Important Information

| I. | Value Partners Asian Food and Nutrition Fund (The “Fund”) primarily invests in the equity securities of companies engaged in or profit from any activity forming part of the food and beverage nutrition value chain based, or carrying out their business, in the Asia (ex-Japan) region which the Investment Manager believes contribute positively to environmental, social and governance (“ESG”) attributes along the value chain. |

| II. | The Fund may subject to risks associated with ESG investing, including concentration and exclusion risks, subjective judgment in investment selection, etc. | |

| III. | The Fund invests in concentrated region/sector and subjects to higher level of risks than a fund having a more diverse portfolio of investments. | |

| IV. | The Fund’s equity portfolio may include small- and mid-cap companies. Investments in such companies may involve greater risks. The stock of such companies may also have lower liquidity and their prices are more volatile to adverse economic developments than those of larger capitalisation companies in general. | |

| V. | The Fund may also invest in derivatives and engage in securities financing transactions which can involve material risks, e.g. counterparty default risk, collateral reinvestment risk or liquidity risk, and may expose the Fund to significant losses. | |

| VI. | In respect of the distribution classes for the Fund, the Investment Manager currently intends to make monthly dividend distribution. However, the distribution rate is not guaranteed. Distribution yield is not indicative of the return of the Fund. Distribution may be paid from capital of the Fund. Investors should note that where the payment of distributions are paid out of capital, this represents and amounts to a return or withdrawal of part of the amount you originally invested or capital gains attributable to that and may result in an immediate decrease of the net asset value per share of the Fund. | |

| VII. | You should not make investment decision on the basis of this material alone. Please read the prospectus for details and risk factors. |

Capturing the

opportunities in Asia’s

food and nutrition

upgrade demand

Robust growth potential

in underpenetrated

food services sector

The rising adoption

of food and

agri-technology

Global food challenges persist over decades, with issues such as undernourished population, food security etc. more pressing in Asia. The change in regional demographic such as rising middle-class population and improving sustainable corporate practices, however, are expected to bring unique opportunities in the food value chain universe. The Fund aims to identify companies in the

farm-to-fork universe that benefit from the three key structural trends:

Key structural trend 1:

Huge demand for Asia's food and nutrition upgrade

Huge demand for Asia's food and nutrition upgrade

- Challenges: Asia has bigger undernourished population and less nutritious diet compared to developed markets. For example, the average Asian diet has 20% less protein.

Source: (Left chart) FAO – The State of Food Security and Nutrition in the World 2022 & (Right chart) FAO, data as at 2020

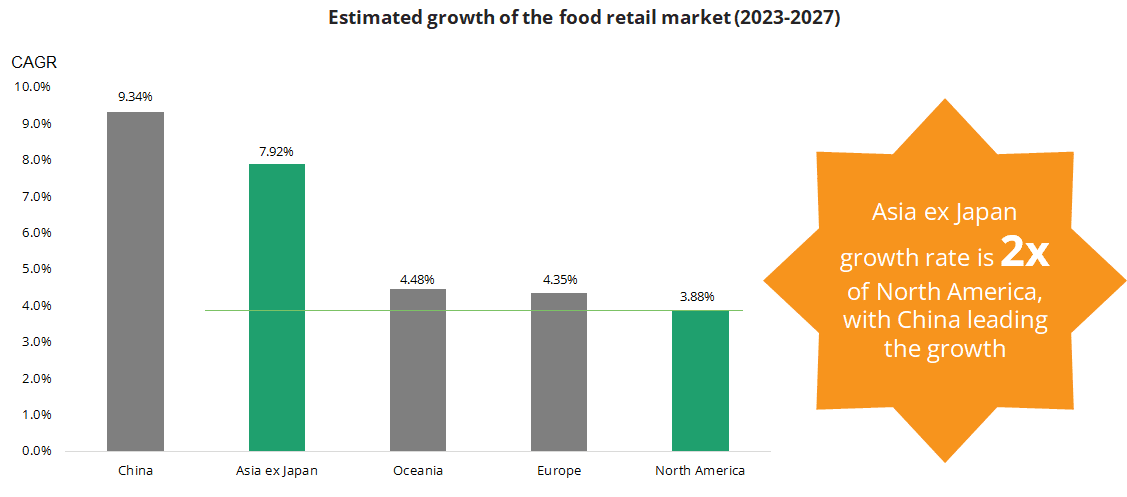

- Thesis: Asia is home to two-thirds of the world’s middle class population by 2030. This is a core pillar to drive an increase demand in food quantity and quality. Asia’s retail food market is projected to double in the next decade, significantly outpacing the developed markets.

Source: OECD-FAO, PWC Analysis, Statista, Value Partners

- This also presents massive opportunities for Asian domestic players, given the food premiumization, rising recognition and preference for local brands. For example, the top four dairy brands in China and Korea are all local brands and have taken up 65% of total market shares.

Key structural trend 2:

Robust growth potential in the underpenetrated food services sector

Robust growth potential in the underpenetrated food services sector

- Challenges: Organized food retailers that enable food accessibility are underpenetrated in many Asian countries.

Source: Euromonitor, Goldman Sachs Research; Spark Capital Research, March 2022

- Thesis: Similarly, the rising middle class is critical to lead a rapid increase in demand for organized food services, such as grocery stores, chain restaurants and food delivery.

- The Fund aims to capitalize on companies that enhance food or grocery accessibility through internet solutions and large restaurant chains that provide enhanced quality and nutritious food to customers.

Key structural trend 3:

The rising adoption of food and agri-technology

The rising adoption of food and agri-technology

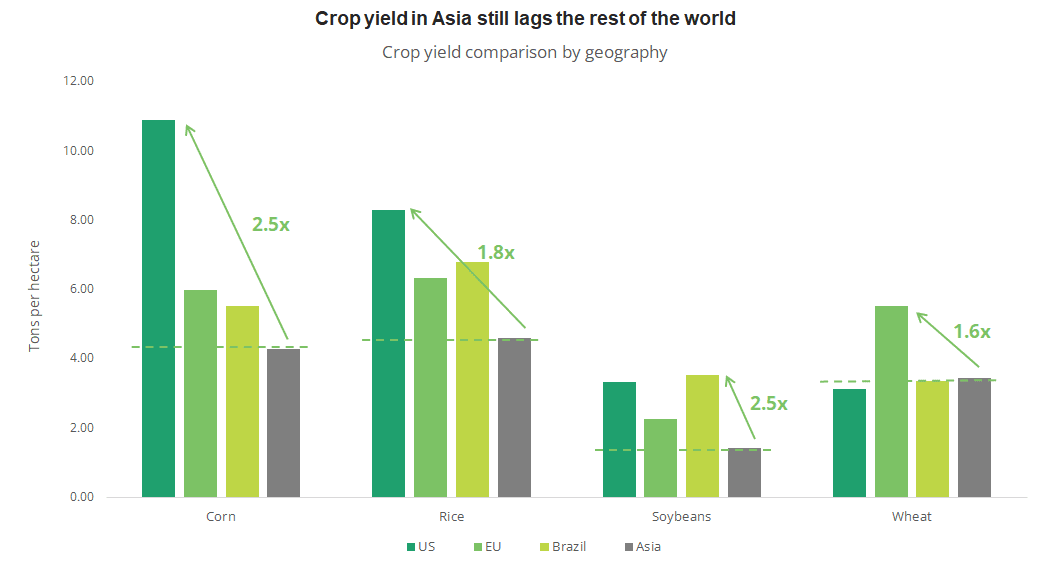

- Challenges: 80% of the region’s food sources are from small-scale farmers who tend to lack technology adoption, employ irresponsible farming and fishing techniques, suffer from water pollution and soil erosion, and thus resulting in low crop yield.

- This also leads to other issues, such as food safety, due to the lack of tracking and traceability of food sources.

Source: USDA (2019), The Asia Food Challenge, various news sources

- Thesis: To serve the needs of increasing demand of both food quantity and quality, the adoption of technology to enhance sustainable food production and quality is taking place in Asia.

- On food production, Asia is home to several leading food-tech players with advanced technologies, such as the development of hybrid seeds, vertical farming, which can greatly enhance crop yield and food security.

- On food quality, technology adoption for food inspection, sampling and testing, supply chain traceability is increasing to address concern on food safety.

The ESG investment process involves four steps:

1. Risk-based exclusion, 2. Proprietary risk assessment, 3. Active Engagement, 4. Post-trade monitoring.

The Fund seeks to address the Asian food challenges by investing in Asia ex Japan companies that promote and aligned with the following 7 Sustainable Development Goals of the United Nations (UNSDGs):

1. Risk-based exclusion, 2. Proprietary risk assessment, 3. Active Engagement, 4. Post-trade monitoring.

The Fund seeks to address the Asian food challenges by investing in Asia ex Japan companies that promote and aligned with the following 7 Sustainable Development Goals of the United Nations (UNSDGs):

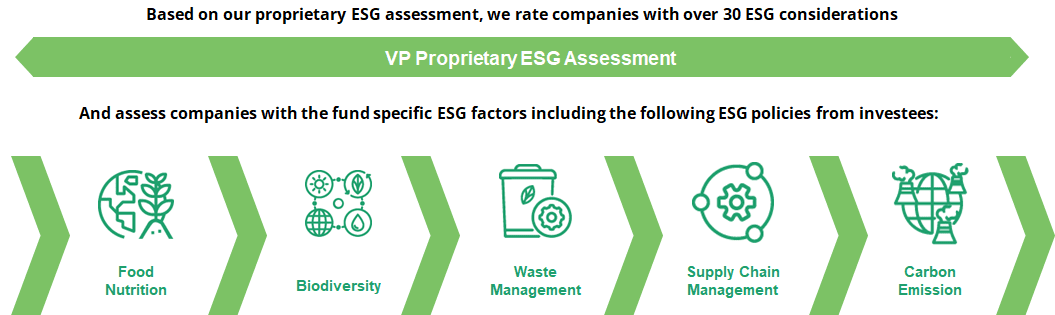

After the negative screening, every company in the Fund is assessed by Value Partners’ proprietary ESG assessment framework which we rate companies from 1 (ESG Laggard) to 5 (ESG Leader):

This comprehensive ESG assessment, together with our rigorous fundamental bottom-up research process allows the Fund to promote and advance sustainability practices along the food value chain in the region.

Learn more about Value Partners Value Partners Asian Food And Nutrition Fund:

For more details, please contact your bank or investment consultant. You may also contact our Fund Investor Services Team.

#This funds is a sub-fund of Value Partners Ireland Fund ICAV (the “Company”). The Company is both authorized and supervised by the Central Bank of Ireland (“Central Bank”) as an undertaking for collective investment in transferable securities pursuant to the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011. Authorization of the Company by the Central Bank shall not constitute a warranty as to the performance of the Company and the Central Bank shall not be liable or the performance or default of the Company. The authorization of the Company is not an endorsement or guarantee of the Company by the Central Bank.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investors should note investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. SFC authorization is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.

The views expressed are the views of Value Partners Hong Kong Limited only and are subject to change based on market and other conditions. The information provided does not constitute investment advice and it should not be relied on as such. All materials have been obtained from sources believed to be reliable, but their accuracy is not guaranteed. This material contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Investors should note investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the explanatory memorandum for details and risk factors in particular those associated with investment in emerging markets. Investors should seek advice from a financial adviser before making any investment. In the event that you choose not to do so, you should consider whether the investment selected is suitable for you. SFC authorization is not a recommendation or endorsement of a scheme nor does it guarantee the commercial merits of a scheme or its performance. It does not mean the scheme is suitable for all investors nor is it an endorsement of its suitability for any particular investor or class of investors. This material has not been reviewed by the Securities and Futures Commission of Hong Kong. Issuer: Value Partners Hong Kong Limited.