Important Information

| I. | Value Partners Japan REIT Fund (the “Fund”) invests primarily in real estate investment trusts (“REITs”) listed in Japan. |

| II. | The Fund is subject to concentration risk as a result of the concentration of its investments in the Japanese real estate sector. The Fund may be more volatile than other broad- based funds. | |

| III. | Investing in REITs may also involve risks associated with the ownership of real estate, as well as other risks e.g. operation and management risk, interest rate risk, liquidity risk, regulatory risk and leverage risk. | |

| IV. | The Fund may also invest in financial derivative instruments for both hedging and investment purposes. These instruments can be highly volatile and expose investors to increased risk of loss. | |

| V. | In respect of the distribution units for the Fund, the distribution rate is not guaranteed. Distribution yield is not indicative of the return of the Fund. Distribution may be paid from capital of the Fund at the Manager’s discretion. This amounts to a return or withdrawal of part of the amount you originally invested or capital gains attributable to that and may result in an immediate decrease in the value of units of the relevant distribution units. | |

| VI. | The Fund is not authorized by the SFC under the Code on Real Estate Investment Trust but is authorized under the Code on Unit Trusts and Mutual Funds, such authorization does not imply official recommendation. You should not make investment decision on the basis of this material alone. Please read the explanatory memorandum for details and risk factors. |

Maximizing Income Potential:

Benefits from Japan REITs'

Attractive Income1 and

Currency-Hedged Share Classes

Prime Opportunities:

Japan as the Largest

Market Value REITs Market

in Asia-Pacific2

The Power of Diversification:

Well-diversified across various

types of properties:

Industrial, Office, Residential,

Retail, Hotel and Healthcare

Maximizing Income Potential:

Benefits from Japan REITs' Attractive Income1 and Currency-Hedged Share Classes

Benefits from Japan REITs' Attractive Income1 and Currency-Hedged Share Classes

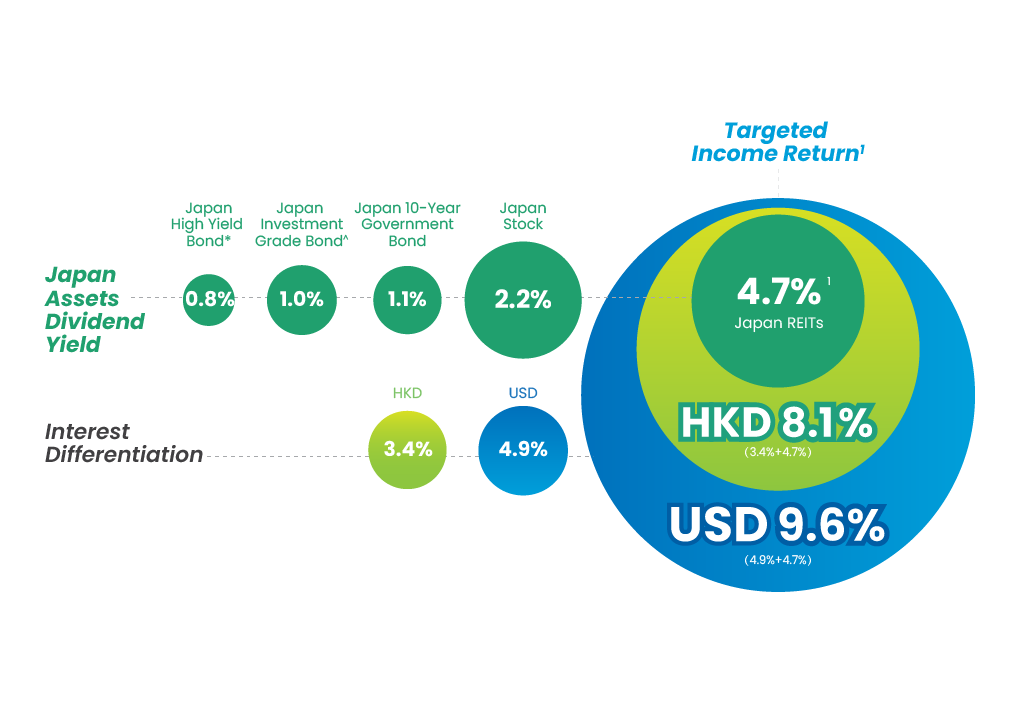

- Japan Real Estate Investment Trust (REITs) is one of the asset classes offering the highest yield in Japanese Yen (JPY) terms, currently paying 4.7% per annum.This refers to yield of Japan REITs asset class only and not the distribution yield of the Fund. The distribution yield of the Fund is not guaranteed. Please refer to Important Information V for further details.

- As the interest rate remains low in Japan relative to other currencies, investors can enjoy additional income offered by various currency-hedged share classes. For example, the USD- hedged share class allows investors to capture additional income of about 5% per annum arising from the difference between the short-term interest rate of the USD and JPY.

- The stable and sustainable income offered by Japan REITs, together with the interest differential of different currencies against Yen, provide investors with an attractive and complementary source of income in today’s environment.

! As dividends may be paid out from capital, this may result in an immediate decrease in the NAV per share/unit and may reduce the capital available for the Fund for future investment and capital growth. Distributions are not guaranteed and may fluctuate. Past distributions are not necessarily indicative of future trends, which may be lower. Distribution payouts and its frequency are determined by the manager. The payment of distributions should not be confused with the Fund’s performance, rate of return or yield. Positive distribution yield does not imply positive return. Annualized yield of MDis Class is calculated as follows: (Latest dividend amount/NAV as at exdividend date) x 12. Please refer to the offering document further details including the distribution policy.

Source: Bloomberg, Value Partners, FTSE, as of 31 March 2025.

Source: Bloomberg, Value Partners, FTSE, as of 31 March 2025.

Prime Opportunities:

Japan as the Largest Market Value REITs Market in Asia-Pacific2

Japan as the Largest Market Value REITs Market in Asia-Pacific2

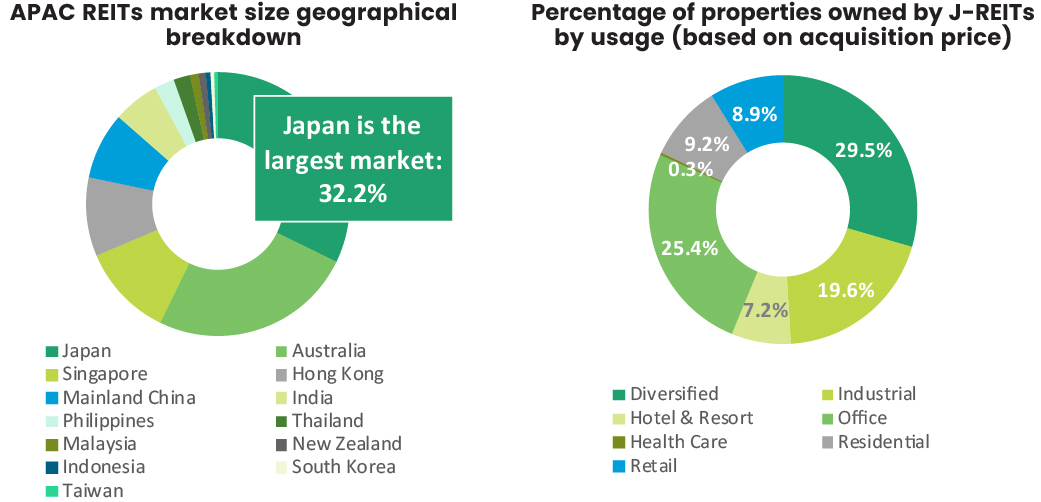

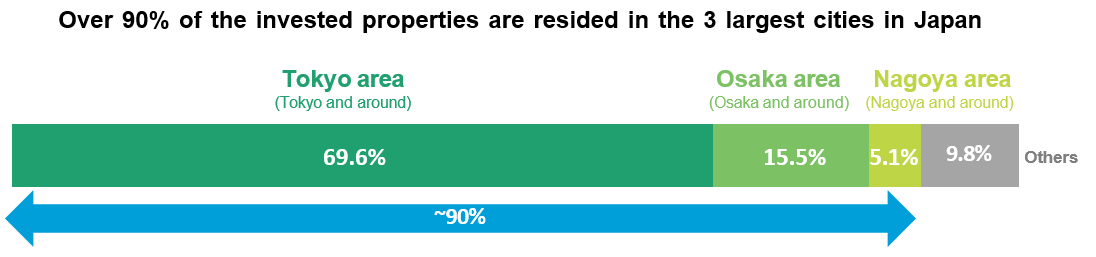

- The Japan REITs market is the largest in Asia, with a market capitalization of about JPY 15 trillion. It is also well-diversified across industries and locations, offering ample attractive investment opportunities.

Source: TSE, Bloomberg, Japan land price announcement, Websites of each Exchanges. as of 31 March 2025.

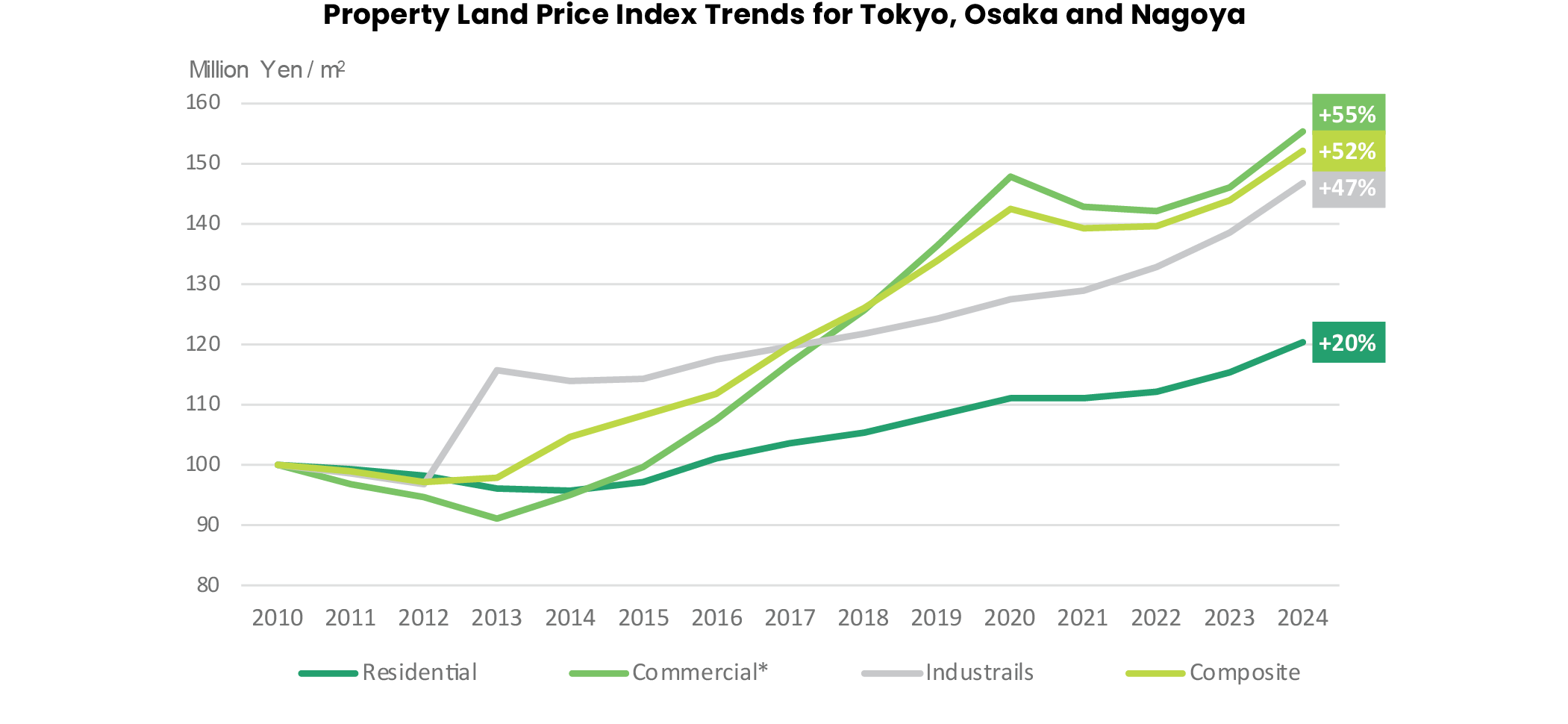

- With Japan’s economy gaining more momentum, property prices and rentals are expected to continue their uptrend with further growth. Japan REITs provide investors with an efficient and relatively stable way of capturing the income and growth potentials arising from the recovery of Japan’s economy.

Source: TSE, Bloomberg, Japan land price announcement, Websites of each Exchanges. as of 31 March 2024.

~Commercial property contains office, hotel and retail real estate.

~Commercial property contains office, hotel and retail real estate.

Source: The Association for Real Estate Securitization, as of 31 March 2024.

The Power of Diversification:

Well-diversified across various types of properties: Industrial, Office, Residential, Retail, Hotel and Healthcare

Well-diversified across various types of properties: Industrial, Office, Residential, Retail, Hotel and Healthcare

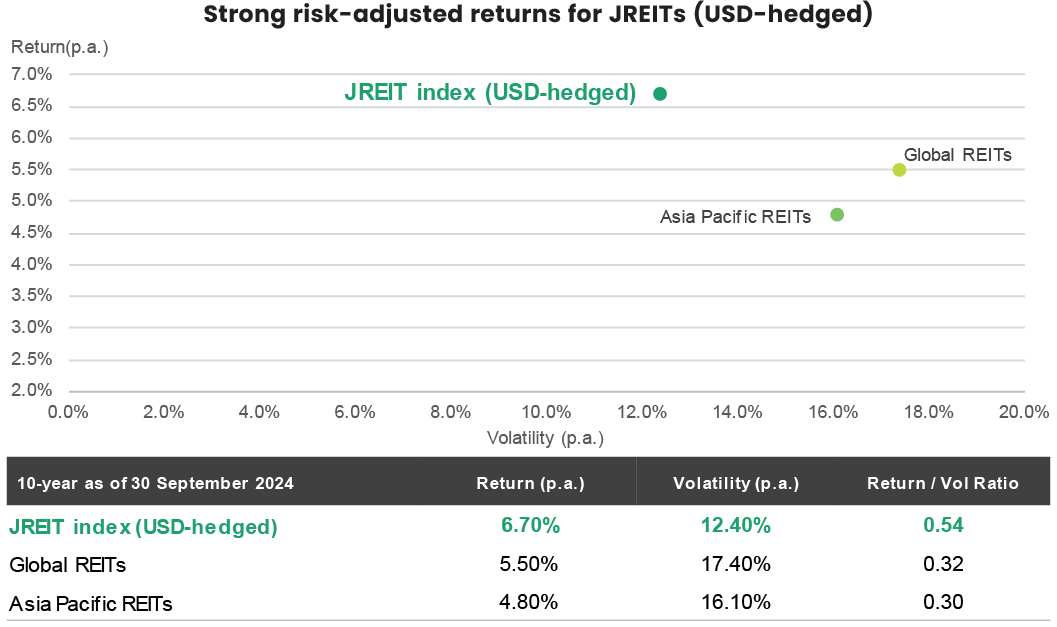

- Japan REITs have a low correlation with equities and bonds in other markets, highlighting the strong diversification benefits it could bring to a portfolio.

Source: Bloomberg, Value Partners, as of 31 December 2024.

Collaboration with Daiwa Asset Management

- Value Partners collaborates with Daiwa Asset Management (Daiwa) focusing on the Japan REITs market. The research findings and ideas would deepen our understanding of the Japan REITs market. With Daiwa’s more than 20 years of experience in Japan REITs research together with Value Partners’ 30 years of value investing experience, it helps elevate our ability to deliver more diversified investment solutions to our clients.

Learn more about Value Partners Japan REIT Fund:

For more details, please contact your bank or investment consultant. You may also contact our Fund Investor Services Team.

1. This refers to yield of Japan REITs asset class only and not the distribution yield of the Fund. The distribution yield of the Fund is not guaranteed. Please refer to Important Information V for further details.

2. Source: Bloomberg, as at 31 March 2025.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward- looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in real estate related securities. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. SFC authorization is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.

For Singapore investors: The Fund is registered as a restricted foreign scheme in Singapore and will only be distributed to (i) institutional investors and (ii) accredited investors and certain other persons in Singapore in accordance with section 304 and 305 of the Securities and Futures Act. Value Partners Asset Management Singapore Pte Ltd, Singapore Company Registration No. 200808225G. This material has not been reviewed by the Monetary Authority of Singapore.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward- looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Investors should note investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in real estate related securities. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. SFC authorization is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.

For Singapore investors: The Fund is registered as a restricted foreign scheme in Singapore and will only be distributed to (i) institutional investors and (ii) accredited investors and certain other persons in Singapore in accordance with section 304 and 305 of the Securities and Futures Act. Value Partners Asset Management Singapore Pte Ltd, Singapore Company Registration No. 200808225G. This material has not been reviewed by the Monetary Authority of Singapore.