Multi-Asset Perspective – September 2021

18-09-2021

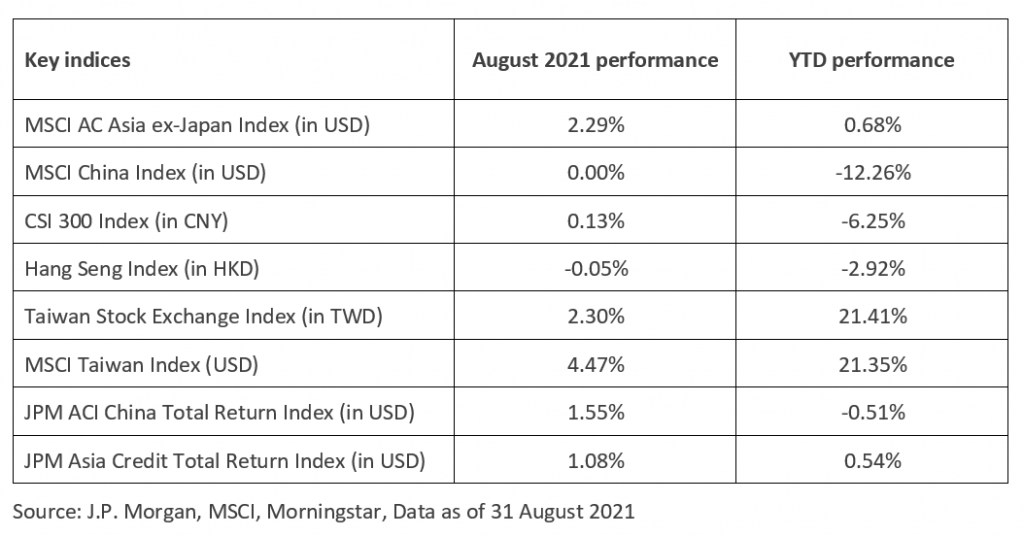

Sentiment has improved in most markets in Asia as the Fed remained its accommodative stance.

As short-term volatility is expected to continue, investors have moved towards the more defensive parts of the market.

China / Hong Kong equities

- Valuations of new economy sectors now reflect the ongoing concerns of increasing regulatory oversight. After most companies reported inline earnings for the first half, investors have started to pay more attention to macro factors, such as potential targeted easing, increasing local government bond issuance, carbon neutrality, and common prosperity.

- While the overall market is expected to be range-bound, flows will continue to focus on sectors that will benefit from the policy direction.

China A-Shares

- PMI numbers are expected to be maintained at the 50 levels, indicating that growth will remain moderate. While the pandemic situation has been under control, consumption is not expected to likely pick up significantly for the upcoming mid-autumn festival and golden week in October.

- However, with common prosperity a main goal for the medium term, consumption will be key to support the economy as the middle class will be empowered. Investors should focus on sectors that would benefit from the potential targeted easing policies that may be announced by the fourth quarter.

Asia ex-Japan equities

- Investors are concerned about the tighter liquidity environment as the Fed has signaled to start tapering before the year-end.

- In August, Korea also has made its first rate hike in years, with another one likely to come in November. Investor sentiment has become more cautious as the earnings outlook has been revising downwards.

- Foreign investors are also taking profit from Taiwan as the market is losing momentum after strong first half results from most companies.

- While India continues to be supported by strong domestic flows, the market is also showing signs of peaking as valuations have become very expensive.

Emerging market ex-Asia equities

- Investors are expecting the economy to reopen again as the pandemic situation is slowly improving. Emerging markets are also expected to benefit from the rise in commodity prices, driven by strong demand and low supply.

Japanese equities

- With Suga’s unexpected resignation, the early election has boosted investor sentiment, with hopes of earlier reopening of the economy and increasing fiscal stimulus to support recovery.

- Corporate earnings have beaten expectations in the first half. Japan’s attractive valuations will attract foreign capital to come back, narrowing the underweight in Japanese equities. Share buybacks by companies will also support the market.

Asia investment grade bonds

- US Treasury yields will remain stable in the near term, supported by the dovish message sent from the Jackson Hole meeting and the moderated nonfarm payroll number in August.

- Investors will continue to support Asian investment grade bonds as Asian high yield continues to be volatile.

Asia high yield bonds

- The liquidity concerns on some of China’s property companies have caused a spillover to the whole sector, causing the Chinese property high yield bond space to correct further.

- With a risk-off sentiment, indicated by investors’ rotation to the defensive areas of the market, Asia ex-Japan high yield credit spreads have widened. We expect that it will take time for sentiment to pick up for spreads to tighten again.

Emerging market debt

- With the dovish message sent from the Jackson Hole meeting, together with a moderated nonfarm payroll number in August, US Treasury yields will remain stable in the near term. However, with tapering concerns around the world, emerging market bond spreads will remain range bound.

Gold

- Gold is likely to move sideways as the US dollar has tactically strengthened. However, the valuations of Gold are becoming attractive versus other commodities. Over the long term, Gold remains a good hedge against geopolitical uncertainties and would benefit from easing fiscal policies.

Multi-asset

- Multi-asset offers lower volatility compared to traditional single-asset or balanced portfolios. However, the correlation between risk-assets, such as equities, credits, and commodities, has increased dramatically recently. In an uncertain environment with low yields, income becomes an essential source of return for investors.

The author is Kelly Chung, our Senior Fund Manager.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

This commentary has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.