on China in technology have led local companies (especially state-owned enterprises and government departments) to increasingly choose local suppliers. That has encouraged the innovation of domestic enterprises to replace imports, and we see this happening in many industries. In the long term, this trend will allow more and more Chinese companies to be more competitive globally.

- In addition to the emphasis on “security”, the 20th National Congress of the CCP also attached great importance to economic development, and we believe that economic development is necessary for “security”. In fact, the recent Meetings of the Political Bureau of the CPC Central Committee explicitly stressed the need to “vigorously boost market confidence” and “promote the overall improvement of economic performance”, reflecting that economic development is still the top priority of the government. In the report of the 20th National Congress of the CCP, Chairman Xi also made clear that China’s GDP per capita should be increased to the level of middle-income countries by 2035, that is, double the current level.

- Regarding inflation, we believe China will continue to have inflation lower than other countries and regions, thanks to its outstanding energy security and infrastructure.

We are optimistic about three industries in the long term

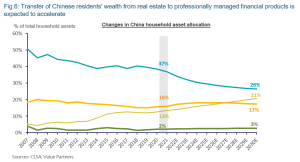

- Financial companies that benefit from the growth in wealth management. China’s per capita living area has reached a high level. Many policies issued over the past few years have led residents to reduce their expectations of a sustained rise in housing prices. In addition, the recent downturn of the real estate market led to the wide recognition of the “houses are for living rather than speculation” concept, which should propel the transfer of residents’ wealth from real estate to wealth management products. According to a CLSA research, the proportion of real estate to the total wealth owned by Chinese households will fall from 37% in 2021 to 26% in 2030, while the proportion of professionally managed wealth management assets will rise sharply (See Fig.6). We believe that banks and insurance companies with leading wealth management capabilities could benefit from this.

- Companies that benefit from post-pandemic recovery and consumption upgrades. With the impact of the pandemic fading and economic activity returning to normal, many consumer goods are expected to benefit from the recovery in consumer confidence. Among them, we believe that the domestic liquor industry and sports brands will continue to benefit from the general upward trend of household income growth and consumption upgrading. In addition, we expect that travel between Hong Kong and Mainland China will reopen next year, which will benefit the retail industry in Hong Kong.

- Excellent companies that benefit from scientific and technological innovation. The government’s strong support for scientific and technological innovation, especially the promotion tech/scientific self-sufficiency, will bring strong development opportunities for superior enterprises. In our more than 6,000 survey activities each year, we have come across several companies that have invested in scientific and technological innovation to provide higher value-added technology innovation products, which in turn increase profitability and return on equity.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

This commentary has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.