Fixed income outlook – 3Q 2021

20-07-2021

Executive Summary: policy to drive sentiment

The vaccination rollout and easing of mobility restrictions have reset global growth higher. However, the growth pace in the near-term could be derailed by the delta variant and fading low base effect, but we view that the uptrend in growth should be maintained. With global credit spreads being priced for growth recovery and benign default rates, in the coming quarters, we are cautious about any major shift in the Fed’s tone on policy normalization in the US and taper timetable and any change in China’s onshore financing environment that has been kept in a tightening mode for most of this year as growth slowly dissipates.

In the US, we expect that the possibility of a rate hike remains low in the near term, as the recent inflation increase in the country is due to pent-up demand and supply chain bottlenecks, and the US labor market is yet to normalize. That said, we view that a sharp turn in the Fed’s dovish tone could derail market sentiment in the fixed income markets. We will continue to stay cautious on possible US tapering timetables. After the consolidation in 10-year US Treasury yield in the second quarter of 2021 (“2Q21”), we believe there are scopes to trend higher towards end-2021 despite the growth normalization. The possibility of a US rate hike remains low in the near-term. The market is now pricing in one or two hikes by 2023.

In China, the recent RRR cut in July underscores PBOC’s intention to support liquidity and preserve lower funding costs. Falling credit impulse would linger to keep financial risks under control. This, and slower growth momentum should keep onshore government bond yields at a lower level – currently at about 3% –after tightening 11bps YTD.

In addition, the ongoing demand/supply imbalance behind the upcycle in commodities may turn in 2H21. Nonetheless, we think it is a bit early to expect a material correction in commodity prices when growth is still expanding, albeit at a moderating pace. This, together with a benign US dollar, matters for maintaining a supportive tone for emerging market (EM) credit markets and fund flows.

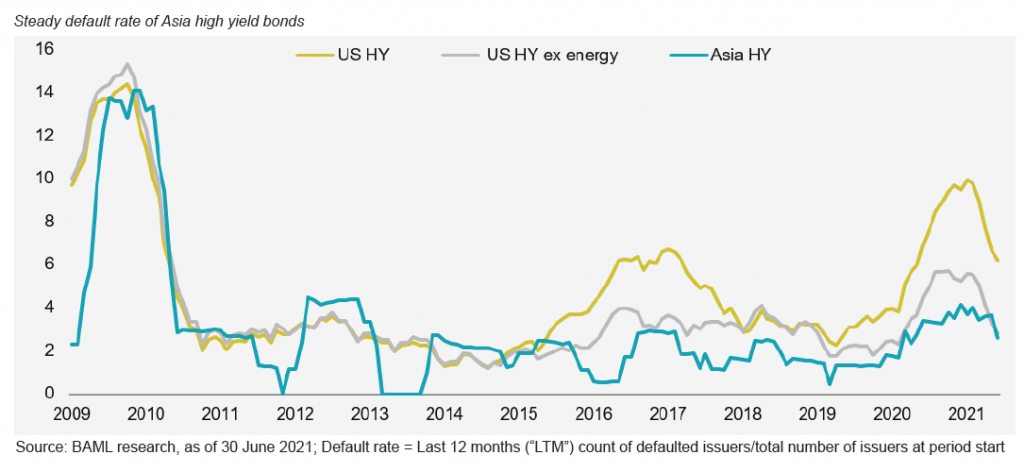

The prospects for growth recovery in Asia and manageable default rates should bode well for the region’s dollar bond market. Moreover, the ample level of global liquidity looking for yield enhancement should lure demand for Asian high yield dollar bonds, which has scope to mean reverse as China’s tightening cycle is being priced in.

Overall, we view that Asia high yield continues to provide attractive value over Asia investment grade and US high yield. During the first half, credit spreads of the JP Morgan Asia Credit Index Investment Grade (“Asia IG index”) tightened 22bps, while that of JP Morgan Asia Credit Index High yield (“Asia HY index”) widened 42bps. The Asia high yield index fared better at 1.3% during the same period, mainly driven by carry, versus the muted returns of Asia investment grade (-0.5%), driven by the falling 10-year US Treasury yields in the second quarter. Segment-wise, consumer and sovereigns continued to outperform against real estate being affected by onshore tightening.

Watch out for idiosyncratic events

Besides policy changes, idiosyncratic events, particularly in the high yield space, should also be the market’s focus in the second half. We stick to our bottom-up approach on bond selection and move up the credit quality spectrum as we expect markets would likely stay jittery. These events, that we shall monitor include:

1) Whether or not Huarong will publish its upcoming FY20 results by the due date at end-Aug 2021 to avoid an event of default; if the government will bail out these SOEs to keep reputational risks under control; and if there is a concrete plan on addressing its offshore bond maturity

2) Whether Evergrande’s sizable payable issue will drag on and if will there be any form of debt restructuring.

Contagion risks have been under control as better names with decent fundamentals could still issue bonds. That said, market volatility will not abate until there is a clearer picture of those events. Some spillover effects could occur but these events should not result in an acceleration of systemic defaults in the offshore bond market. From an index weight perspective, Huarong accounts for 1% of the JACI composite, while Evergrande accounts for 3.9% of the JACI HY (0.9% in the JACI composite). Hence, any impact should be manageable given bond valuations have also moved. Fallen angel risks in Asia IG bonds are also low. Strong property presales YTD, cashflow preservation and the decelerating Chinese property’s offshore bond refinancing needs in 2H21 (US$17 billion, US$23 million in the first half) should keep their credit profiles in check.

In our view, China’s policy target to balance growth and risk controls should provide a healthier credit landscape in the longer run. To neutralize risk exposure in Chinese property, we diversify into commodities- and consumption-related credits as defensive plays.

>> Download the full report

Featured fund:

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable as of the date of presentation, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.