“Two Sessions” strengthen the base for a sustainable recovery

15-03-2023

Three key points for this article:

- The business-friendly and pragmatic new leadership team looks at consumption and technology innovation to drive economic growth.

- A massive stimulus package looks unlikely; meanwhile, a simpler and clearer financial regulation structure may help to enhance the system’s robustness.

- We remain positive on the China market’s medium-to-long-term outlook but also caution investors to prepare for more bumpiness down the road.

GDP: a low target to beat

The much-awaited “Two Sessions” – a grand summit of the lawmakers and political leaders in China – was concluded on 13 March 2023. While being held on an annual basis, this year’s meetings were particularly noteworthy as they showcased the new leadership team’s plans and also included some institutional changes that could profoundly impact China’s long-term development.

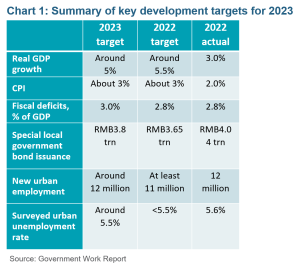

The former premier, Li Keqiang, kick-started the Two Sessions with the government’s work report on 5 March 2023, where he announced a new set of targets for the economic growth plan for 2023 (see Figure 1 below).

Among them, the most noteworthy was the GDP growth target of “around 5%”, which came at the conservative end of the range of consensus forecasts (of 5-6%). While some market participants might be disappointed by the relatively low target, we think it is worth bearing in mind that:

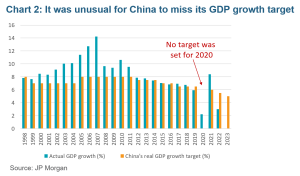

1.China usually beats its GDP growth targets (see Chart 2 below). For example, in 2021, the actual GDP growth was 8.4%, which far exceeded the target of more than 6%. Having missed the set target in 2022, we believe a rather conservative target was set to avoid missing it again.

2.Other indicators, such as the fiscal budget (3.0% versus 2.8% target last year) and new urban employment (12 million versus the 11 million target last year), suggest that the government remains committed to driving economic growth recovery ahead.

3.Meanwhile, given the long-term side effects of the 2008/09 massive stimulus package, authorities are unlikely to resort to the same policies. Instead, setting a modest growth target could ensure a more sustainable and healthy growth of the economy.

Although the growth target is closer to the lower bound of market expectations, it is also worth remembering that a 5% GDP growth would still make China a clear stand-out amongst major global economies in 2023.

Institutional reform: bolster technology and control financial risks

Besides discussions around the economy, the Two Sessions meetings also provide a venue to discuss and approve institutional reform proposals. This time, the proposals put out by the State Council, which were reviewed and passed on 10 March 2023, have caught more attention from local investors. Some key changes include:

- The reorganization of the Ministry of Science of Technology, which we believe signals stronger and more cohesive efforts to boost technology and innovation.

- The establishment of the National Data Bureau and the upgrade of the National Intellectual Property Administration. The latter was previously managed by the State Administration for Market Regulation and will changed to an institution directly under the State Council. In our view, these underpin the policy initiatives to further develop the digitalization of China’s economy.

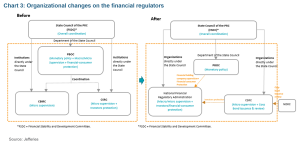

- The newly established State Administration of National Financial Regulation will replace the China Banking & Insurance Regulatory Commission (CBIRC). Also, provincial-level branches of the PBOC will continue to take over the functions of financial work bureaus in local governments. Both initiatives aim to better control shadow banking activities and reduce the room for regulatory arbitrage.

- The China Security Regulatory Commission (CSRC) will become an institution directly under the State Council and take over the function of corporate bond issuance review from the NDRC. This indicates policy intentions to bolster direct financing and support technology companies, especially those at the rapid development stages.

Overall, we believe these institutional changes (see Chart 3 for a summary of the financial regulators) clearly indicate the government’s intentions to further promote technology developments and, at the same time, control financial risks. Although it is clearly not easy to handle the massive debt issues of the local governments – especially on the local government financing vehicles (LGFV) – while maintaining a sufficient amount of financial support, we believe the clearer and simpler financial regulatory structure could strengthen the government’s execution capability, helping to resolve any potential challenges more effectively.

The new administrative team sends a clear and reassuring message on economic growth

Another key focus of the Two Sessions is the new leadership team, especially the appointment of the new Premier, who will play the most instrumental role in setting and implementing key economic policies.

Li Qiang, the former Communist party chief of Shanghai, became the new Premier and delivered an inspiring yet pragmatic press conference on 13 March 2023. During the conference, Premier Li firmly expressed his views on some key issues, such as the rising youth unemployment rate, demographic changes (especially the ageing population), and private entrepreneurship. In particular, Premier Li has emphasized his background work in some regions with a booming private economy (like Zhejiang) and pledged support and bolster the confidence of private business owners.

On economic policies, Premier Li reiterated the directions set in the Central Economic Working Conference last year (see here for a recap: Policy Matters: CEWC injects further confidence to the economic growth outlook in 2023 | Value Partners (valuepartners-group.com), which have a strong focus on ensuring steady growth, employment, and prices, while also making progress in the high-quality developments. While not much detail was given, Premier Li mentioned the effective usage of the macro policies and measures to boost demand and innovation and prevent and mitigate risks. We believe these reaffirmed the new leadership team’s priority in driving economic growth, with more supportive policies likely to come (though, in relative scale, probably nowhere comparable to the massive ones back in 2008/09).

It is also noteworthy that the head of the country’s central bank, Yi Gang, remains unchanged, which was a surprise to many market participants, as Governor Yi had already approached the normal retirement age of 65. This might indicate that the focus remains on maintaining the continuity of the macro and monetary policies amid the volatile external environment and the state’s own institutional reforms.

Stay positive, but also stay alert

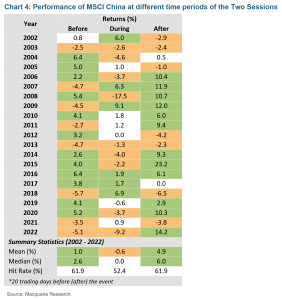

Historical statistics suggest the stock market may rebound right after the Two Sessions. In the last two decades, the MSCI China Index rose by around 5% on average in the 20 trading days after the Two Sessions (see Chart 4). In addition, nearly two-thirds of the time, the market was up following the meetings. This perhaps reflects the improved market sentiment as greater policy clarity and market expectations of more policy support come through.

We will be able to tell soon if history can guide us this time. Despite the lack of positive surprises, overall, the outcomes from the Two Sessions are supportive of economic recovery. That said, there are still headwinds ahead, such as ongoing geopolitical tensions, the deteriorating external environment, as well as some hidden risks associated with large debt burdens of the local governments. For example, the latest SVB incident in the US – although the risks seem to be contained for now – is a clear reminder about the fragility of the financial system (or at least part of that) amidst rapid tightening. While China is in a different economic cycle and is ahead of the curve in recovery, we caution investors to remain mindful of these potential events and challenges.

For the China market, the next big event to watch will probably be the third plenary session of the central committee of the Chinese Communist Party (more commonly termed the “third plenum”), which will take place in the latter part of this year and unveil more details about the new administrative team’s economic policy development and reforms.

In a nutshell, a new page has turned for the China market following the closing of this year’s Two Sessions. Nevertheless, the future is unlikely to be a smooth runway; one thing is for sure, though: the sharp and broad-based share price rebounds that started from the end of last October (and lasted until the Lunar New Year) are less likely to repeat in the near term. Hence, to capture the “alpha” opportunities, we believe diligent, thorough, and bottom-up analysis would thrive going forward.

Data as of March 2023

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note that investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you.

This commentary has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.