Important Information

| I. | Value Partners Asian Income Fund (The “Fund”) invests primarily in Asian equity and/or fixed income securities including convertible bonds and to deliver lower portfolio volatility. |

| II. | The Fund is subject to concentration risk as a result of the concentration of its investments in the Asian markets. The Fund may be more volatile than a broadly based fund as it is more susceptible to fluctuation in value resulting from adverse conditions in the Asian market. | |

| III. | The Fund may invest in small and mid-capitalization companies. The stocks of such companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalization companies in general. | |

| IV. | The Fund may invest in debt securities including those that are below investment grade/unrated, and may involve greater risks, including credit risk, issuer-specific risk, counterparty risk and sovereign debt risk. The Fund may also invest in derivatives which can involve material risks, e.g. counterparty default risk, insolvency or liquidity risk. All these may expose the Fund to significant losses. | |

| V. | Investment in fixed income securities may include contingent convertible bonds whose structure is innovative and untested. These instruments may be subject to conversion risk e.g. compulsory conversion by the issuer upon uncontrollable triggering events and hence the Fund may experience losses. | |

| VI. | In respect of the distribution units for the Fund, the Manager currently intends to make monthly dividend distribution. However, the distribution rate is not guaranteed. Distribution yield is not indicative of the return of the Fund. Distribution may be paid from capital of the Fund. Investors should note that where the payment of distributions are paid out of capital, this represents and amounts to a return or withdrawal of part of the amount you originally invested or capital gains attributable to that and may result in an immediate decrease in the value of units. | |

| VI. | You should not make investment decision on the basis of this material alone. Please read the explanatory memorandum for details and risk factors. |

Achieving lower volatility while generating attractive returns

Exhibiting a better risk-return profile relative to the broad market and its peers1

Attractive and sustainable income with a payout of 5.5%2

(Dividend is not guaranteed and may be paid out of the capital of the Fund. Please refer to Important Information VI.)

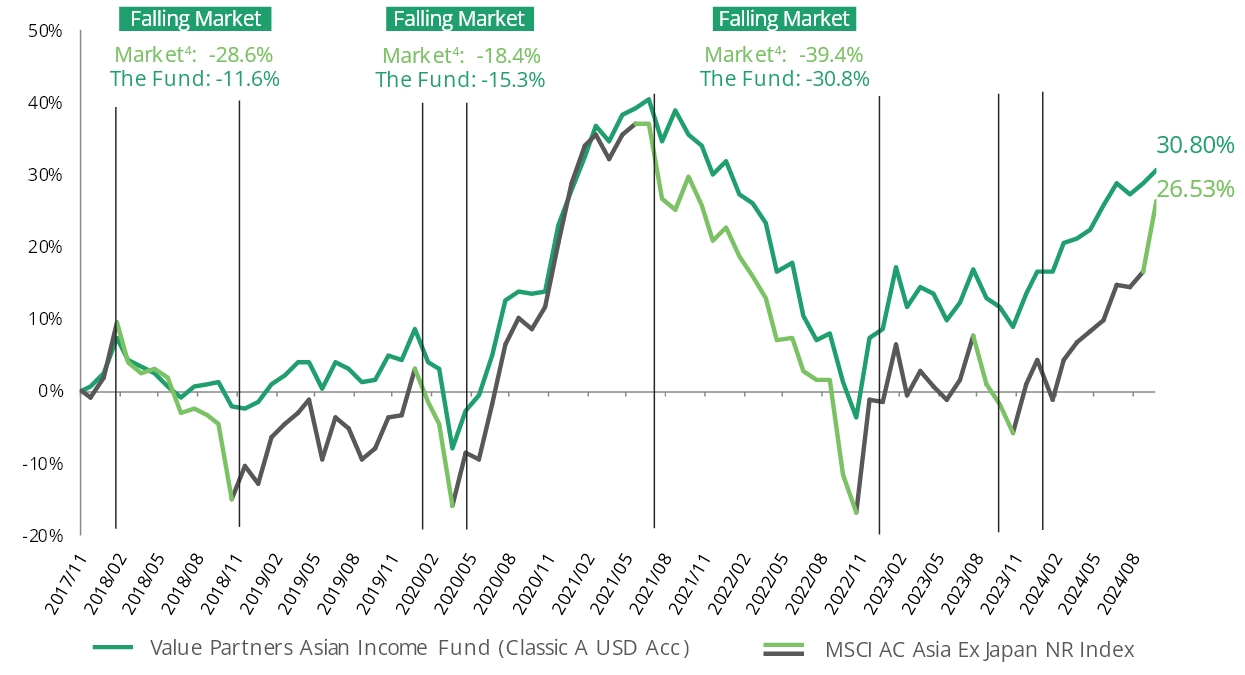

Achieving lower volatility while generating attractive returns

- The Fund aims to reduce the impact of market volatility in the equities market arising from uncertainties and generate attractive returns through a diversified portfolio of Asian assets, including equities and bonds. With the Fund’s dynamic approach to asset, market, and sector allocation, investors are able to navigate the volatile environment with a smoother ride

Cumulative return since launch3

Source: Value Partners, as of 30 Sep 2024.

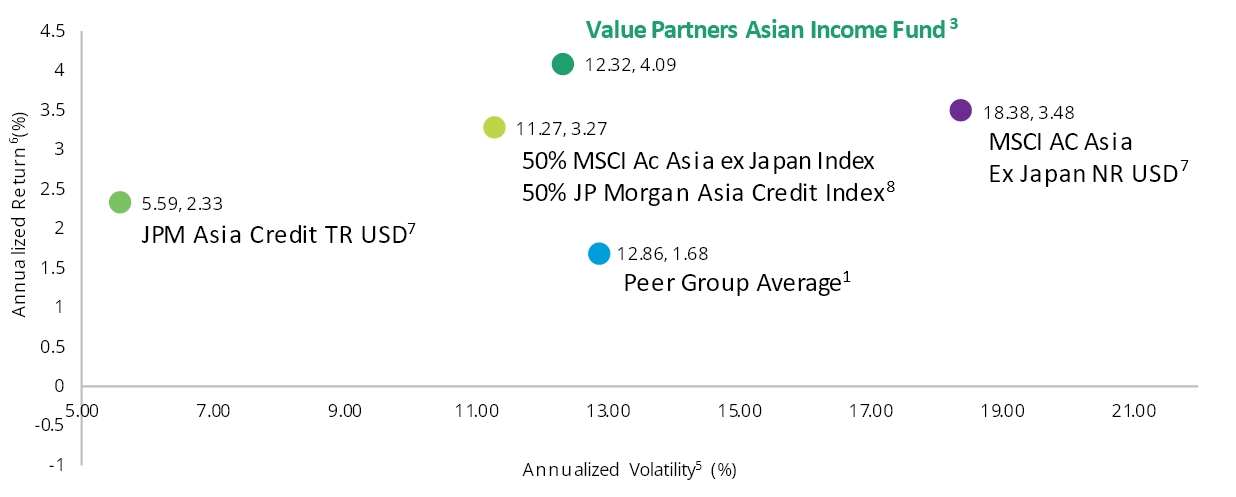

Exhibiting a better risk-return profile relative to the broad market and its peers1

- Since its launch, the Fund has delivered stronger risk-adjusted returns than both the Asian equity and credit market as well as its peers1, demonstrating our strong ability to generate returns and manage risks

Risk-return profiles of different asset allocation strategies (Since Launch)

Source: MorningStar, Value Partners, as of 30 Sep 2024.

Attractive and sustainable income with a payout of 5.5%2 (USD share class)

(Aims to make monthly dividend distributions. Actual dividend payouts are not guaranteed and dividends may be paid out of the capital of the Fund.) Please refer to Important Information VI

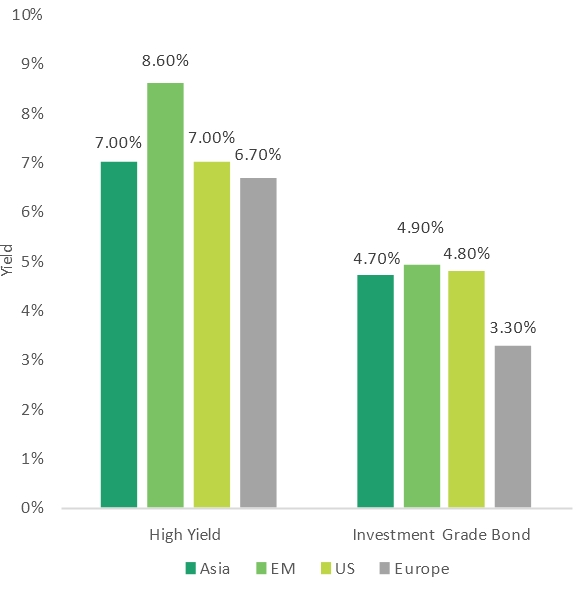

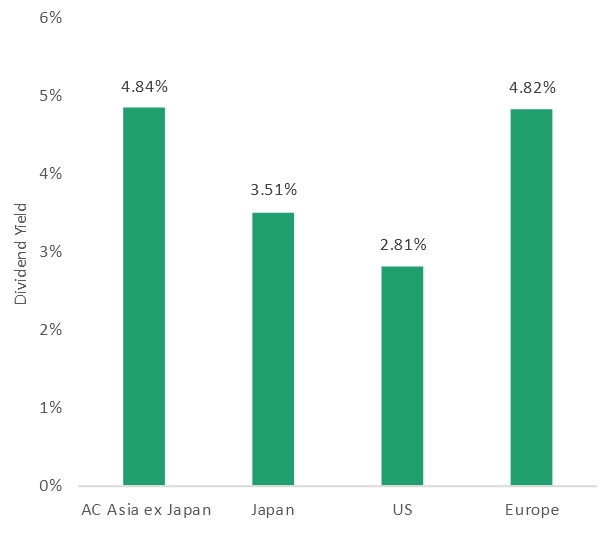

- Asian credit remains one of the major asset classes offering the highest yield, while REITs, infrastructure, and the banking sectors in the equities market also offer attractive dividends. These assets provide a stable source of income for the portfolio to support its attractive payout

- The latest payout of the USD share class of the Fund is 5.5%2, supported by healthy cash flows generated from dividends and coupons of a diversified portfolio of Asian equities and bonds of companies with quality businesses, strong management teams, and attractive valuations

Yield of HY and IG bonds

across different markets

across different markets

Dividend yield of equities

across different markets

across different markets

Source: Bloomberg, as of 30 Sep 2024.

Source: MSCI, as of 30 Sep 2024.

A flexible approach to capture various opportunities

- Asia is expected to contribute more than 70% of global growth this year*. With its flexible approach to investing, the Fund is able to capture unique opportunities in various areas, including prospects driven by long-term drivers and tactical opportunities arising from cyclical trends

*The International Monetary Fund’s upgraded outlook, April 2023

Source: FactSet, MSCI, Value Partners, as of 30 Sep 2024.

Source: FactSet, MSCI, Value Partners, as of 30 Sep 2024.

Learn more about Value Partners Asian Income Fund:

For more details, please contact your bank or investment consultant. You may also contact our Fund Investor Services Team.

All indices are for reference only.

1. Peer group refers to the Morningstar Category of Asia Allocation (HKSFC).

2. Refers to Class A USD MDis. Source: Value Partners, as of 30 Sep 2024. Annualised yield is calculated as follows: (Latest dividend amount/NAV as at ex-dividend date) x 12. Investors should note that yield figures are estimated and for reference only and do not represent the performance of the Fund, and that there is no guarantee as to the actual frequency and/or amount of dividend payments. The manager intends to declare and pay monthly dividends equal to all or substantially all of the net income attributable to each of the Distribution Classes. However, there is neither a guarantee that such dividends will be made nor will there be a target level of dividend payout. No dividends will be paid with respect to the Accumulation Classes. Distribution may be paid from capital of the Fund. Investors should note that where the payment of distributions are paid out of capital, this represents and amounts to a return or withdrawal of part of the amount that have been originally invested or capital gains attributable to that and may result in an immediate decrease in the value of units. Please refer to the explanatory memorandum for further details including the distribution policy.

3. The Fund (Class A Acc USD) was launched on 13 November 2017. Calendar year returns of Value Partners Asian Income Fund (Class A Acc USD): 2019 : +10.4% ; 2020: +17.6%; 2021: +3.3%; 2022: -17.8%; 2023: +7.6%; 2024 (YTD): +12.9%.

4. Market is represented by MSCI AC Asia Ex Japan NR Index.

5. The annualized volatility is calculated from the date of fund’s inception. The volatility is a measure of the theoretical risk based on the standard deviation, based on monthly return. The smaller the value, the lower the risk; and vice versa.

6. Annualized return is calculated from inception based on published NAV.

7. Performance history is from 1 April 2018 to 30 Sep 2024.

8. Reference benchmark of the Fund since the Fund’s inception.

Investors should note investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. SFC authorization is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.

Investors should note investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. SFC authorization is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.