Important Information

| I. | Value Partners Asian Innovation Opportunities Fund (the "Fund") invests predominantly in Asian equity and/or fixed income securities of companies that are related to innovative technologies or business innovations. |

| II. | The Fund's investments are concentrated in the Asian market and therefore subject to emerging market risks. Generally, investments in emerging markets are more volatile than investments in developed markets due to additional risks relating to political, social, economic and regulatory uncertainty. | |

| III. | The Fund is also subject to concentration risks due to its concentration in the sectors relating to innovative technology or business innovation. Such companies are characterised by relatively higher uncertainty and volatility in price performance when compared to other economic sectors. | |

| IV. | The Fund may invest in small and mid-capitalisation companies. The stocks of such companies may have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general. | |

| V. | The Fund may invest in unrated or below investment grade bonds and financial derivative instruments. The Fund is therefore exposed to additional risks, including volatility risk, valuation risk, leverage risk, liquidity risk, correlation risk, counterparty/credit risk, legal risk, over-the-counter transaction risk and settlement risk. | |

| VI. | In respect of the distribution classes for the Fund, the Manager currently intends to make monthly dividend distribution. However, the distribution rate is not guaranteed. Distribution yield is not indicative of the return of the Fund. Distribution may be paid from capital of the Fund. Investors should note that where the payment of distributions are paid out of capital, this represents and amounts to a return or withdrawal of part of the amount you originally invested or capital gains attributable to that and may result in an immediate decrease of the net asset value per unit of the Fund. | |

| VII. | You should not make investment decision on the basis of this marketing material alone. Please read the explanatory memorandum for details and risk factors. |

Riding the wave of Asia's innovation

Discover the long-term investment potential

of Asia's innovative industries

Rank number one in its peer group1

delivering a return of 87.4%2 since its inception

Combat volatility

with flexible multi-asset approach

Why Value Partners Asian Innovation Opportunities Fund?

ICapturing the growth of Asia's tech advancement

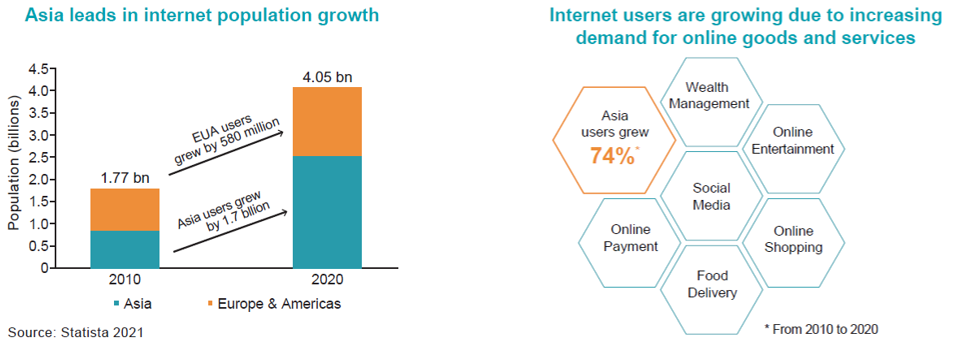

- Asia is the most populated continent, accounting for more than 55% of the world's population. With its population composition being younger than that of Europe and the U.S., there is a strong demand for digital transformation, driving Asia to become a new hotspot for innovation

- The total number of Internet users in Asia is more than 2.5 billion, demonstrating the potential for growth of users and technology advancement in Asia

Gold’s price historically rallied in periods of high inflation (1971-2022)

Why Asia?

Dynamic asset allocation supports an all-weather investment strategy

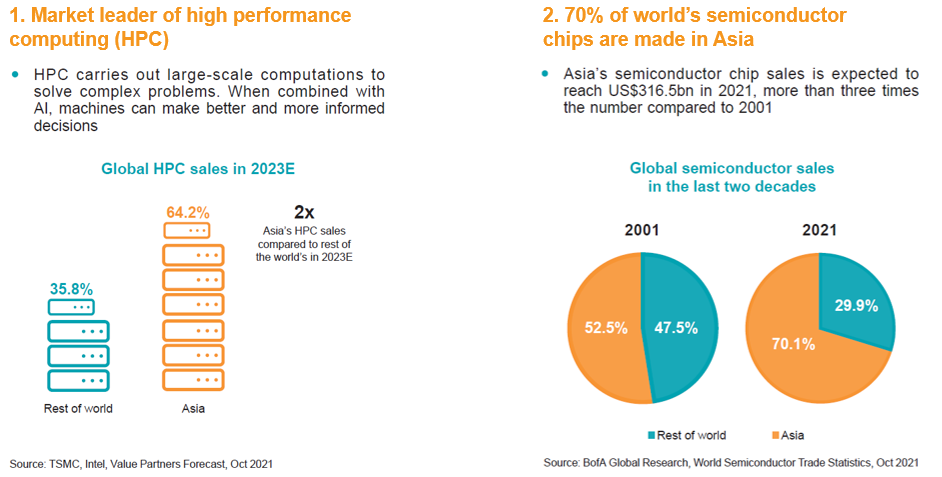

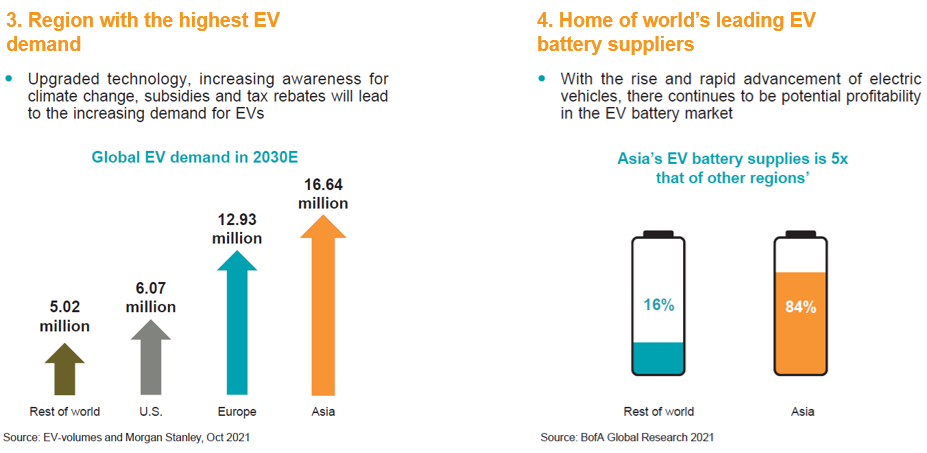

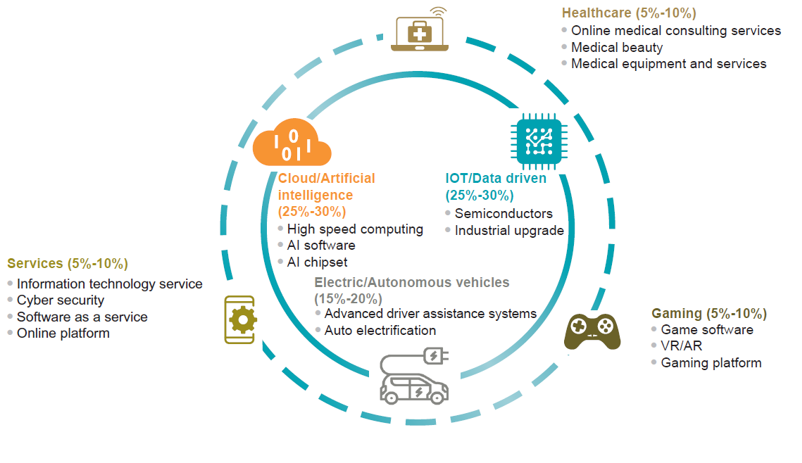

- The Fund focuses on investing in the following innovative areas to capture various growth trends in the region

The Fund's areas of investment within the innovation sector†

†The above-mentioned technology investment portfolio will change according to the market environment

Learn more about Value Partners Asian Innovation Opportunities Fund:

For more details, please contact your bank or investment consultant. You may also contact our Fund Investor Services Team.

1. Morningstar. Peer Group refers to Morningstar Category of Asia Allocation (HKSFC authorized funds) which includes all funds with performance history started between between 26 February 2019 and 31 December 2021. HKSFC authorisation does not imply official recommendation. 2. Value Partners Asian Innovation Opportunities Fund (Class A USD Acc) was launched on 26 February 2019. Calendar year return: 2019 (since inception): +20.2%; 2020: +43.0%; 2021: +9.0%.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investors should note investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Information in this report has been obtained from sources believed to be reliable but Value Partners Hong Kong Limited does not guarantee the accuracy orcompleteness of the information provided by third parties. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. This material has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable, but its accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investors should note investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Information in this report has been obtained from sources believed to be reliable but Value Partners Hong Kong Limited does not guarantee the accuracy orcompleteness of the information provided by third parties. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. This material has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.