Important Information

| I. | Value Gold ETF (the “Fund”) is a fund listed on the Stock Exchange of Hong Kong Limited (“SEHK”), which aims to provide investment results that closely correspond to the performance of the London Bullion Market Association Gold Price. |

| II. | The Fund only invests in bullion and may experience greater volatility due to single economic, market or political occurrences when compared to diversified mutual funds or unit trusts. | |

| III. | The Fund has adopted a multi counter and units are traded in HKD, RMB and USD on SEHK. The nature of the multi-counter may make investment in the units riskier than in single counter units or shares of an SEHK listed issuer. Investors without RMB or USD accounts may buy and sell HKD traded units only. | |

| IV. | RMB is not a freely convertible currency and is subject to foreign exchange control policies, as well as repatriation restrictions imposed by the PRC government. Investors whose base currencies of investments are not in RMB should take into account the potential risk of loss arising from fluctuations in value between such currencies and the RMB. | |

| V. | The Fund does not insure its bullion and the Fund and unitholders could suffer a loss if the bullion held by the custodian is lost or damaged. | |

| VI. | As the Fund is not actively managed, the Manager will not adopt a temporary defensive position against any market downturn. Investors may lose part or all of their investment. | |

| VII. | Trading prices of units on the SEHK are subject to market forces and the units may trade at a substantial premium/discount to the net asset value of the Fund. | |

| VIII. | You should not make investment decision on the basis of this material alone. Please read the prospectus for details and risk factors. |

The market’s only gold ETF with a physical depot in Hong Kong

- Value Gold ETF holds physical gold bars in the HKIA Precious Metals Depository, which allows redemption of gold bullion1 (through a Participating Dealer that allows physical gold delivery: Redford Securities Limited), reducing geopolitical risks

“Outstanding Performance” ETF2

- Multiple currency counters (HKD, RMB, USD)

- With solid track record of 14 years since 2010

- A multi-award-winning product3

Transparency, Convenience, and Affordability

- The amount of gold storage, price, and net asset value (NAV) are disclosed daily

- Value Gold ETF is more cost-effective generally than buying and storing physical gold bullions

Why gold, Why now?

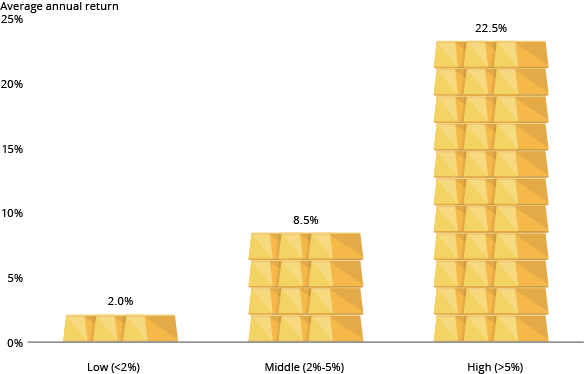

Why gold, Why now?Inflation Hedge

- Gold has historically rallied in periods of high inflation

- In years of higher inflation with over 5%, gold’s price has increased over 20% since 1971*

Gold’s price historically rallied in periods of high inflation (1971-2024)

*Based on y-o-y changes of the LBMA Gold Price and US CPI between 1971 and 30 June 2024.

From 1971 to 2024, there were 12 years of inflation of less than 2%, 28 years between 2% and 5%, and 13 years of more than 5%. Source: World Gold Council, Bloomberg.

From 1971 to 2024, there were 12 years of inflation of less than 2%, 28 years between 2% and 5%, and 13 years of more than 5%. Source: World Gold Council, Bloomberg.

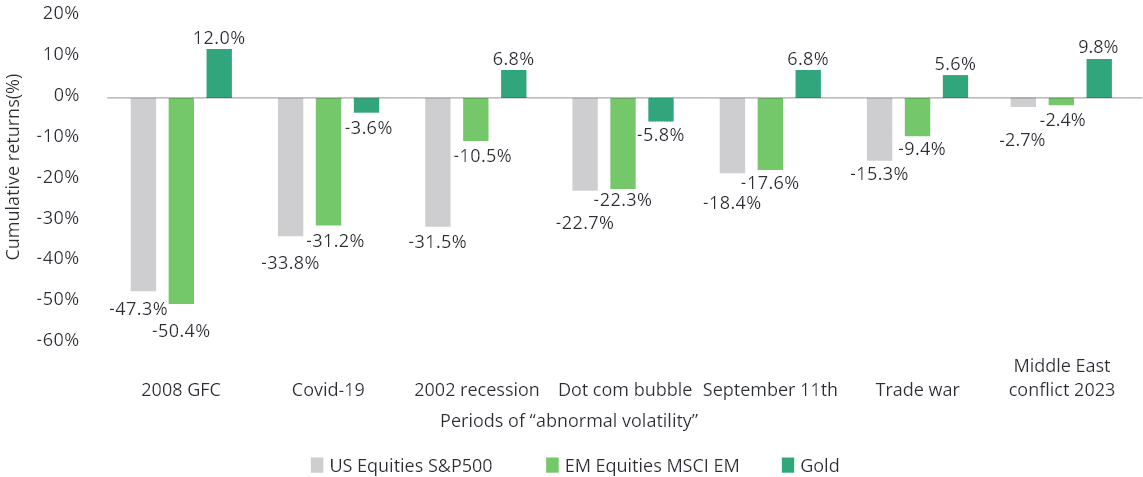

Diversify Risk During Market Downturns

- Gold can mitigate losses in times of market stress, especially during periods of “abnormal volatility”

- Due to this unique property (downside protection), gold is considered as a safe haven and a portfolio stabilizer during market downturns

Gold has performed well in uncertain markets

Source: World Gold Council, Reuters, 2008 GFC (11/08/2008-09/03/2009), Covid-19 (19/02/2020-23/03/2020), 2002 recession (19/03/2002-23/07/2002), Dot com bubble (29/09/2000-04/04/2001), September 11th (24/08/2001-21/09/2001), Trade war (21/09/2018-26/12/2018), Middle East conflict 2023 (7/10/2023-31/10/2023). Iran–Israel conflict 2024 (01/04/2024-19/04/2024), Second Trump tariffs (20/01/2025-now, as at 07/04/2025).

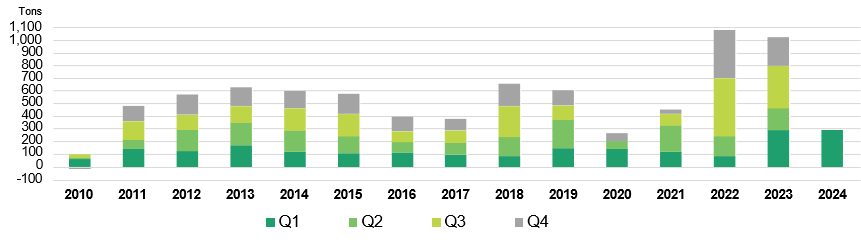

Support From Global Central Banks

- In the recent report by the World Gold Council (WGC), central banks bought a record amount of gold from 2022 to 2024.

- Gold remains a good hedge against inflation and heightened geopolitical risks, especially when great nations collide. Unlike currencies whose supply is influenced by monetary policies, gold is a finite physical commodity. That is one of the reasons why global central banks buy gold in bulk, as the asset class helps diversify their reserves. Value Gold ETF holds physical gold bars in Hong Kong, eliminating investment risks from geopolitical events or foreign policies, which helps investors achieve risk diversification

- It is expected that central banks, especially emerging market ones, will continue to diversify their reserve with gold being one of the most favored asset during periods of high inflation

Central Bank’s gold demand

Source: World Gold Council, Data as of 31 Dec 2024.

Learn more about Value Gold ETF:

For more details, please contact your bank or investment consultant. You may also contact our Fund Investor Services Team.

1. The minimum creation/redemption unit size (by authorized participants only) is 300,000 Units (or multiples thereof). 2. Value Gold ETF was selected as the Outstanding Performer ETF (Total Return 1 Year – Commodity – Gold ETFs) in the Bloomberg Businessweek/Chinese Edition Top Funds Award 2024. 3. Value Gold ETF has won 15 awards from 2011 to 2024. To understand all the award details, please click on our website: https://www.valueetf.com.hk/eng/awards.html

Investors should note investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the prospectus for details and risk factors, particularly those associated with the arrangement in the event that the Fund is delisted. Investors should also note that the Fund is different from a typical retail investment fund. Units in the Fund may only be created or redeemed directly by a participating dealer in large unit sizes. This website has not been reviewed by the Securities and Futures Commission. Issuer: Sensible Asset Management Hong Kong Limited.

Investors should note investment involves risk. The price of units may go down as well as up and past performance is not indicative of future results. Investors should read the prospectus for details and risk factors, particularly those associated with the arrangement in the event that the Fund is delisted. Investors should also note that the Fund is different from a typical retail investment fund. Units in the Fund may only be created or redeemed directly by a participating dealer in large unit sizes. This website has not been reviewed by the Securities and Futures Commission. Issuer: Sensible Asset Management Hong Kong Limited.